Liquid funds are usually the most popular mutual fund schemes for parking surplus money for very short periods of time e.g. few days, weeks or months. Capital safety and liquidity are two very important considerations in short term investments. Liquid funds used to have no exit loads and investors can redeem partially or fully at any point of time. However, SEBI now has introduced exit loads even for liquid funds. These schemes usually invest in money market securities which mature in less than 91 days and hence have very low sensitivity to interest rate movements. There was also a perception that these schemes had very little or no credit risk owing to their very short maturity profiles.

However, over the past 12 months, credit risk has become a major concern across all maturity profiles in debt funds due to a series of rating downgrades and defaults. Even liquid funds were not spared from adverse credit risk events and several liquid funds saw reduction in NAVs following defaults. In response to the credit risk concerns, SEBI mandated all liquid funds to change its NAV accounting method from straight line amortization to mark to market valuation. The previous accounting method ensure high degree of NAV stability and steady returns accrual, but the change in accounting method has made liquid fund NAVs much more volatile in the event of ratings downgrade.

Arbitrage funds are safe alternative investment options

Arbitrage funds are hybrid mutual funds which primarily invest in equity and equity related securities with the objective of generating risk free profits by exploiting the price difference of the same underlying securities in different market segments, in technical parlance also known as arbitrage. They also invest in debt and money market securities for income accrual. We will discuss investment strategy of arbitrage funds in slightly more details later in this article, but since the strategy is theoretically risk free, it ensures high degree of capital safety.

A major advantage of arbitrage funds compared to liquid funds is that arbitrage funds are not subject to credit risk. Arbitrage strategies are market neutral. In other words, gains will accrue irrespective of price movement. So even if the credit rating of the CPs or NCDs issued by a company gets downgraded and its share price affected, arbitrage strategy will still generate risk free profits. Arbitrage funds usually have exit loads usually ranging from a week to 30 days. This makes arbitrage funds highly liquid.

Returns of arbitrage funds usually depend on the volatility in the stock market. In bull markets, arbitrage funds can give good returns, even matching the returns of liquid funds. In the last 3 months, arbitrage funds and liquid funds as categories gave almost the same average returns. In range-bound markets or corrections, these funds give subdued return but the risk of capital loss is very low.

Taxation advantage of arbitrage funds

One major advantage of arbitrage funds is that they enjoy equity taxation. While short term capital gains (investing holding period of less than 3 years) in liquid funds are taxed as per the income tax rate of the investor, short term capital gains (investing holding period of less than 12 months) in arbitrage funds are taxed at 15%. Long term capital gains (investing holding period of more than 12 months) of up to Rs 1 lakh in arbitrage is tax free. Long term capital gains in excess of Rs 1 lakh are taxed at 10%.

How arbitrage works

The most common arbitrage strategy is between the cash and futures. If the futures price of a stock is trading at sufficiently large premium to the price in the cash market, then the fund manager can lock in risk-free profits by simultaneously selling the futures and buying the stock. The trading strategy is risk free because the futures and cash price converges on expiry of the futures contract. You will make a profit irrespective of whether the share price moves up or down.

IDFC Arbitrage Fund

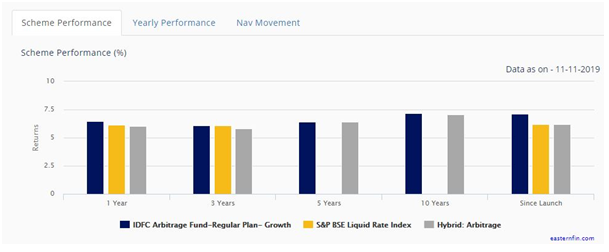

Our endeavour in Eastern Financiers is to curate best performing schemes suited to the needs of our investors. IDFC Arbitrage Fund is one of the best performing arbitrage schemes in the last 1 year (please see our top performing mutual funds in the arbitrage category). It is also one of our top ranking arbitrage mutual fund schemes based on performance consistency (please refer our top ranking mutual funds in the hybrid arbitrage category). The scheme was launched in December 2006 and has given in excess of 7% CAGR returns since inception. The scheme has nearly Rs 10,900 Crores of assets under management (AUM). The expense ratio of the scheme is 1.09%.

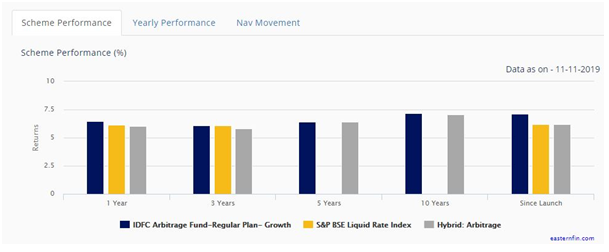

The chart below shows the annualized trailing returns of the scheme across different time-scales. You can see that the scheme outperformed the arbitrage funds category and also the BSE Liquid Rate Index over the last 1 to 3 years.

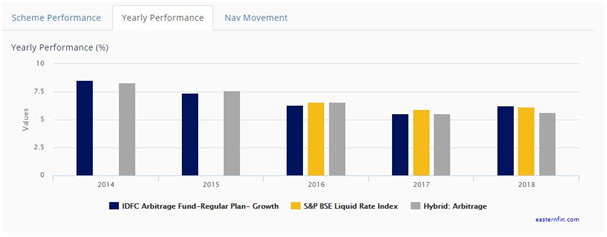

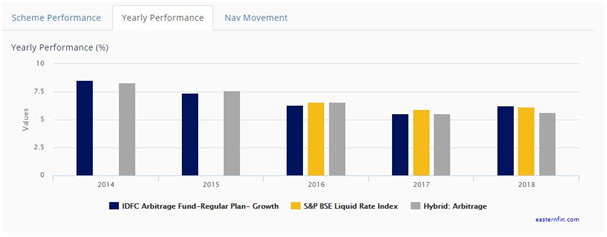

The chart below shows the annual returns of the scheme versus the arbitrage funds category over the last 5 years. You can see that the scheme outperformed the arbitrage funds category in most years.

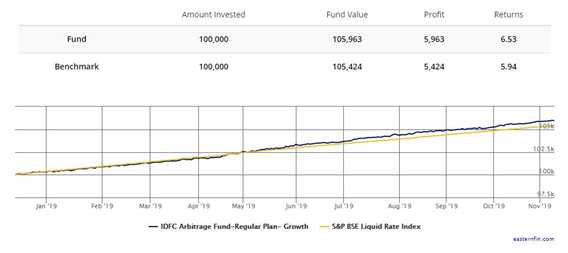

Lump Sum Returns

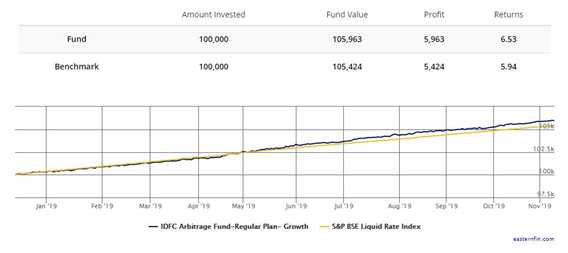

The chart below shows the growth of Rs 1 lakh lump sum investment in the scheme over the last 12 months.

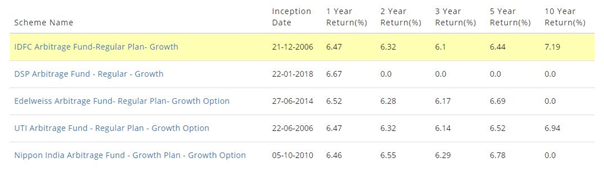

Peer comparison

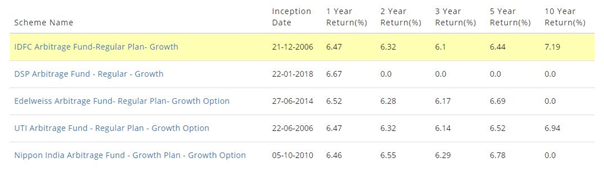

The table below shows the performance comparison of IDFC Arbitrage Fund versus its peers across different investment horizons.

Conclusion

In this article, we discussed why arbitrage funds are excellent investment options for parking your surplus funds for short periods. In order take advantage of long term capital gains taxation of arbitrage funds, investment period of 12 months or more is recommended. Based on its strong performance in the last 1 to 3 years, we are recommending IDFC Arbitrage Fund to our investors. If you want to invest in arbitrage funds or want to know more about it, please contact with your Eastern Financier financial advisor.