Dear Investors,

From this month, EF Monthly Digest is going digital! Readers may recall that we have been printing this Digest since November 1999 and it has been a favourite of our investors since it kept them updated with the financial world. However, I with my team, decided to go digital to keep pace with the changing time which I am sure you all will appreciate.

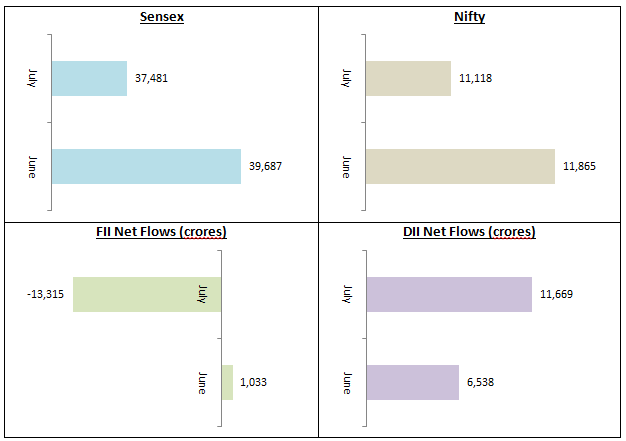

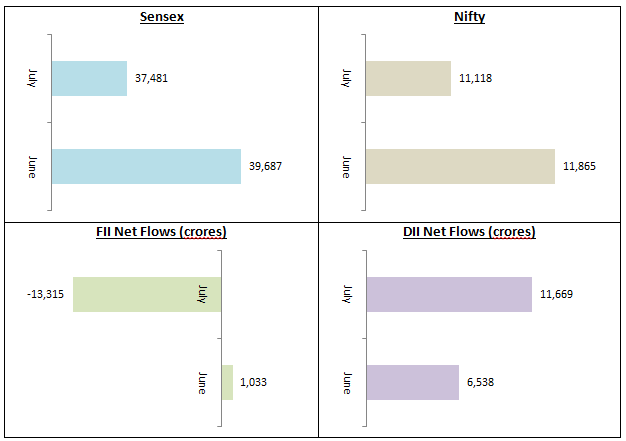

Stock market has continued to remain volatile for the second month in row. In July, the Nifty corrected by around 6% and is now trading at around 11,000 levels. FIIs were net sellers in the stock market, while DIIs were buyers. Weakness in the market can be attributed to several factors like tax issues for foreign portfolio investors, economic slowdown, weak corporate earnings and renewed concerns of global trade wars (particularly between US and China).

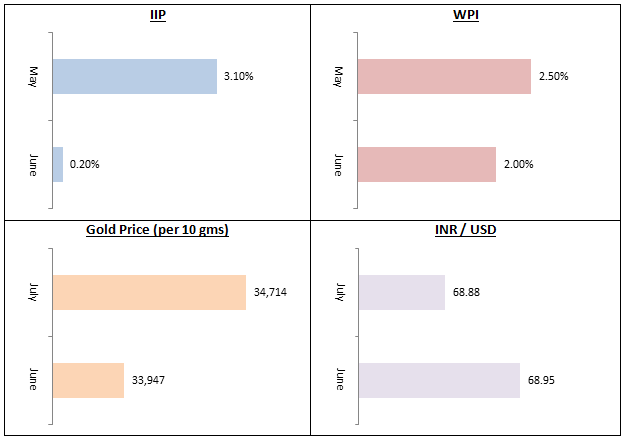

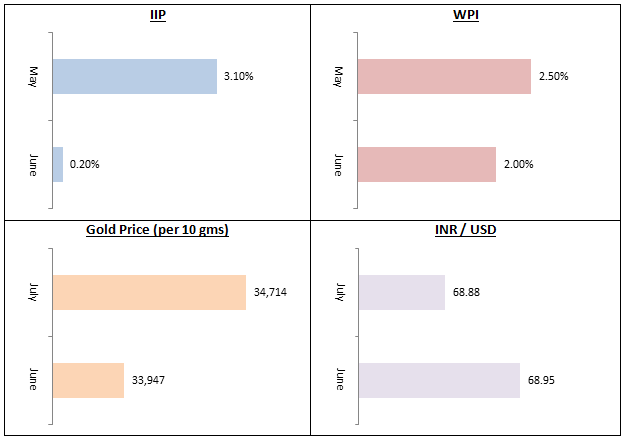

After seeing growth slippage in May, Index of Industrial Production (IIP) was almost flat in June. WPI Inflation fell 2.5% in May to 2.0% in June, creating room for the Reserve Bank of India (RBI) to reduce interest rates further. Domestic price of gold increased 2.2% month on month, while the Rupee ended almost flat to the US Dollar.

Continuing with the last 1 year trend, small / midcaps underperformed large caps. Midcaps (Nifty Midcap 100) fell by almost 10% (Nifty Midcap 100), while small caps (Nifty Small Cap 100) fell more than 11%. From an industry sector standpoint, most sectors were in red except IT and FMCG among the major sectors. IT was the best performing sector while automobiles, capital goods, manufacturing, agriculture and real estate underperformed.

Among the major events in this month is the RBI monetary policy meeting. The Street expects a rate cut on the back of the interest rate cut announced by the US Federal reserve. In the last policy meeting, the RBI Governor made clear the central bank’s accommodative policy stance to boost economic growth. While a rate cut by the RBI will be a positive for the stock market, we expect volatility to continue due to multiple reasons weak global risk sentiments, lack of clarity on the Fed’s roadmap, economic stress in some sectors and credit risk concerns etc.

In prolonged volatile conditions investors are advised to pay attention to their asset allocation to reduce downside risks, generate stable income and create wealth in the long term. In this newsletter we have reviewed ICICI Prudential Asset Allocator Fund, which works on the principle of dynamic asset allocation based on market valuations. Investing in systematic manner through SIP / STPs to build long term wealth reaps benefits in volatile market through Rupee Cost Averaging.

Investors can also take advantage of corrections to tactically increase their asset allocation to equities by investing in lump sum. Mid and small cap funds also present attractive investment opportunities from a long term investment perspective. Investors must be patient and have long investment horizon.

The most major risk for debt funds is credit risk - investors should invest in funds whose credit quality is good. With interest rates on a downward trajectory, medium to long duration funds and dynamic bond funds have given good returns in the last 1 year and may continue to do so in the future. However due to global risk factors, investors in duration based funds should be prepared for volatility and have a sufficiently long investment horizon (3 years plus). For investors who prefer stable income and low volatility, accrual based debt funds like low duration funds, short duration funds etc with high credit quality are preferable investment options. Our financial advisors can help you select the right debt funds for your investment needs and risk appetite.

We look forward to serving your financial needs with our array of products. As always, we assure you of our best services. Please provide us your valuable feedback so that we can further improve our services to serve your financial planning needs.

Hope you enjoyed reading the digital version, Please share your feedback with me in order to improve it further.

Happy investing,

Ajoy Agarwal,

(Chairman & Managing Director)