Dear Investors,

In my last month’s letter to investors, I had written about the concerns about the rapid spread of Coronavirus across the world. It has now become a global pandemic - across the world the number of cases (nearly 860,000) and death toll (more than 42,000) has been riding rapidly. The number of Coronavirus infections and related fatalities in India is still relatively small (1,637 cases and 37 deaths as on 31st March). However, we have seen a sharp rise in daily new cases over the last 3 days. The Prime Minister announced a nationwide 3 week lock-down on 23rd March.

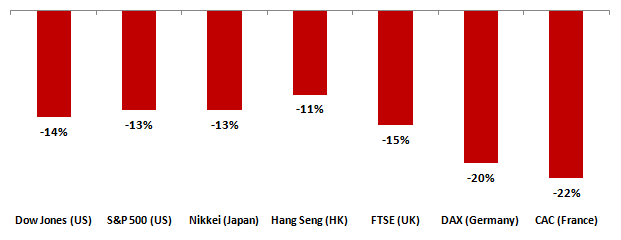

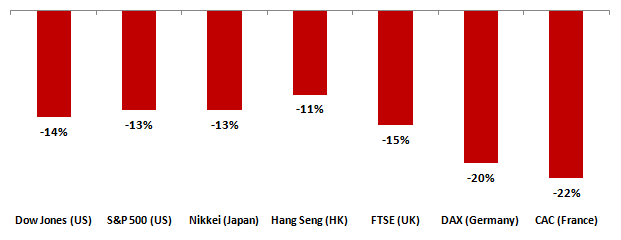

Stock markets all over the world tumbled with the rapid global spread of Coronavirus in March. In the US, the Dow Jones and S&P 500 were down 14% in March. Other major markets fell by 13 to 22% in March.

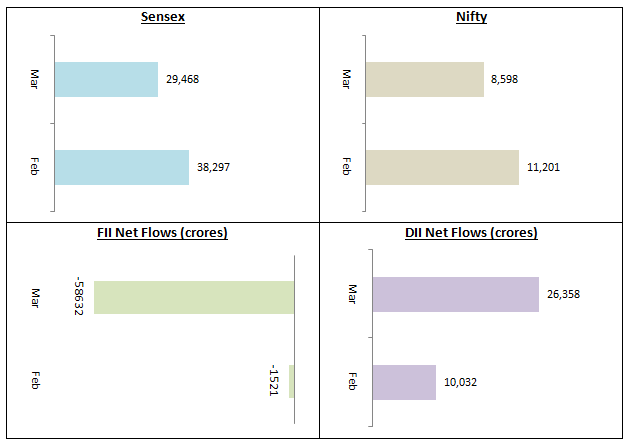

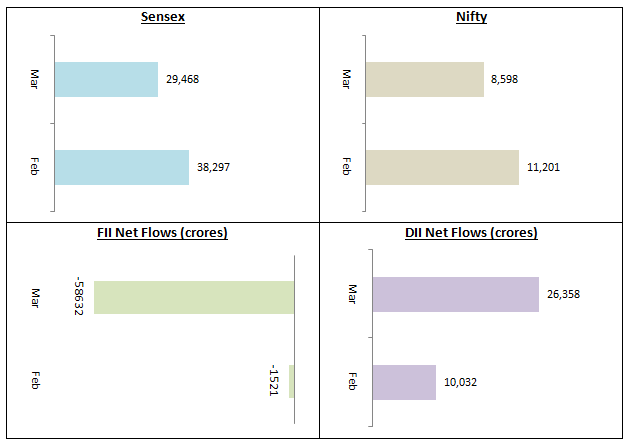

Emerging markets saw bigger correction. March was the worst month for the Indian stock markets in many decades. The Nifty fell by more than 23%, which was slightly more than worst monthly fall during the Global Financial Crisis of 2008. The Nifty closed the month at 8,598. The Sensex also fell around 23%, closing the month below the psychological level of 30,000. The broader market saw greater price damage in March. The Nifty Midcap 100 index fell nearly 30%, while the Nifty Small Cap 100 index fell 36% in March.

March saw the biggest ever monthly sell-off by Foreign Institutional investors (FIIs). FII outflow in March was more than Rs 52,000 crores. During the Global Financial Crisis in 2008, FIIs sold around Rs 100,000 crores of stocks. DIIs supported the market by buying more than Rs 26,000 crores of stocks. Investors should understand that DIIs may eventually run out of ammunition to keep buying as the market corrects. If FII selling continues unabated in April and beyond, the market is likely to see high volatility in the coming weeks and months.

Though we expect continuing volatility in the market over the coming few months, we urge investors not to panic and remain invested. In fact, you can use the deep correction in the market to tactically increase your asset allocation in equity. As discussed in our article, https://www.easternfin.com/blog/Why-should-you-invest-in-equity-funds-now, 25 – 30% corrections in the past have produced very attractive investment opportunities over sufficiently long investment horizons.

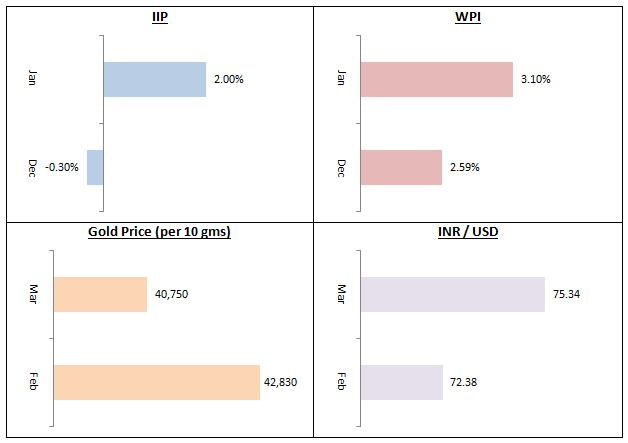

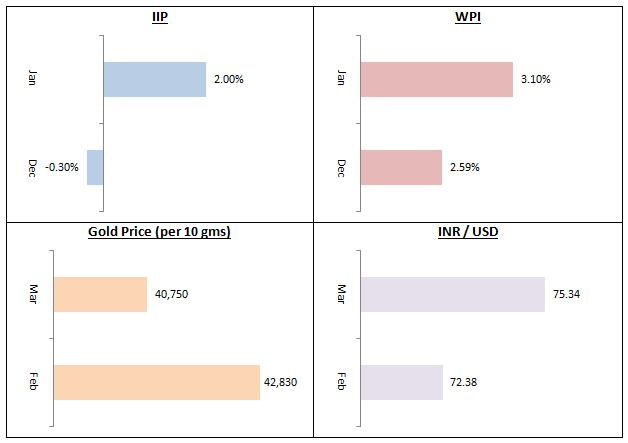

WPI inflation crept up in January as rising fuel price offset moderating prices of food items. However, crude prices have crashed since then due to sharp slowdown in economic activity due to the global spread of the pandemic. Index of Industrial Production (IIP)grew by 2.0% in January, a welcome sign after contracting for several months. However, the lockdown is likely to have a severe impact of IIP and the GDP. On the currency front, the Rupee depreciated 4% against the dollar. Gold reversed many months of bull trend by falling almost 5% in July.

We will have to wait for Q1 quarterly data to be declared in July / August to get a better sense of the damage to corporate earnings caused by the lockdown and also the earnings outlook in the coming quarters of FY 2021. Needless, the impact on quarterly earnings is likely to be severe based on February factory output data in China when many cities and districts in the country were put under lock-down. In its last MPC meeting, the RBI cut repo rate by 75 bps to support the economy. The Government announced a Rs 1.7 lakh crore relief package aimed at providing a safety net to the most economically vulnerable sections of the population. A second fiscal package aimed at providing relief to industries worst affected by Coronavirus e.g. MSMEs, services, export etc is also expected.

Governments around the world have responded quickly to support their economies with unprecedented fiscal and monetary stimuli (bigger than 2008 Global Financial Crisis). The US Government has announced $2 Trillion of stimulus and more is expected. Japan is expected to announce a massive fiscal stimulus package. European countries have also announced hundreds of billions of dollars of stimulus. We expect the massive stimulus packages announced by Governments and central banks will aid quicker market recovery once the governments have the pandemic under control.

In light of all the factors discussed above, we in Eastern Financiers expect more pain in the market before it bottoms out. However, we think this is a good time for investors to tactically invest in equity funds at every major dips. Large caps which seemed expensive at the beginning of this year are now available at fairly inexpensive valuations. The Nifty is trading at a PE multiple of 18 – 19X, which is significantly lower than its long term (10 year) average of 22 – 23X. We recommend large cap and large cap oriented equity funds for investors. However, if you have high risk appetite and long investment horizon, you can also allocate a portion of your investments to midcap.

We are clearly in a bear market now and in bear markets, debt funds usually have a negative correlation with equity fund returns e.g. in 2008, several long duration debt funds gave nearly double digit good returns while equity funds gave – 40% to - 50% returns. With RBI aggressively reducing interest rates and reiterating its accommodative policy stance to support the economy, longer duration funds like medium to long duration, long duration, dynamic bond, gilt funds etccan continue their good performance. However, you must have at least 3 year investment tenures for this fund and appetite for volatility. If you have low risk appetite or want to invest for shorter durations (1 to 3 years), then accrual based debt funds like ultra short duration funds, money market funds, banking and PSU funds, low and short duration funds are suitable investment choices. Given the continuing stress in many industry sectors, we urge investors to look for highest credit quality funds.

A deadly pandemic like Coronavirus is also a useful reminder for us to protect our loved ones with adequate health insurance. In case you need to buy health insurance cover for your family, please contact your Eastern Financiers insurance advisor. Even though we are all under lockdown, your Eastern Financiers’ financial advisor is on the standby to serve your financial needs in these difficult times. Please do not hesitate to contact your financial advisor if you need any assistance. As always, we assure you of our best services.

Stay safe,

Ajoy Agarwal,

(Managing Director)