Dear Investors,

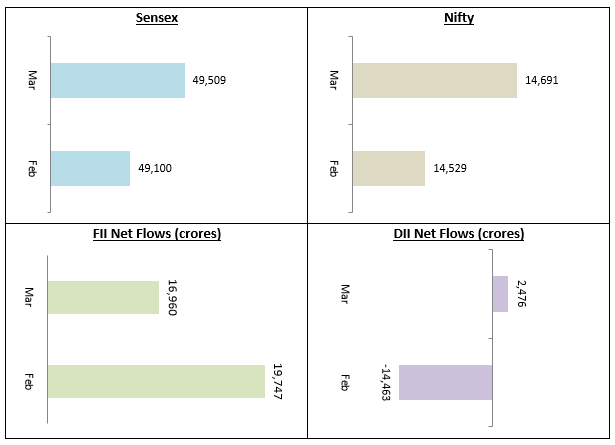

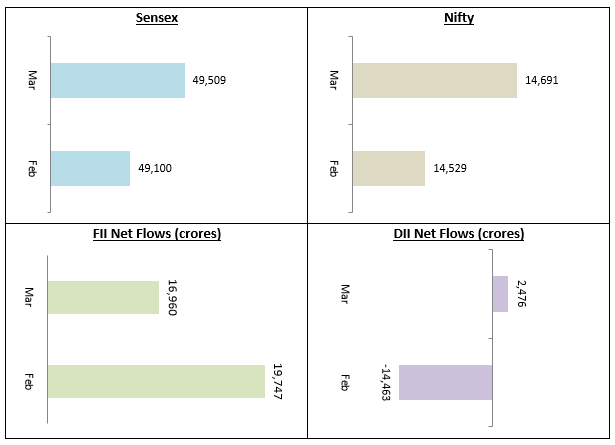

The stock market maintained its momentum in March 2021 continuing its strong performance in February. The Sensex gained 0.8% closing above the 49,500 level and Nifty gained 1.1%, closing at around 14,690. FIIs continue to be bullish on India with net purchase of Rs 16,960 Crores.

DIIs, after being net sellers for many months, turned net buyers in March with net purchase of Rs 2,476 crores. The economy is still on the recovery mode from the effects of COVID-19 but there are many challenges ahead. The most immediate challenge for the economy is the resurgence in COVID-19 pandemic in many states across the country. Though the State Governments have imposed on only limited restrictions so far, partial / total lockdowns cannot be ruled in the view of worsening COVID situations in many states like Maharashtra, Karnataka, Chhattisgarh, Uttar Pradesh, Gujarat, Delhi, Punjab etc. We think re-imposition of lockdown even for short period will have an adverse impact on market sentiments. Investors should be prepared for volatility in the coming days / weeks.

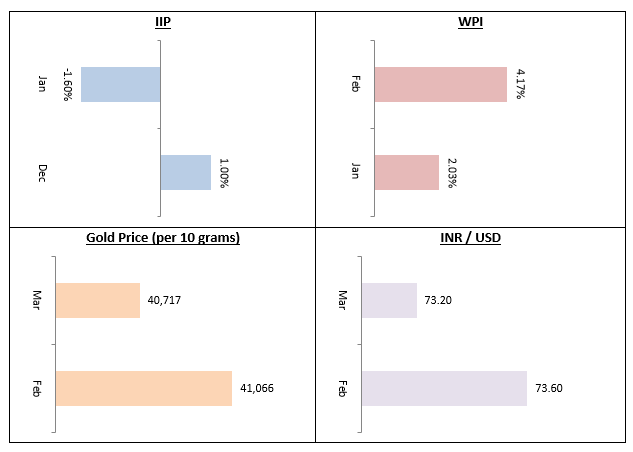

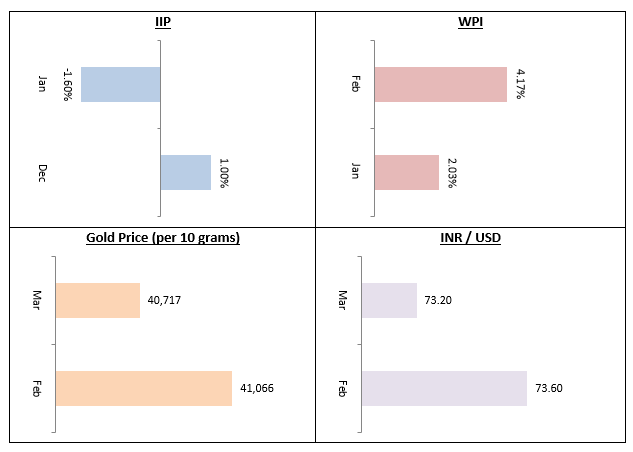

I had mentioned in my previous letter that while we expect IIP growth to gradually inch up in 2021, but we may face some bumps on the road. The January IIP contracted by 1.6% after showing positive growth in December. In view of the COVID-19 situation around the country, it is difficult for economists to form an outlook on IIP recovery. As seen during the previous lockdown in 2020, lockdown whether partial or total has a severe impact on industrial activity.

Based on what we have seen over the past few weeks, the Coronavirus situation is worsening. WPI inflation climbed up even further to 4.17% in February driven by higher crude and also food prices. Gold continued on its declining trend falling nearly by a percentage in March. If you want to invest in Gold, then you should have a long term investment horizon or long term life-stage goal (e.g. children’s marriage etc). We do not expect Gold to outperform in the short term but for the medium to long term horizon, investments at current level provide a good opportunity. The Indian Rupee (INR) ended flat to the US Dollar (USD) in March.

Continuing with the trend over the last several months, the broader market (i.e. midcaps and small caps) outperformed in February. While you can tactically increase your allocations to midcap and small cap funds through lump sum on dips or through STP / SIP, you should also keep your overall asset allocation in mind and have a balanced approach; you should ensure that you have adequate allocations to large caps also. Our financial advisors can help you make the right investment decision according to your asset allocation and risk profile.

I had mentioned in my previous letter that one should expect bond yields to firm up in line with higher US Treasury yields. US Treasury bond yields have been rising over the past month or so. This is likely to put pressure on Indian Government bond (G-Secs) yields. Though the RBI is trying to alleviate the pressure on bond yields with its own borrowing program, investors should be wary in the face of the large borrowing needs of the Government in this financial year and the external pressures on account of rising US Treasury yields. In the current macro environment, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Banking and PSU debt funds etc will be good investment choices for conservative investors with tenures of at least 3 years. Over 3 years plus investment tenures, you can enjoy indexation benefits in debt fund taxation. For shorter investment tenures, ultra-short duration funds, money market funds and low duration etc. can be a good choice depending on your investment needs. Our financial advisors will help you select high quality debt funds that are suitable for your specific needs.

Outlook

The near term market outlook depends on how the COVID situation evolves and the steps taken by the Central and State Governments. The COVID vaccine will play the most important role in controlling the pandemic because past lockdowns have shown that lockdown alone is only a temporary solution. India has a significant challenge in vaccinating our very large population and though the vaccination drive has been successful so far, we are facing challenges with respect to manufacturing capacity; many States are facing vaccine shortages. How the Government and Pharma companies respond to this challenge and ramp up vaccine production will have a bearing on our economic recovery and also on market sentiments. However, from a longer term viewpoint, our moderate to long term outlook is positive. The 2021 Budget provides a roadmap of how India can go back to path of economic growth and emerge even stronger.

Conclusion

The unfortunate resurgence of COVID in our country is a warning for us not to lower our guard against this pandemic. We should also prepare ourselves financially by buying sufficient life and health insurance to protect our family from this pandemic. Tax planning is an important part of our financial planning for the year. We in Eastern Financiers’ are of the opinion that you need to begin your tax planning early in the financial year. Our financial advisors can help you with your tax planning and other financial planning needs like insurance, investments etc. I reiterate my commitment for the highest standards of service. Please provide us your valuable feedback so that we can further improve our services.

Best Wishes,

Ajoy Agarwal,

(Managing Director)