Dear Investors,

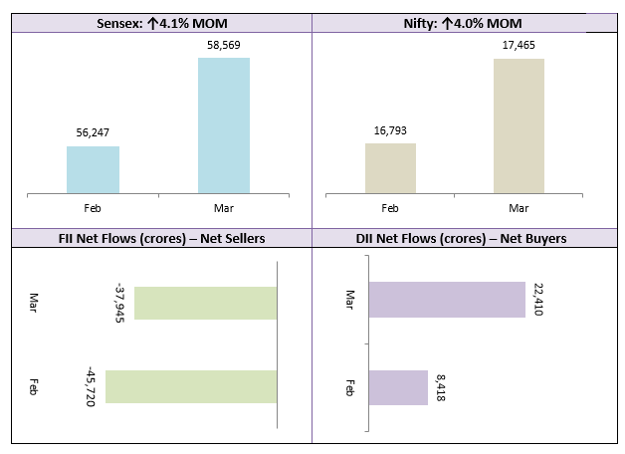

The equity market in March showed resilience in the face of adverse news and closed the month with solid gains. The war in Ukraine weighed on the markets as we began this month, dragging the market down to its 8-month low. However, the market rebounded with Nifty closing the month near the 17,500 level. The FIIs continued to be sellers in March as well, continuing the trend for 6 months now. However, the market was supported by strong DII buying. Overall, global equity markets are bullish despite surging commodity prices and US Fed hiking interest rates. As we ended the month, there are some signs of the conflict in Ukraine de-escalating; this will be good for equity markets.

The broader market has been more volatile over the past 2 months or so, but it has also bounced back over the past few weeks. We may see midcaps and small caps outperforming again, once we are past this volatile phase. As far as the primary market was concerned, March was a weak month for IPOs. The much awaited LIC IPO has got postponed. However, April may see a flurry of IPOs and we may hear about the future of LIC IPO from the Government. While the LIC IPO can be very positive for equity market in India, we advise investors to evaluate each IPO on a case by case basis before investing. You should consult with your Eastern Financier’s financial advisor before investing in IPOs.

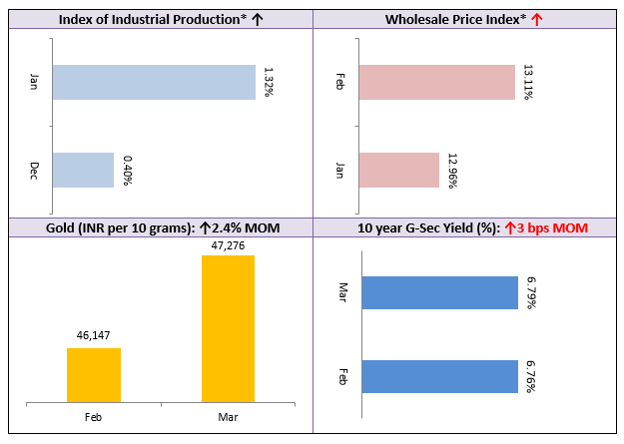

Gold has performed very well over the past two months, primarily due to high commodity prices and global risk aversion due to the Ukrainian situation. However, gold closed the month significantly lower than it’s high. Though gold outperformed equity in past 2 months, we expect the trend to reverse if we see de-escalation of the war in Ukraine. Overall, we have positive outlook on equities from a medium to long term perspective. Investors are advised to continue their SIPs in equity mutual funds.

The 10 years Government Bond yield remained relatively flat in March, but we can expect the yields to creep higher if interest rates go up. The trajectory of interest rates will depend on global factors like actions taken by central banks and commodity prices, mainly crude oil. In the current environment we should expect yields to go up. In the current situation, we advise high credit quality, shorter duration, accrual based debt funds. In a rising interest rate scenario, shorter duration funds can give higher returns because they can re-invest the proceeds from the maturing securities in higher yields.

As we begin a new financial year, this is a good time to review your investment portfolio with your Eastern Financiers financial advisor and make changes according to your investment needs. We also urge you to begin your tax planning for FY 2022-23 early in the year. I want to assure you that I and my team are committed to servicing all your financial services needs to the best of our abilities.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!