Dear Investors,

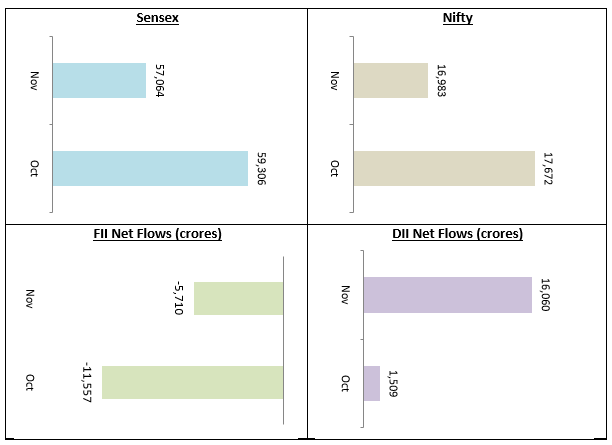

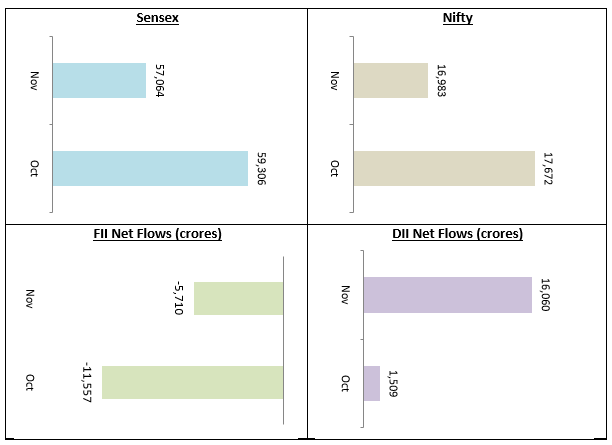

The stock market remained volatile in the month of November. Sentiments weakened in the last week of November as fears of a new COVID wave caused by the highly virus strain, Omicron gripped the market. As scientists around the world are studying the new virus stain, volatility is expected to continue for the next few weeks. The Nifty lost nearly 4% in November closing the month below the psychological 17,000 level. The Sensex was also near 4% down, closing the month near the 57,000 level. FIIs continued to be net sellers, while DIIs were net buyers in November.

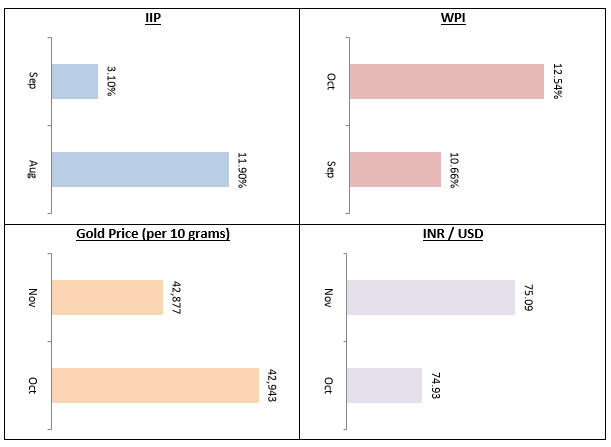

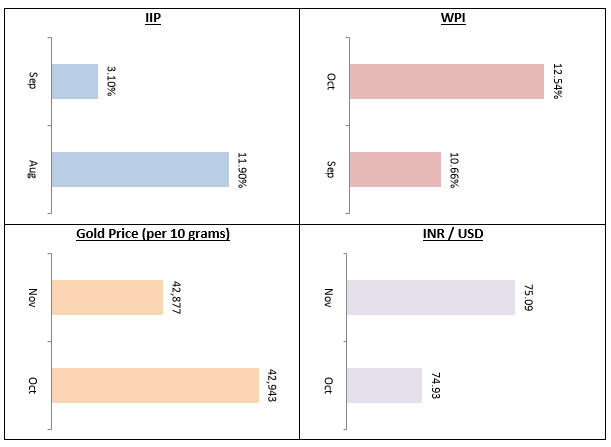

The Index of Industrial Production (IIP) registered growth of 3.1% in September versus 11.9% in August; however, the August figures have the benefit of low base effect. The second quarter (July to September 2021) GDP growth figures were released by the Government. 8.4% real GDP growth in Q2 indicates that India is gradually on the path to economic recovery. WPI inflation has remained persistently high for many months now, spiking to 12.54% in October, reflecting the global trend in inflation. The RBI Governor has said that the central bank is keeping a close watch on core inflation but he has not yet indicated any change in monetary policy stance.

Gold prices were choppy in November. The yellow metal closed the month almost flat to the previous month. The INR also closed the month nearly flat to the US Dollar in October. I had mentioned in my last monthly newsletter that all eyes will be on the US Federal Reserve meeting in November. As expected, the Fed began its tapering of bond purchase program in November. The market is expecting a gradual and orderly taper, keeping in mind the impact on the economy. The Fed has indicated that it may quicken the taper in December. We will see how the market reacts to the Fed’s commentary in December.

As far as debt funds are concerned, a lot will depend on Fed’s actions in the coming months as well as the trajectory of global commodity prices. Though the RBI has maintained an accommodative monetary policy, the 10 year Government Bond yield has been creeping up throughout the year, some volatility notwithstanding. The yields of money market and short term corporate bonds have also crept up. In these market conditions, we think, it is prudent to invest in shorter duration accrual like low duration and short duration funds to minimize interest rate risks.

Conclusion

December is usually a slow month for the stock market since a lot of people plan their annual leaves around this time of the year. However, this December will be a very important month because the market will be waiting for relevant updates. The most important update will be on the spread of the Omicron virus strain and potential impact on economic growth. Over the next few weeks we will also have more information on the severity of the disease caused by the Omicron (patients so far have shown only mild symptoms) and how widespread the Omicron cases are.

The market will also be closely following the policy stance of the US Fed. The Fed has indicated that it may have to re-look at its inflation stance; the Fed has so far maintained that the current high inflation is transitory caused by supply chain disruptions due to COVID. However, commodity prices have persistently remained high and the Fed will have to decide whether it maintains its current policy stance on inflation or take on the inflation challenge by tightening monetary policy. Fed’s policy direction will have significant impact on both stock and bond markets going in 2022.

We will keep a close watch on these developments for you and update you in our next monthly newsletter. You can also reach out to your Eastern Financiers’ financial advisors, if you have any question or concern. On behalf of Eastern Financiers’ team, I wish all our esteemed customers a very enjoyable holiday season and advance greetings for a happy and prosperous 2022.

Best Wishes,

Ajoy Agarwal,

(Managing Director)