Dear Investors,

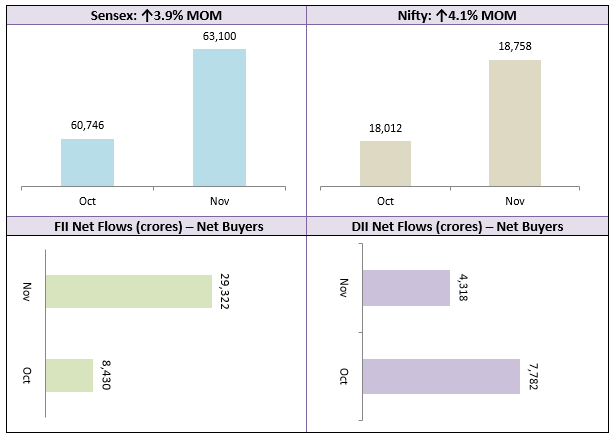

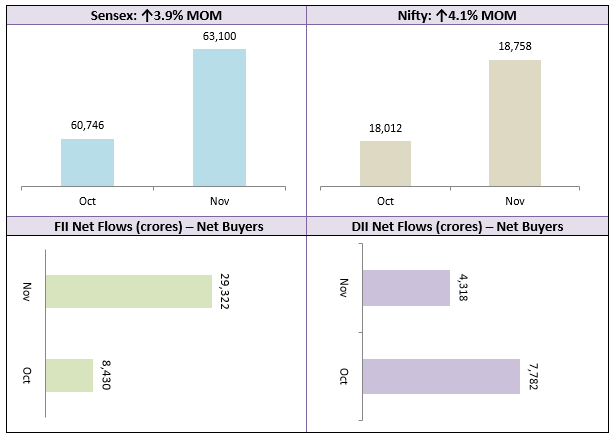

The bullish trend in the stock market continued in November 2022. Major brokerage houses in the US are expecting the US to avoid a recession in 2023 when the interest rate cycle comes to its end. With crude oil prices falling, fear of stagflation is falling. With favourable global cues, both the Nifty and Sensex rallied by 4% in November, closing the month at record highs. India has been, over the past few months, the star performer in the emerging market pack as per Standard and Poor; foreign institutional investors (FIIs) pumped in Rs 29,322 Crores in Indian equities in November.

Recent comments made by the US Federal Reserve Chairman, Jerome Powell, indicates a change in stance of the Fed tending towards dovish with possible readjustment of rate hikes from December. That may trigger a Santa rally in US markets with follow on impact in India as well. The Q2 corporate earnings were largely in line with analyst expectation with the BFSI sector outperforming. We expect the stock market rally in India will be largely led by the BFSI sector in the coming months and quarters. While valuations may seem relatively expensive to some investors, historical data shows that momentum takes the market to significantly higher levels, while earnings catches up later.

In the broader market, the midcap and small cap indices continued to outperform large caps. We expect midcaps and small caps outperform in the early to mid-stages of bull market. You should continue to invest in midcaps and small caps through SIP. You can also tactically invest in lump sum on market dips. You should always have long term investment horizons for investing in equities.

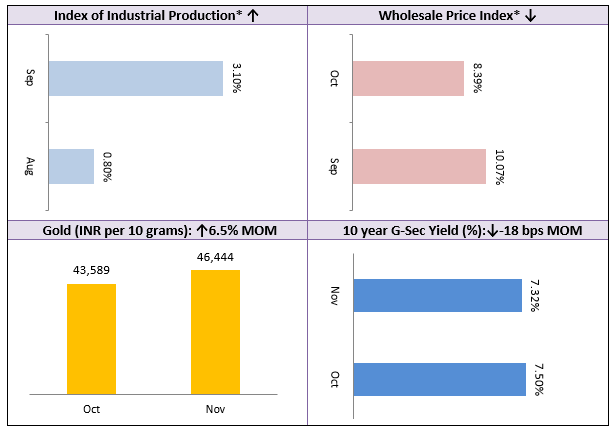

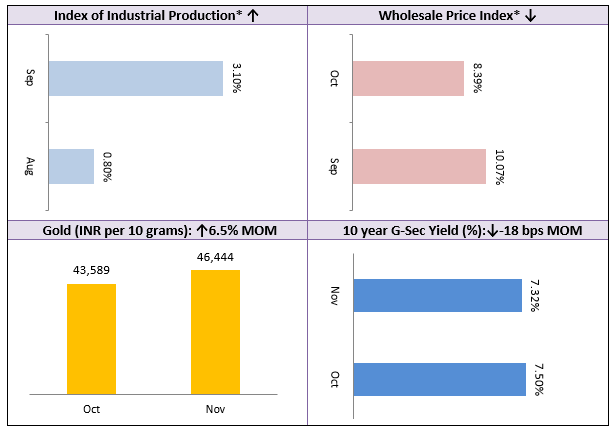

As far as commodities are concerned gold rallied after months of underperformance in November. With the Fed indicating readjustment of rate hikes and the dollar weakening, we expect gold to rally further. Silver has been one of the strongest performers among commodities over the past 3 months. In November Silver rallied by more than 13%. Silver may rally even more, if the Chinese Government relaxes its zero COVID policy in wake of protests there. China is the largest manufacturer of solar panels, in which silver is a key raw material. If China ramps up its production of solar panels again, demand for silver will increase substantially, leading rise in prices.

Debt funds have been underperforming for more than a year now. But we are expecting a turnaround in debt funds now. With inflation waning, we expect long term yields to ease; the 10 years bond yield eased by 18 bps in November and will take cues from the RBI’s monetary policy committee meeting in December. Investors with long investment tenures can lock-in the current yields by investing in roll down maturity debt funds and target maturity funds. Short term yields hardened further by 8 bps in November. For short investment tenures (up to 1 – 2 years), ultra-short duration and money market funds can be attractive investment options.

Wishing you and your family a very happy, healthy and prosperous New Year

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!