Dear Investors,

Global equities rebounded in January, with increasing confidence among global investors that the US Federal Reserve is nearing the end of its interest rate tightening cycle. The comments made by the Fed Chairman in the last FOMC meeting further reinforced this viewpoint. US market rebounded in January and technology stocks, which had seen the biggest cuts in 2022, rallied strongly in January. The reopening of China after repeated COVID lock-downs brought cheer to Chinese stocks.

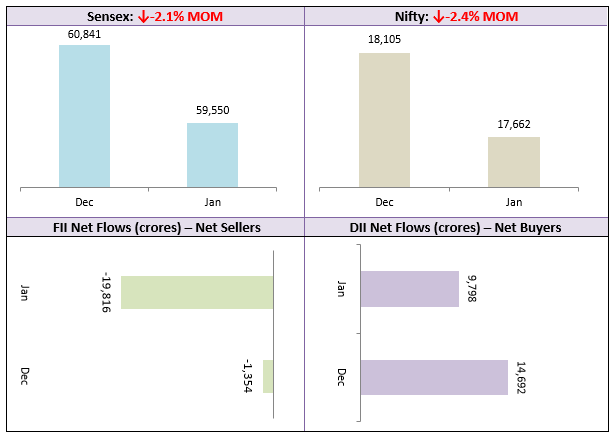

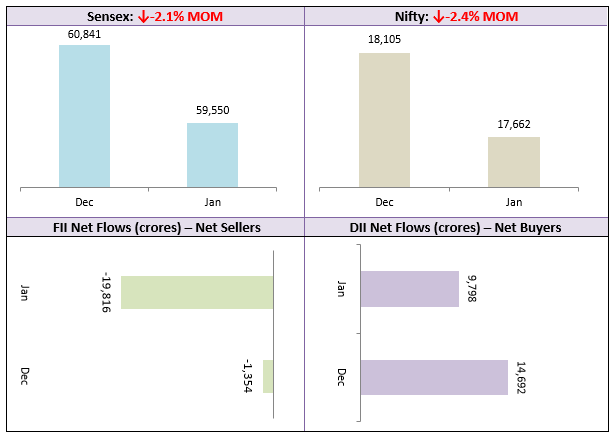

India was an underperformer in January as stock market was rocked by reports of an US based short seller, Hindenburg Research, on the Adani Group. Share prices of Adani Group companies crashed and the group had to call off their FPO despite it being fully subscribed. The sharp fall in Adani Enterprises and Adani Ports, which are part of the Nifty, dragged down the index which closed the month 2.4% down. Despite the dramatic events in the last week of January, we see the fall in Adani stocks simply as unsystematic risk and we do not think that they constitute any systemic risk for the market.

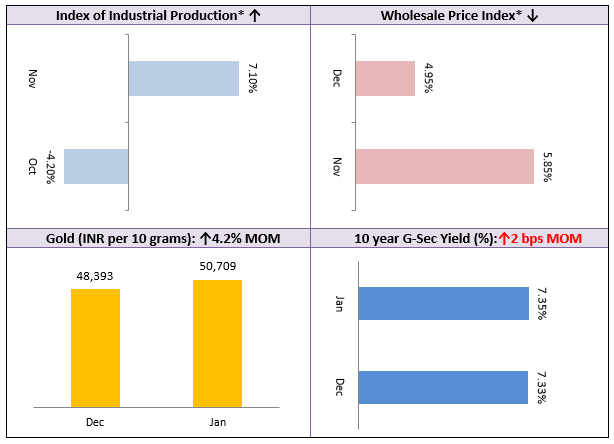

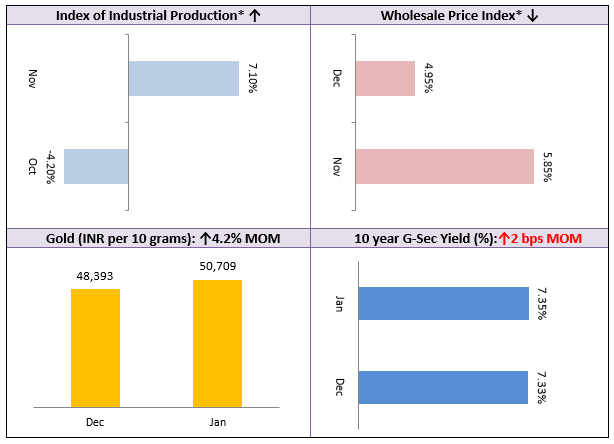

The Union Budget of 2023 was largely in line with market expectations. The Government’s has shown fiscal prudence despite 2024 being an election. The commitment to fiscal discipline (5.9% fiscal deficit in FY 2023-24) will increase the confidence of FIIs. The Government has increased its allocation to capex, which may have a multiplier effect and also boost private sector capex spending. There were no surprises in capital gains taxation and the Finance Minister clarified its intention of continuing with the old tax regime alongside the new tax regime. The Government has extended some benefits to the new tax regime, by effective income taxes up to an annual income of Rs 7.5 lakhs, but we think that this will only have a marginal impact on savings or consumption.

Overall, 2023 seems to be a good year for equities globally since the Fed expects a soft landing for the US economy at the end of the interest rate cycle. Indian equities may remain volatile in the coming weeks partly due to the Adani overhand and partly due to valuations, but the India growth story remains intact. You should remain disciplined in your financial planning and continue to invest systematically.

As we approach the end of this financial year, we would like to remind investors to complete their tax planning for the year sooner than later. We look forward to serving all your investment and other financial needs to the best of our abilities.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!