Dear Investors,

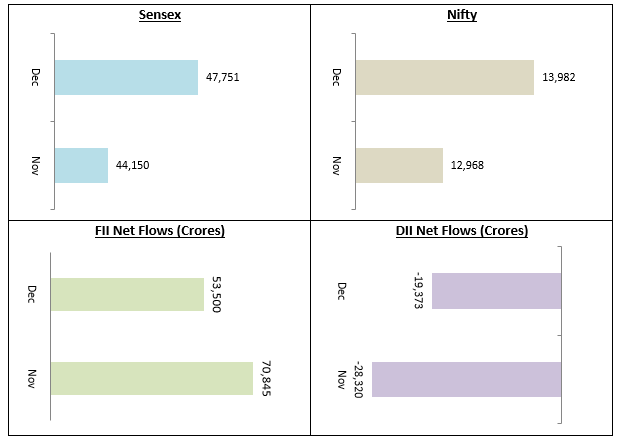

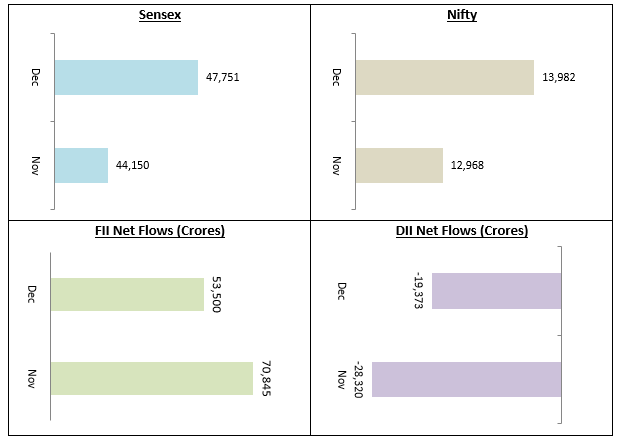

The stock market extended its gains in the month of December 2020 ending the year at its all-time high. The Sensex closed the year within touching distance of the psychological 48,000 level (8.2% month on month gain) while Nifty also closed the year, very close the important 14,000 level (7.8% month on month gain). FIIs continued to be bullish about Indian stocks pumping in net purchase of nearly Rs 53,500 Crores in December. DIIs continued to be net sellers in this market with net sales of Rs 19,373 Crores. The broader market also saw impressive gains with Nifty Midcap 100 rising 5.7% and the Nifty Small Cap 100 rising 7.8% in December.

The market sentiment remains positive with clear signs of pickup in economic growth from the COVID induced slump, the Government approving the vaccine for COVID-19 and expectations of more economic reforms in Budget 2021. Globally, with a new President taking office in the United States, easing of tension with several countries on matters of trade, immigration, climate change and other important issues is expected. Overall, we can look forward to the year 2021 with a lot of optimism.

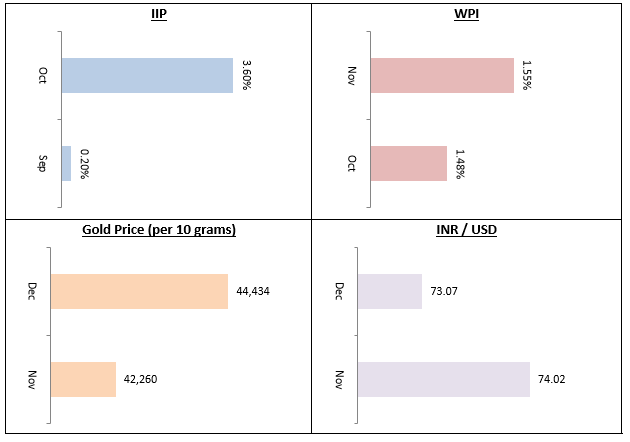

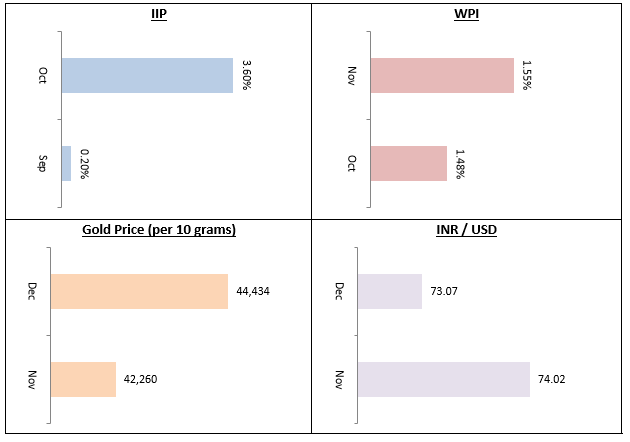

There were further signs of economic turnaround from Index of Industrial Production (IIP) data -After returning to positive growth in September, IIP showed further signs of picking up with 3.6% growth in October. WPI inflation crept up to a 4 month high in November, but food prices eased during the month which is a good sign. The RBI maintained status quo on interest rates in the December monetary policy committee meeting. Gold prices firmed by about 5% in December, while the Rupee eased by 1.3% against the US Dollar. Though we are still in very early stages of economic recovery, the economic data seems to support the market sentiment.

I have mentioned several times in my last few letters that we expect small / midcaps to outperform large caps during the recovery from the bear market bottom. You can tactically increase your allocations to midcap and small cap funds either through lump sum or STP / SIP. You should always have long investment horizons for midcap and small cap funds. You need to keep your overall asset allocation in mind, when investing in mid and small caps. Our financial advisors can help you make the right investment decision according to your asset allocation and risk profile.

As far as fixed income is concerned, longer duration funds e.g. Gilt funds, dynamic bond funds etc. and funds with high credit quality e.g. corporate bond funds, Banking and PSU funds etc. had a very strong year giving 9 – 10% returns in 2020. They were undoubtedly helped by RBI’s very accommodative monetary policy, which included cutting interest rates and infusing massive amounts of liquidity in the financial system and bond markets. However, with inflation creeping up the RBI may be forced to a pause in its extremely accommodative policy. Therefore, investors should temper their expectations with regards to debt fund returns in 2021.

However, debt funds continue to be excellent investment options for investors given the decline in interest rates of bank FDs and other traditional fixed income investments like Post Office Savings Schemes. Given the outlook on the yield curve, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Banking and PSU debt funds etc. will be good investment choices for investors with investment horizon of at least 2 to 3 years. If you can remain invested for 3 years or more, you can also get benefits of indexation in capital gains tax. Credit quality continues to be of utmost importance especially in the current economic situation. Our financial advisors will help you select high quality debt funds that are suitable for your specific needs.

Year 2020 in perspective

Year 2020 was a difficult year for many across the world. We had to face once in a lifetime global pandemic, restrictions placed in our day to day lives and businesses due to the lockdown and other measures to curb the spread of the pandemic and extreme market volatility especially in the first quarter of the calendar year, but we ended the year on a positive note on several fronts.

Despite facing one of the worst economic crises since the Great Depression of 1930s, the Sensex rose 15.7% (Nifty rose by 14.9%) in 2020. The broader market (midcaps and small caps) after 2 difficult years are again in a bull market phase. While we ended 2020 with market at all-time highs, some of you may be worried about investing when the market is at its all-time high, but favourable economic data and corporate earnings can push the market to much greater highs, as we have seen many times before in the stock markets. The economic data over the past few months indicate signs of recovery and therefore, we expect the market to scale greater heights in 2021.

Conclusion

One of the important lessons learnt this year was that if we stick to the basics, be it investing (buying when the market is low, importance of asset allocation etc.), health (observing precautions, good food and lifestyle habits, exercise, yoga etc.) or other aspects of life, we can emerge stronger from a crisis. I on behalf of the Eastern Financier’s team, wish our esteemed customers a very happy, healthy and prosperous 2021. We look forward to serving your investment and other financial needs with the highest standards of service.

Best Wishes,

Ajoy Agarwal,

(Managing Director)