Dear Investors,

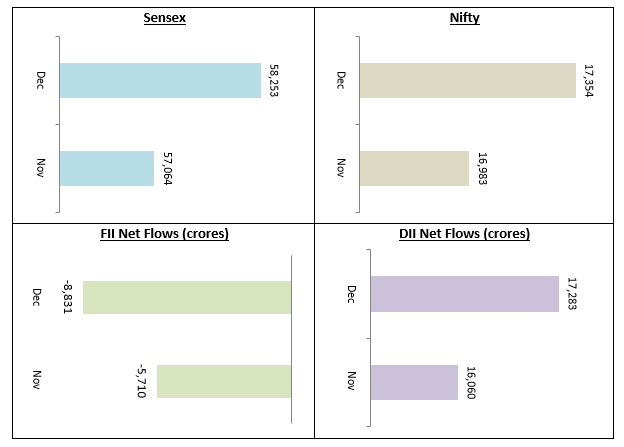

The stock market was volatile in the first half of December 2021 as concerns about the highly infectious Omicron variant of COVID made markets nervous. However, as information about the virulence of Omicron started coming in from different countries, the market recovered its losses and posted solid gains to close the month. Both the Sensex and Nifty closed the month 2% higher. FIIs continued to sell in December, while DIIs continued to be bullish about Indian equities.

The market is expected to look past Omicron concerns, since data shows that the Omicron variant has relatively low hospitalization rates and hence lockdowns or very stringent restrictions may not be required unlike the first two COVID waves. Overall, 2021 was a great year for equities, as the Nifty rose 25% during the year. This is on back of a strong performance in 2020 as well. Investors should know that Nifty has risen 40% in the last two years (2020 and 2021); however, you should temper your expectations in 2022.

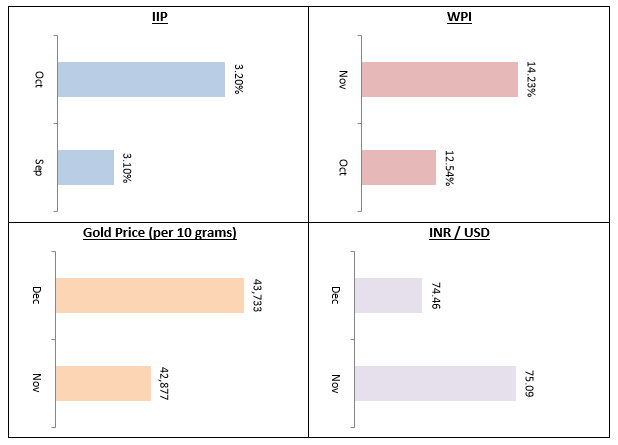

The Index of Industrial Production (IIP) growth remained subdued at 3.2% in October 2021. Economic growth recovery after a major economic shock is not always V-shaped. Many economists think that India will see a U-shaped recovery, which may take several months or even years. However, the macroeconomic data suggests that we are on the path of recovery. WPI inflation has remained persistently high for many months now, spiking to 14.23% in November. The RBI Governor has so far kept its monetary policy stance unchanged. RBI’s policy stance seems compelling in view of the fact that the Indian economy is facing headwinds due to the Omicron threat and high global commodity prices. The more immediate priority for RBI is to revive growth. However, it remains to be seen that for how long, RBI can stick to its accommodative policy with changes in global interest rates scenarios. In that regard, we will keep a watch on the US Fed’s policy actions on ending the bond purchase program and interest rates.

Gold prices strengthened by 2% in December. The yellow metal has risen nearly 6% in the last quarter of CY 2021 primarily due to high commodity prices (gold prices usually increase in line with commodity e.g. crude oil, metals etc prices) and Omicron concerns. With Omicron concerns easing, we can see the Gold rally slowing down or even coming to a halt in 2022. However, it would be prudent to have Gold in your asset allocation, since equity valuations seem expensive at these levels.

The Fed, in its December meeting, has quickened the taper as was expected by the market and discounted in prices. The Fed has also changed its stance on inflation to a more hawkish one. The market has taken Fed’s changed policy stance in its stride. A stronger US economy will be good for global equities. With the Indian economy also on the path to recovery, our outlook on equities is positive from the perspective of medium to long term investment horizon.

Conclusion

As we begin this New Year, we look forward to it with a lot of optimism. The economy is on recovery path and there will be huge earnings growth potential in the post COVID scenario. At the same, we also have to exercise caution both in our day to day lives and in our investments. The number of COVID cases is rising in India and some restrictions have already been announced by several State Governments. There will be some uncertainty with the near term growth outlook. In this regard, the Union Budget 2022 on 1st February will be an important event. We expect the budget to be reform and growth oriented like the last Budget. We will follow the Budget and update you in my next newsletter.

Wishing our esteemed investors and their families a very happy, healthy and prosperous 2022.

Best Wishes,

Ajoy Agarwal,

(Managing Director)