Dear Investors,

Markets turned volatile in December 2022 after hawkish comments by the US Federal Reserve. Though the Fed resized its rate hike to 50 bps in its December meeting, the Fed is committed to reducing its balance sheet (assets) to bring down inflation. By selling its assets, the Fed plans to suck up liquidity from the financial system forcing prices to go down. This will only have an impact on the bond market, but on stock markets as well. The major US indices Dow Jones and S&P 500 were down 4 - 6% in December, while the tech-heavy NASDAQ was down nearly 9%.

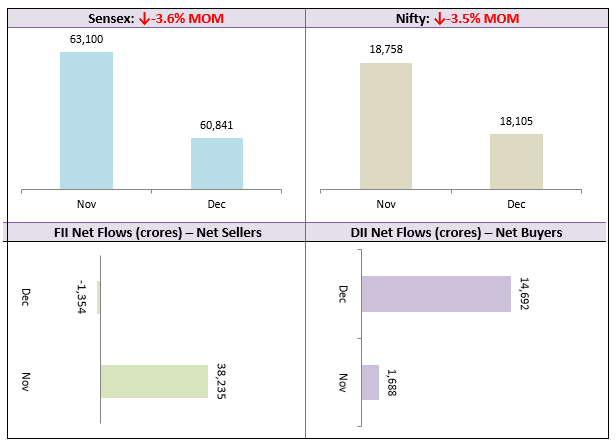

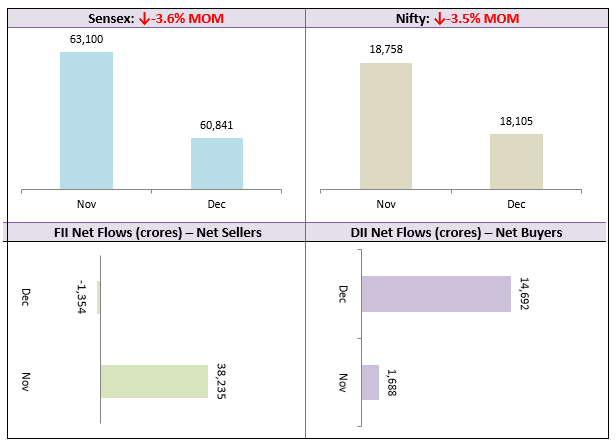

Global headwinds had an impact on Indian equity market as well, with Sensex and the Nifty 50 correcting by about 3.5%. In December 2022, in another extraordinary move, the Bank of Japan changed its decade old policy, by allowing its 10 years bond yield to move 50 bps from the 0% target. This may have ramifications for global markets. In January the focus will be on US jobs data. Though non-farm payroll growth decelerated in December, the labour market in the US continues to surprisingly strong, which may provide room for further rate hikes causing headwinds for global equities. Mechanical indicators in Indian stock market are signalling more volatility in the coming weeks and months.

With recession looming in many parts of the world, India emerged as a bright spot in global economy and markets. The World Bank has revised India’s GDP growth in FY 2022-23 to 6.9%. While major global markets were in the red, Nifty closed the year with a 4.3% gain. We expect the Nifty to remain range-bound with a downward bias with near term support at around 17,700 - 17,800 levels. However, further downside risk cannot be ruled out. Investors should be patient and have long term investment horizon in this market. You should continue your SIPs and use large corrections to invest in lump sum. There are attractive investment opportunities especially in the small cap space.

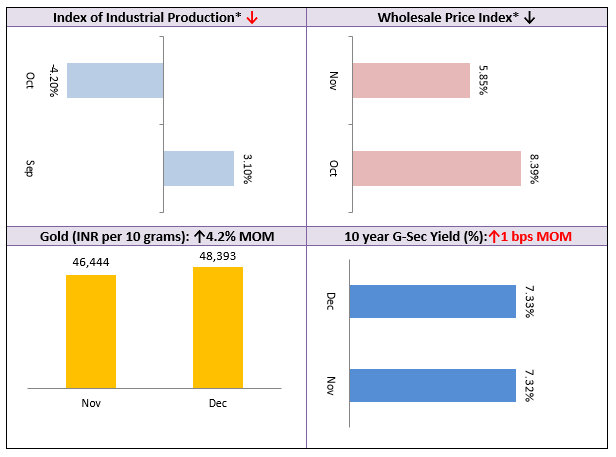

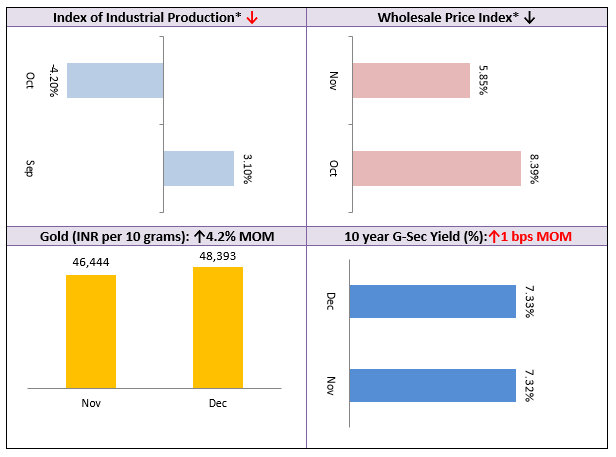

Among other asset classes gold and silver continued its rally in December. According to analysts, gold and silver are expected to outperform in 2023, with interest rates peaking and inflationary conditions persisting for much longer than expected. As far as debt funds, 4 - 7 years Government Bond yields are quite attractive; investors with long investment tenures can lock-in the current yields by investing in roll down maturity debt funds and target maturity funds. I think that asset allocation will be very important in 2023. You should consult with your Easter Financier’s financial advisor and make investment decisions suited for your investment needs.

I on behalf of my team, wish you and your family a very happy, healthy and prosperous 2023. We look forward to serving all your investment and other financial needs to the best of our abilities in 2023 and beyond.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!