Dear Investors,

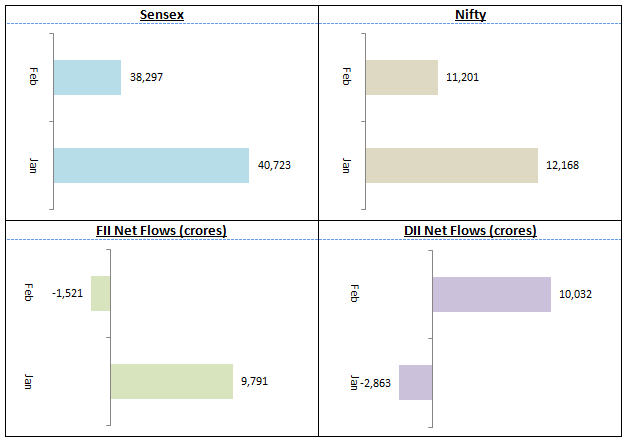

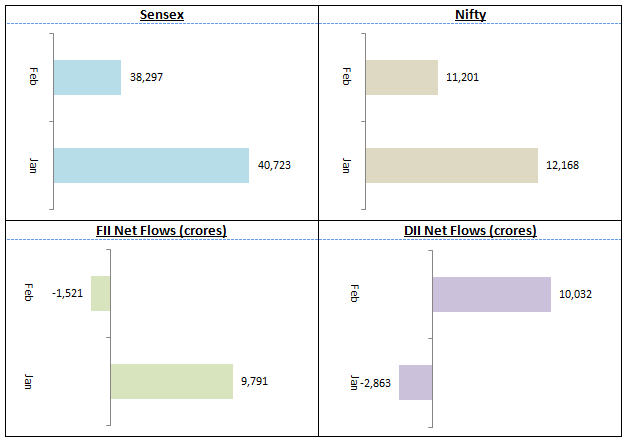

February 2020 was not a good month for the stock market. The month was dominated by the concerns about global spread of Coronavirus and its impact on the global economy. Nifty closed February at 11,201, nearly 8% lower month on month. The Sensex was down 6% to 38,297 well below the psychological 40,000 level. The death toll from Coronavirus globally has crossed 3,000 with several hundreds of fatalities reported from outside China e.g. Italy, Iran, South Korea etc.

95,000 people are infected with Coronavirus around the globe as of 5th March 2020, including 29 cases reported from India. The rapid spread of Coronavirus in East and South East Asia has severely disrupted global supply chains and will have a significant effect on the global economy in the near term. The main focus of Governments around the world including India is to stop the contagion from spreading and minimizing fatalities, but Governments and central banks will soon have to address the economic fallout of this disease.

The most immediate impact of Coronavirus in the stock market was seen in large-scale FII selling (Rs 1,500 crores net). In the cash market, FIIs sold more than Rs 12,680 crores of stocks. DII were net sellers in January. DIIs lapped up stocks in every FII sell-off and were net buyers to the extent of Rs 10,000 crores.

The other major event in February was the Union Budget. We discussed the Budget in our last month’s blog - https://www.easternfin.com/blog/Tax-Implications-of-Union-Budget-2020. From the stock market’s viewpoint, there was a big sell-off on the Budget day itself, largely because the market was expecting removal of long term capital gains tax on equity and was disappointed with regards to it in the Budget. The sell-off on the Budget day was clearly an over-reaction and the market quickly recovered its losses within a few days after the Budget. As of now and in the near term, the main concern will be the fall-out of Coronavirus. It is very difficult for anyone to forecast the full impact and time-line of a global contagion. As such, we in Eastern Financiers expect volatility to continue and urge investors to exercise caution.

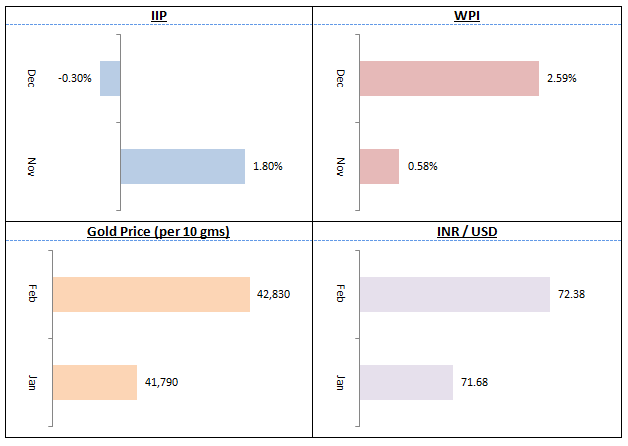

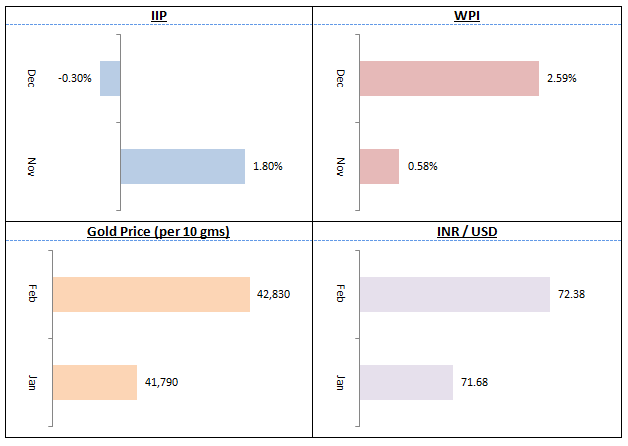

Index of Industrial Production (IIP)contracted by 0.3% in December indicating continuing slowdown of the Indian economy. WPI inflation accelerated sharply in December to 2.6% primarily driven by rise in price of food items, particularly vegetable prices. The sharp increase in inflation has forced the RBI to keep interest rate unchanged, but the RBI has reiterated its accommodative policy stance provided inflation remains within the expectations. On the currency front, the Rupee depreciated further against the dollar. Gold, which was the best performing asset class in 2019 (25% return), continued its impressive run in both January and February growing almost 6.7% to Rs 42,830 / 10 grams. In our view, the economy continues to remain weak and may weaken further depending on the impact of Coronavirus.

In light of the global risk factors, Gold will continue to outperform in the near to medium term. Investors can increase their asset allocation in gold as a hedge against equity risks in the near term. We think that asset allocation should be one of the most important considerations in investment planning. You should plan your asset allocation according to your financial situation and goals in consultation with our financial advisors. In volatile markets and environment of economic uncertainty dynamic asset allocation is also a good approach to add stability and get superior risk adjusted returns. In this month’s blog we have reviewed IDFC Dynamic Equity Fund which uses the dynamic asset allocation approach. You should also continue investing through SIP in a disciplined manner for your long term goals.

On 3rd March, the US Federal Reserve cut interest rates by 50 bps as an emergency measure to protect their economy from the impact of Coronavirus. The Fed’s rate cut is likely to be a signal for lower interest rates in other major economies, including India. The RBI has also been working with banks to improve transmission of policy rate cuts. With lower lending rates in the future, we also expect bank fixed deposit interest rates to come down even more. The Government has already lowered Employee Provident Fund interest rate by 5% and is expected to reduce interest rates of small savings schemes like PPF, NSC, MIS, etc over the coming weeks or months. In the current economic climate, debt mutual funds are much more attractive investment options than traditional fixed income investments. Investors who have large sums parked in bank FDs are urged to consider debt mutual funds. Our financial advisors will help in selecting the right fund for your investment needs.

Medium to long duration, long duration and dynamic bond funds gave 9.5 to 10% or more returns in the last 1 year. If interest rates remain low or go lower, these funds can continue their good performance in the medium term. However, you must have at least 3 year investment tenures for this fund and appetite for volatility. If you have low risk appetite or want to invest for shorter durations (1 to 3 years), then accrual based debt funds like short duration funds, banking and PSU funds, low duration and ultra-short duration funds are suitable investment choices. Given the continuing stress in many industry sectors, we urge investors to look for highest credit quality funds.

We look forward to serving your financial needs with our product offerings to suit your specific short term, medium term and long term financial goals. As always, we assure you of our best services. Please provide us your valuable feedback so that we can further improve our services to serve your financial planning needs.

Happy investing,

Ajoy Agarwal,

(Managing Director)