Dear Investors,

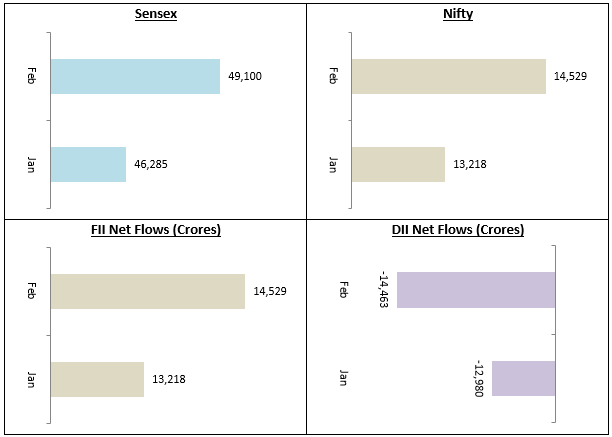

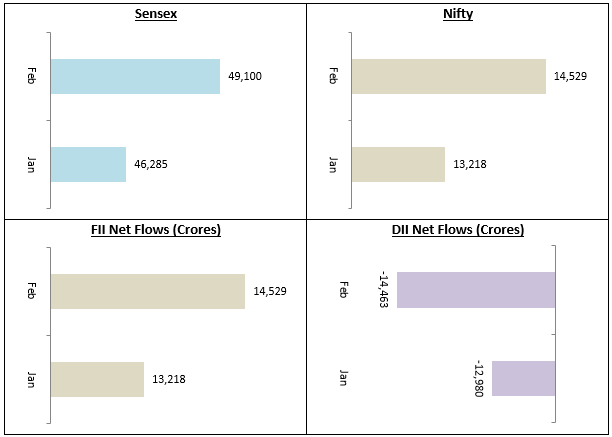

The stock market resumed its upward move in February buoyed by a Union Budget which many experts believe is likely to aid economic recovery. The Sensex closed February above 49,000 and Nifty closed above the 14,500 mark. FIIs’ interest in Indian equities continued to remain strong with net purchase of Rs 19,747 Crores. I had mentioned in my last monthly newsletter that we are seeing good FII flows primarily because the US Dollar weakening against other currencies. The US Dollar is weakening because the US Federal Reserve has maintained an extremely easy money policy since the outbreak of the COVID-19 pandemic. At some point of time however, we are likely to see gradual tightening of monetary policy in the US. When the Fed begins to tighten monetary policy, the liquidity fuelled momentum rally may slow down. Factors like recovery in India’s GDP growth, corporate earnings outlook etc. will become important. While the returns have been great over the last 8 – 9 months, investors should have reasonable expectations since there is numerous challenges in the short to medium term.

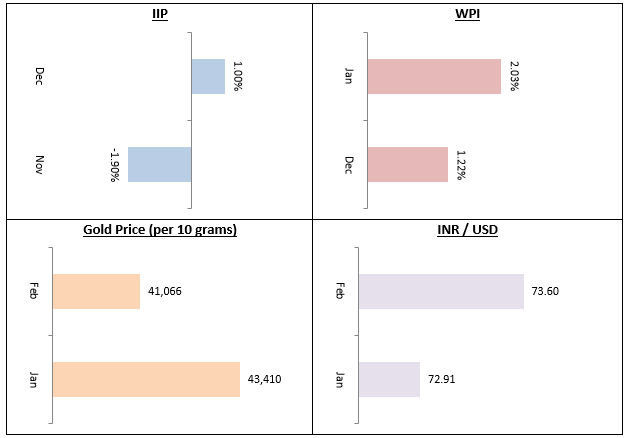

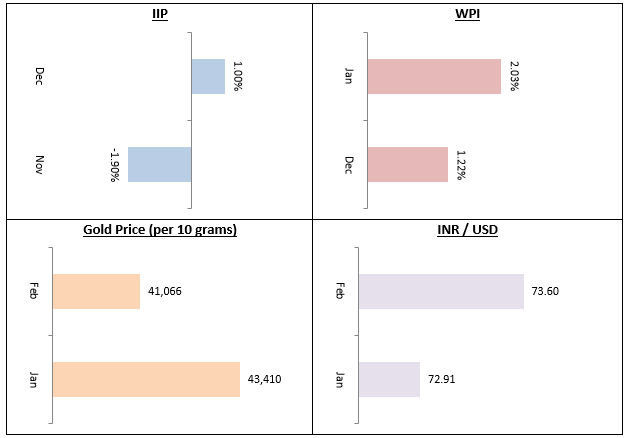

After contracting in November 2020, the Industrial Production (IIP) returned to positive territory (growing by 1%) in December. We expect IIP growth to gradually inch up in 2021, but we may face some bumps on the road. Global rating agency Moody’s has revised India’s FY 2021 – 22 GDP growth forecast upwards from 10.8% to 13.7%. The performance of our stock market in the second half of 2021 will largely be driven by the pace of our economic recovery. WPI inflation climbed up to 2.03% in January driven by higher crude prices and also other commodities. Higher WPI figures are also indicative of rising demand and pricing power of manufacturers. I had mentioned in one my of my newsletters in Q2 of this fiscal year that Gold as an asset class has been doing very well. However, as Gold has corrected by around 5% in the recent past, we suggest that it can be accumulated for the long term. You may also invest in Gold ETFs or Gold Funds systematically on dips.

Continuing with the trend over the last several months, the broader market (i.e. midcaps and small caps) outperformed Nifty / Sensex in February. While you can tactically increase your allocations to midcap and small cap funds through lump sum investments on dips or through STP / SIP, you should keep the overall asset allocation in mind and have a balanced approach by ensuring that you have adequate allocations to large caps also. Our financial advisors can help you make the right investment decision according to your asset allocation and risk profile.

As far as debt funds are concerned, investors should now have reasonable expectations in terms of returns. One should expect bond yields to firm up in line with higher US Treasury yields. In the current macro environment, longer duration funds may be volatile and not be able to give high returns in the short term. In this environment, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Banking and PSU debt funds etc. will be good investment choices for conservative investors with tenures of at least 3 years. Over 3 years plus investment tenures, you can enjoy indexation benefits in debt fund taxation. If your investment horizon is shorter, then you can invest in low duration, ultra short duration funds etc. For very short investment tenures, you may consider overnight or liquid funds. Our financial advisors will help you select high quality debt funds that are suitable for your specific needs.

Conclusion

As mentioned in my last newsletter to you, our market outlook for 2021 and beyond is positive. March is the final month of this financial year. You should ensure that you complete your tax planning for this year before March 31st. There are several avenues of tax savings in the Income Tax Act. Our financial advisors can help you with your tax planning needs and ensure that you have maximized all the benefits available to you under our tax laws. As always, I reiterate my commitment for the highest standards of service. Please provide us your valuable feedback so that we can further improve our services.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!