Dear Investors,

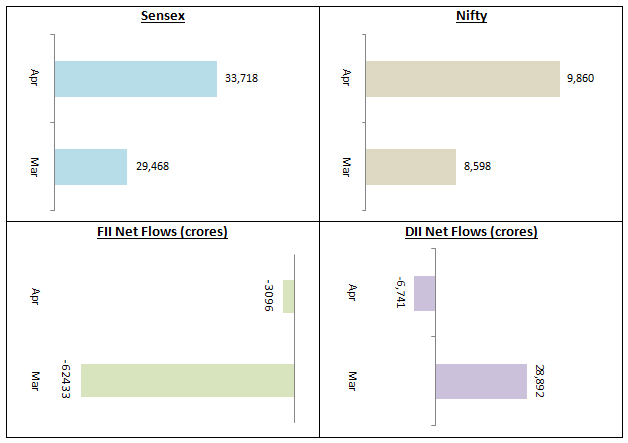

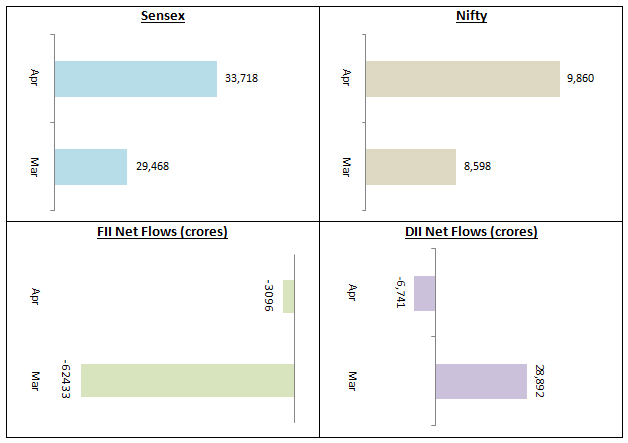

Around one third of the world’s population was under lockdown in the month of April as Government’s around the globe waged a battle against COVID-19 pandemic. As economic activity saw severe slowdown and unemployment rose sharply many Governments announced massive stimulus packages. The United States announced $2 trillion fiscal stimulus, Japan $990 billion, and Germany $660 billion. The stock markets reacted favourably to the stimuli and bounced back from the March lows. The Nifty and Sensex also bounced back in April closing 14 – 15% above March lows on the hopes of a fiscal stimulus from the Government. The Government announced a relief package of Rs 1.7 lakh Crores aimed at most economically vulnerable sections of our society. As per news reports, the Finance Ministry is working on a second fiscal package and is expected to be announced shortly.

After biggest ever monthly sell-off in March, FIIs continued to be net sellers in April to the tune of Rs 3000 Crores. DIIs also turned net sellers in April. Despite the impressive rally in April, it will be premature to conclude that market has found its bottom. Experience with past bear markets tell us that bottom is formed only after multiple down legs. We have seen only one down leg In February – March and another big downward move maybe on the cards in the coming weeks. The market is waiting for the second stimulus package and will react accordingly. Though the Government has announced relaxations in the nationwide lockdown from 4th May onwards, major economic centres in the country are in COVID red zones. We expect economic recovery to be gradual and severe corporate earnings slowdown in Q1 results. Therefore, investors should expect volatility to continue.

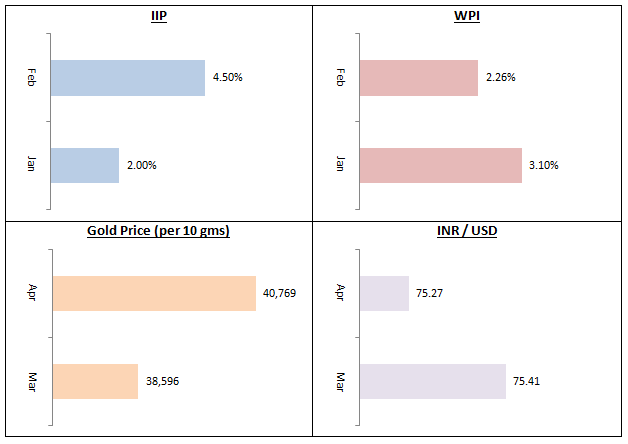

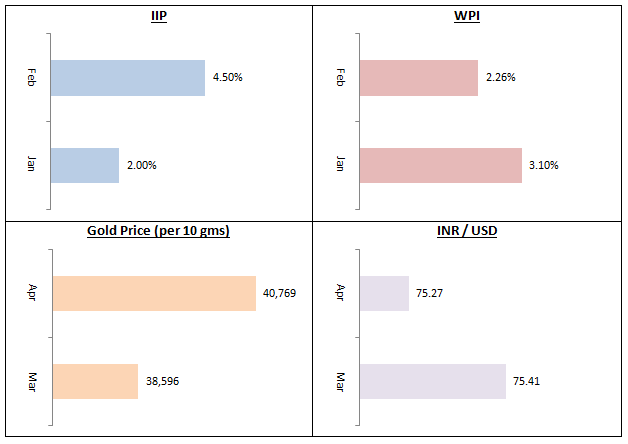

Wholesale Price Index (WPI) inflation eased in February to 2.26% after creeping up in January. Easing inflation provided Reserve Bank of India (RBI) with ammunition to considerably ease monetary policy in April to provide more liquidity in the banking system to improve the credit environment in the economy. Index of Industrial Production continued its positive trend from January, rising to a 7 month high of 4.5% in February. However, the stringent lockdown announced by the Government in the end of March is likely to cause a sharp contraction in IIP in both March and April. Gold resumed its upward trend in April rising 6% to close at an all-time of Rs 40,769 / 10 grams. Rupee closed flat to US Dollar in April. You may like to read is this a good time to invest in gold ETFs

Though we in Eastern Financiers expect more volatility in the market, we think this is a good time for investors to tactically (lump sum) invest in equity funds at every major dips. Investors are also advised to continue their SIPs in large cap and large oriented diversified funds (e.g. large and midcap funds, multi-cap funds etc.). Midcaps and small caps have fallen 40 to 60% over the last 30 months. While mid / small cap may give potentially superior returns in the long term, midcap and small cap funds may take longer to recover than large caps. It is advisable to invest in midcap and small cap funds through the SIP route. Since mid / small caps are trading at attractive valuations, you may consider increasing your SIP instalments to take advantage of low prices in the coming months.

With RBI aggressively reducing interest rates and reiterating its accommodative policy stance to support the economy, longer duration debt funds like medium to long duration, long duration, dynamic bond, gilt funds etc.can continue their good performance. We expect these funds to outperform over the next 12 months or so. However, you must have at least 3 year investment tenures for this fund and appetite for volatility.

If you have low risk appetite or want to invest for shorter durations (1 to 3 years), then accrual based debt funds like ultra-short duration funds, money market funds, banking and PSU funds, low and short duration funds are suitable investment choices. As mentioned in several of my previous letters to investors, credit risk is something that investors should watch out for. The slowdown in economic activity caused by the lockdown will aggravate financial distress for several companies and may impair their debt repayment abilities. However, there is enough supply of high quality papers in the market at attractive yields. Your Eastern Financier’s financial advisor can help you invest in the highest quality debt funds.

Due to extreme conditions created by the lock-down Franklin Templeton announced the closure of 6 debt fund schemes. This may have caused consternation among debt fund investors but you should know that RBI has stepped in to provide liquidity window of Rs 50,000 Crores for debt funds.

You may like to read – Closure of 6 Franklin Templeton Debt Fund Scheme

Under the scheme, the RBI will conduct repo (repurchase agreement) operations of 90-day tenor at a fixed repo rate of 4.40% for banks. According to the RBI, banks can avail funds under this facility exclusively for meeting the liquidity requirements of mutual fund houses by extending loans and undertaking outright purchase of and/or repos against the collateral of investment grade corporate bonds, commercial papers (CPs), debentures and certificates of deposit (CDs) held by the fund houses. This move should assuage investor concerns about liquidity of their investments.

Our financial advisorsare on the standby to serve your financial needs in these difficult times. However, best wealth creation opportunities are often found in these times as history has shown us on many occasions. Please do not hesitate to contact your financial advisor if you need any assistance. As always, we assure you of our best services.

Stay safe,

Ajoy Agarwal,

(Managing Director)