Dear Investors,

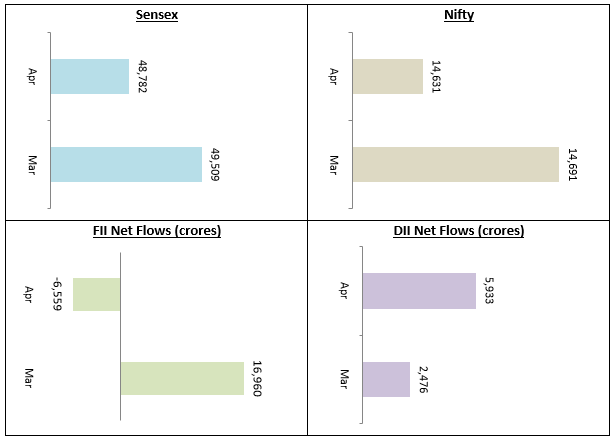

April was a difficult month for the nation as many states struggled with second wave of the COVID-19 pandemic. Several states announced lockdowns in April. The stock market traded sideways with a negative bias in April with the Sensex closing a percentage lower compared to March. FIIs turned net sellers in April while DIIs continued to be buyers in April with net purchase of Rs 5,933 Crores. At the time of writing this letter, the entire country is under partial or total lockdowns. The lockdown is likely to have serious economic consequences and will turn back the wheel on recovery seen over the past of several months. We expect the market to trade flat with bearish sentiments till we get confirmation that the second COVID wave has peaked.

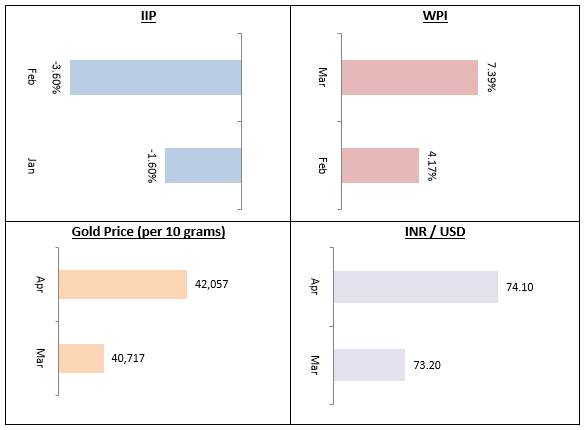

The Index of Industrial Production (IIP) contracted by 3.6% in February, after contracting 1.6% in January. Since IIP has been contracting since January, even before the 2nd COVID wave hit the country, we are likely to see severe economic slowdown, if not contraction in Q1 of this fiscal. As seen during the previous lockdown in 2020, lockdown whether partial or total has a severe impact on industrial activity. WPI inflation climbed up even further to an 8 year high of 7.39% in February primarily driven by higher crude prices.

After months of declining trend, Gold jumped by 3.3% in April. This shows that there is risk aversion in the financial markets. Historically, Gold has been seen as hedge against equity. While we expect equity to bounce back once the worst of the second wave is behind us, the lessons learnt over the past year or so tell us that investors should consider Gold as part of their asset allocation. The Indian Rupee (INR) depreciated against the US Dollar (USD) in April.

The stock market has surprisingly remained relatively firm despite the grim news on the COVID front. This shows that the market has discounted the bad news in prices. However, this may also imply that the market expects a quick recovery when the worst is over. Investors should understand that recovery in GDP growth will depend on a number of factors including how long the second wave lasts, pace of vaccination, liquidity in the financial system etc. There are encouraging signs from states that were worst affected by COVID e.g. Maharashtra, Delhi, Uttar Pradesh, Gujarat etc. But cases in several states are still increasing. The Q1 earnings release, especially management guidance will provide direction to the market. Till then, we expect the market to remain sideways but investors should be prepared for volatility in the coming months.

I had mentioned in my previous letters that one should expect bond yields to firm up in line with higher US Treasury yields. 10 year G-Sec yields inched up in April. Credit spreads have also started to widen a bit. In the current interest rate and credit environment, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Banking and PSU debt funds etc will be good investment choices for conservative investors with tenures of at least 3 years. Over 3 years plus investment tenures, you can enjoy indexation benefits in debt fund taxation. For shorter investment tenures, ultra-short duration funds, money market funds and low duration etc funds can be suitable depending on your investment needs.

Conclusion

These are very difficult times for our country and its economy. Investors must be prepared for volatility and have long investment horizons. I have stated several times in my letters to you that, asset allocation is your biggest friend in difficult (volatile) markets. It is needless to mention that, you should continue to invest for your long term goals through SIP and take advantage of market volatility. Our financial advisors can help you build a resilient investment portfolio with focus on asset allocation and long term financial planning. Some of our esteemed customers may have personally affected by COVID in their families. I and my team stand in solidarity with you in these difficult times and also reiterate my commitment for the highest standards of service.

Best Wishes,

Ajoy Agarwal,

(Managing Director)