Dear Investors,

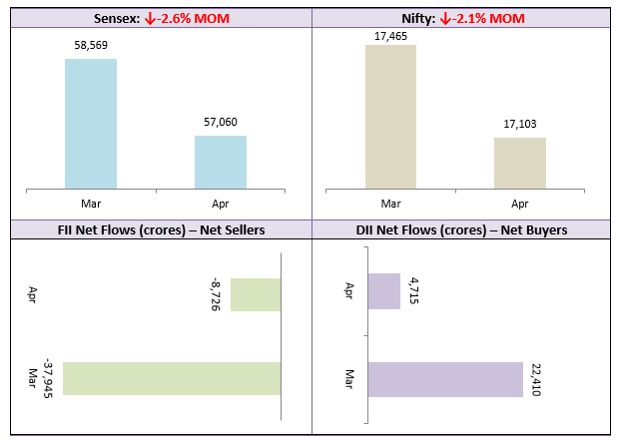

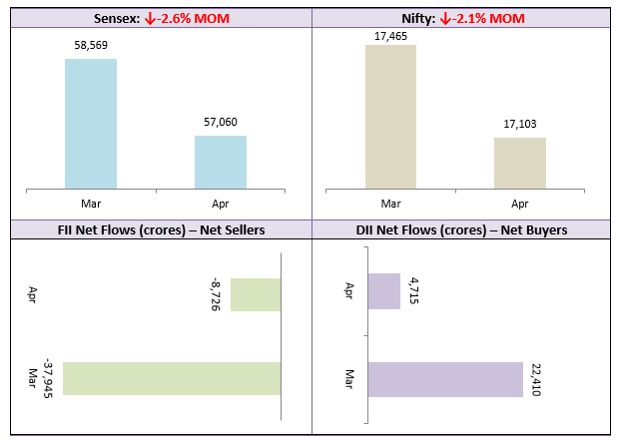

The equity market in April began on a positive note, continuing to build on gains made in March, but sentiments turned negative by the middle of second week. The market had been discounting a gradual increase in interest rates, but the expectations soon shifted towards steeper rate hikes in FY 2022. Strengthening US dollar and rising US Treasury bond yields led to heavy FII selling in the second part of April. The Nifty and Sensex closed the month 2 – 3% down to its March close.

The Government announced the LIC IPO will open for subscription from 4th May to 10th May 2022. The IPO was oversubscribed by nearly 2.95 times and is expected to open at a significant premium to the IPO price. The success of the LIC IPO may encourage other companies to announce their IPOs. Caution should be exercised especially when investing in Tech IPOs since tech companies globally have taken a severe beating over the past 2 – 3 months. You should evaluate each IPO on a case by case basis and consult with our financial advisors if you want to discuss.

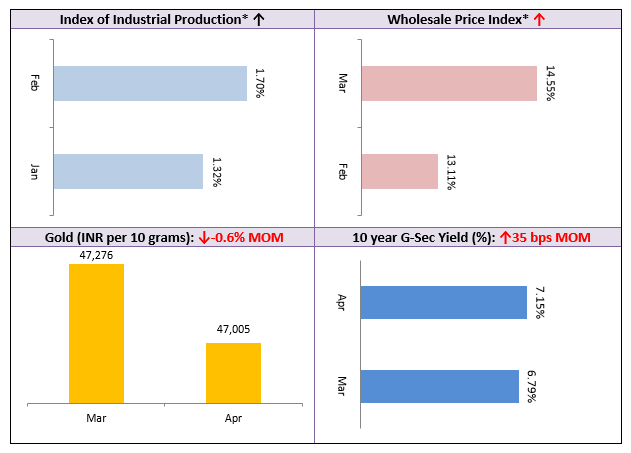

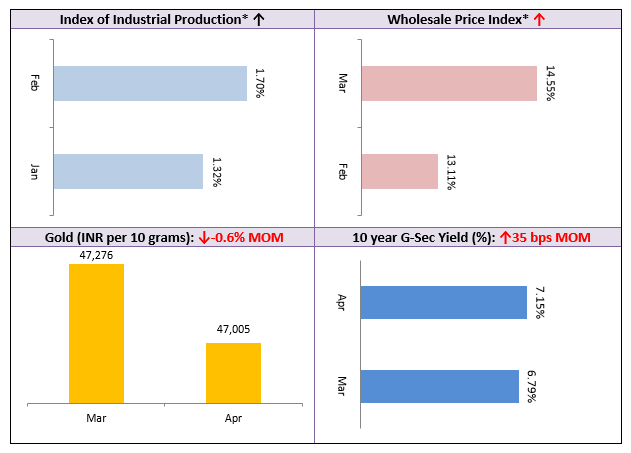

As far as precious metals are concerned, we do not expect gold and silver to outperform as long as US economic data remains strong and there is no further escalation of the war in Ukraine. We expect commodity prices to remain high in the near term (next several months) since the impact of interest rate hikes on inflation comes with a lag. The sanctions of Russian oil exports have made the inflation situation much more complicated. As such, we expect bearish sentiments to prevail with some support coming in at lower levels. You can use the corrections to tactically add equity to your asset allocation at lower levels, since our economy and corporate earnings is showing clear signs of revival. The small cap segment presents attractive bottom up opportunities from long term perspective since the Nifty Small Cap 250 Index is down nearly 20% from January peak. You should continue your SIPs and may even consider investing through 6 – 9 months STP.

The 10 years Government Bond yield spiked up 35 bps and we expect bond yields to rise further in the coming weeks and months. The market is expecting 6 more rate hikes by the Fed by 2023. The RBI has increased the repo rate by 40 bps and more rate hikes are expected. In a rising interest rate scenario, shorter duration funds can give higher returns because they can re-invest the proceeds from the maturing securities in higher yields. The 91 days T-Bill yield rose by 21 bps in April and is likely to go up further. Liquid and ultra-short duration funds can be suitable investment options for up to 12 month tenures. For fixed income investments over long tenures company FDs of high credit quality can be good investment options.

My team will be committed to working on identifying the best investment solutions for your specific needs, keeping current market conditions in mind.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!