Dear Investors,

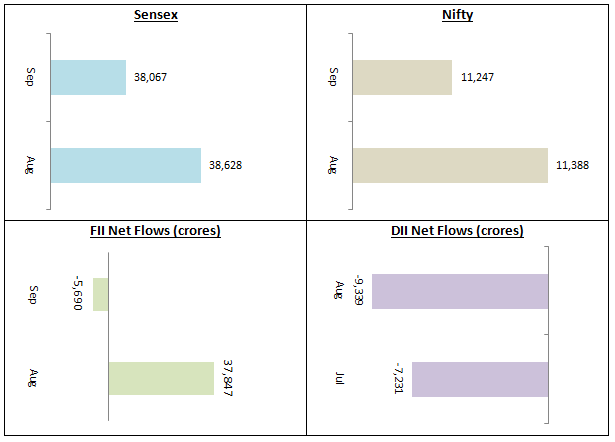

Stock market took a pause after three months of gains in September. Concerns of second wave of COVID-19 infections around the world kept global markets jittery. After remaining weak throughout the month the Dow Jones dropped by more than 500 points (1.9%). Markets around the world followed suit with both Sensex and Nifty ending the month on a slightly weaker note. Nifty closed the month at 11,247 around 1.2% lower than August close, while Sensex closed September at 38,067 (1.5% lower than August close). FIIs turned net sellers to the tune of nearly negative Rs 5,690 Crores in the month of September. DIIs continued to be net sellers in August.

The news on the economic front continued to be grim but there are early signs of recovery from the severe economic impact of the lockdown. GST collection in September was back at pre-lockdown (March) levels and a gradual recovery can be expected in the coming months.

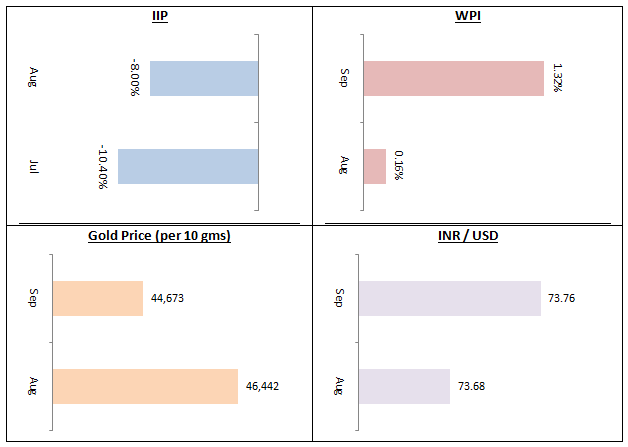

The Index of Industrial Production (IIP) contracted by 8% in August. While the IIP numbers indicate that we are in severe economic slowdown, the August contraction in IIP was lesser than what we saw in July. Wholesale Price Index (WPI) inflation rose to 1.32% in September, caused by increase in food prices, particularly pulses and vegetables. The RBI expects inflation to moderate in coming months to RBI’s projected target. Domestic price of gold eased further in September with equity markets in recovery mode. However, with no clear signs of economic recovery, it is too early to say whether gold prices have topped out. On the currency front, the Rupee closed the month almost flat to the US Dollar.

As far as broader markets are concerned, midcaps continued their outperformance versus Nifty / Sensex in September. Though Nifty / Sensex was down 1 – 1.5% in September, Nifty Midcap 100 Index closed the month 1.8% higher than August. I had mentioned earlier that midcap valuations were looking attractive after the deep correction over the past 2 years. The performance of midcaps over the last couple of months seems to provide confirmation that the midcap correction has bottomed out. Small caps have also performed well rising 45% in the last 4 months. In September Nifty Small Cap 100 Index rose 4.2%.

In September, SEBI issued circular regarding multi-cap funds, whereby these schemes will be required to invest at least 25% each in large cap, midcap and small cap stocks. While SEBI’s circular on multi-cap funds has generated a lot of discussion in the mutual fund industry, we think that SEBI’s new rules will benefit small cap stocks and funds. Accordingly, you can allocate a portion of your equity portfolio to midcap funds and small cap funds, keeping in mind your overall asset allocation.

Our financial advisors will help you with specific investment recommendations depending on your investment portfolio and risk profile. Investors who have multi-cap funds in their investment portfolio and have questions or concerns about the new development can also reach out to our financial advisors. We will provide appropriate guidance based on your specific needs and situation.

As far as debt funds are concerned, yields of liquid funds and ultra-short duration funds are low due to measures taken by the RBI to boost liquidity. We expect the yield curve to flatten in the near future due to increase in Government borrowings. After months of uncertainty regarding GST shortfall for states, the Central Government has agreed to borrow money to meet the GST shortfall for the State Government. This will result in flattening of the yield curve. A flatter yield curve means that the difference in returns of longer duration funds and shorter duration funds will shrink. As such, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Banking and PSU debt funds etc. will be good investment choices for investors with investment horizon of at least 2 – 3 years. With Bank FD interest rates at historic low levels, we think that accrual based high credit quality debt funds with short to medium duration profiles will give superior returns with low or moderately low volatility. If you can remain invested for 3 years or more, you can also get indexation benefits.

After the last few difficult months with the pandemic, we hope that the festive season will bring health, happiness and prosperity for investors. On behalf of the entire Eastern Financiers team members, I wish our esteemed customers very happy and auspicious Durga Puja and Navratri.

Ajoy Agarwal,

(Managing Director)