Dear Investors,

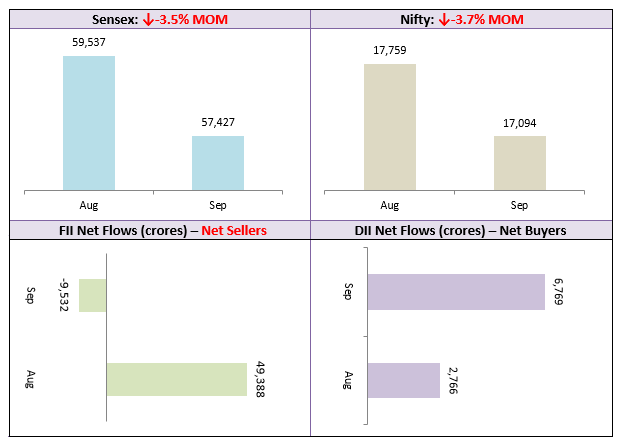

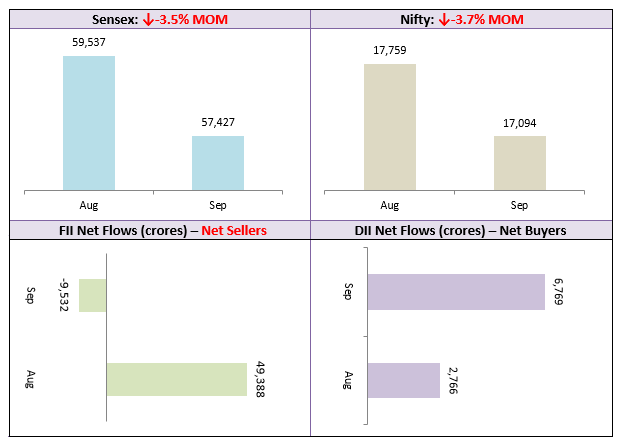

September was a volatile month for global equities. Comments made by US Federal Reserve Governor Jerome Powell at the end of August, weighed heavy on the market and global investors turned risk averse. Governor Powell in his speech said indicated that more interest hikes will be needed and the US economy may go into recession at the end of the interest rate tightening cycle. FII net flows which were positive for the last two months, turned negative again as risk aversion. Higher than expected interest rates in the US will attract global funds flow to risk free US Treasury bonds which are giving attractive yields.

We expect the market to remain volatile till we have visibility of the end of this interest rate cycle. The market is expecting the Fed to hike interest rates two more times this year; one in November and again in December. Fed’s commentary in December will provide some guidance on when we can see an end to the rate tightening cycle. So the equity market may remain volatile for the next 3 months, while there may be intermittent short covering rallies.

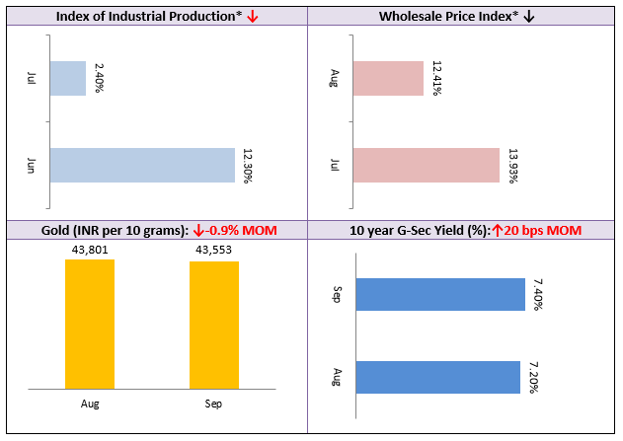

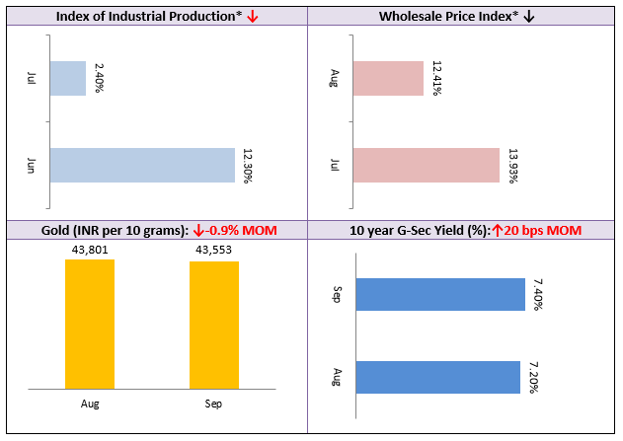

India has been an outperformer for the last few months. While the S&P 500 fell by nearly 10% in September, the Nifty fell by 3.7% only. India has also outperformed the emerging market pack. This shows the investor’s confidence in the fundamentals of Indian equities and the economy. You should continue to invest systematically in equity with long investment horizon, while focusing on asset allocation. We expect the precious metals to perform well from current levels. You can consider adding gold to your asset allocation through gold ETFs or gold fund of funds. As far as fixed income is concerned, accrual based low or short duration funds with high credit quality will be suitable investment options for conservative investors.

The festive season for the year has commenced. You should remember to review your investment plan with your Eastern Financier’s financial advisors. I, on behalf of my team, wish all our dear investors in advance, a very happy and auspicious Diwali.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!