Dear Investors,

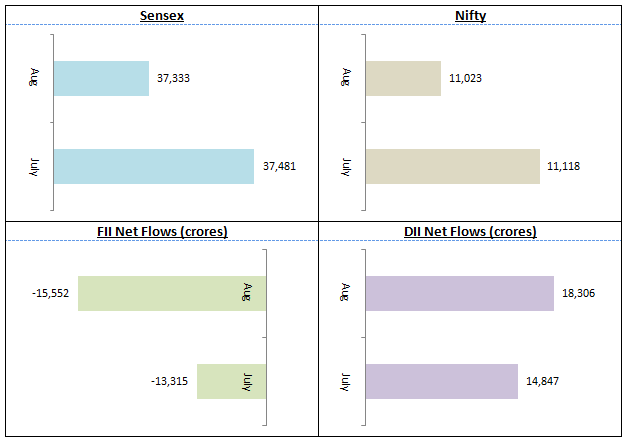

Stock market continued on its declining trend in the month of August 2019. This is third consecutive month on month decline for the major stock indices. However, the correction in Nifty or Sensex was not as sharp as in July 2019. In August the Nifty hit its 6 month low at around 10,740 and recovered to close around the 11,000 level by the end of the month. Sensex closed at around 37,300 which marked a 7% fall from its all time high. FIIs selling accelerated in August and they continued to be seller, while DIIs were buyers.

While a major issue for Foreign Portfolio Investors (FPI) has been addressed by the Government by rolling back the tax surcharge, other significant factors causing nervousness in the market like economic slowdown in several industry sectors, weak corporate earnings outlook, concerns of global trade wars and fears of economic slowdown in the United States remain.

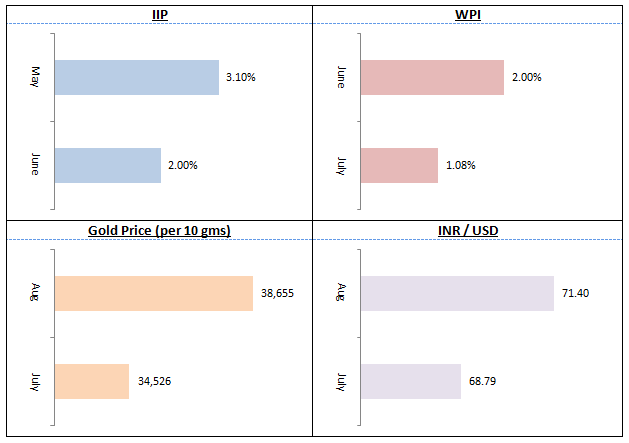

Month on month growth in Index of Industrial Production (IIP), an indicator of manufacturing activity slipped to 2% in June versus 3.1% in May 2019. The market will closely watch the July IIP data will be released by the Government shortly but estimates from independent sources suggest that are not likely to see an uptick IIP growth. WPI Inflation fell 2.0% in June to 1.08% in July, creating room for the Reserve Bank of India (RBI) to reduce repo rate by 35 bps (more than what market was expecting). Domestic price of gold rose sharply by 12% in August, indicating global risk sentiments and also the weakness of the Indian Rupee which depreciated by around 4% versus US Dollar.

Continuing with the last 1 year trend, the broader market underperformed large caps. Midcaps (Nifty Midcap 100) fell by almost 2% (Nifty Midcap 100) and small caps (Nifty Small Cap 100) fell more than 1.4%. From an industry sector standpoint, most sectors were in red on a quarter to date basis except IT and FMCG among the major sectors. Aviation, footwear and retailing were among the handful of sectors which saw gains while automobiles, telecom, capital goods, textiles, manufacturing, construction materials, agriculture and real estate were among the biggest underperformers.

In August, the Finance Minister announced a host of measures to provide fiscal stimulus and revive economic growth. While the market’s reaction to the FM’s measures was lukewarm we should watch what impact the Government’s measures will have on the real economy in the coming months and quarters. The temporary trade truce between United States and China may have a calming effect on trade war fears and market volatility to certain extent this month. The market will also be watching carefully the economic data coming out of the US and also our own economic data. While September may not be as volatile as the previous few months, we expect weakness to continue in the market.

The broader market has been weak for more than a year and we saw volatility intensifying in the last few months. In such prevailing market conditions goal based investment approach with long investment horizon is important. You should have a disciplined approach in goal based investing and continue to invest through SIP.

This is also a good time to look at your financial plan and see if you need to increase your monthly SIP amounts for your financial goals. Mid and small cap stocks have fallen 28% and 43% respectively from their all time highs, and present attractive investment opportunities. At the same time, you should maintain sufficient large cap exposure to provide stability to your portfolio and limit downside risks in case of adverse market movement for any reason.

As far as debt funds are concerned, given the economic slowdown in India and the policy intent of RBI, we think that we are in slightly prolonged lower interest rate regime (interest rates on a downward trajectory).

Longer duration funds like medium duration, medium to long duration, long duration and dynamic bond funds can continue to give good returns in the future. However, if you are looking for superior returns, you should have a sufficiently long investment horizon (3 years plus) so that you can tide over short term volatility.

In this month’s digest we have reviewed Axis Strategic Bond Fund, which you can consider for your medium to long term investments with limited risk. For investors who prefer stable income and low volatility, accrual based debt mutual funds like low duration funds, short duration funds etc. with high credit quality are preferable investment options. In the current environment, we feel that credit risk continues to be an important concern. Eastern Financier’s financial advisors can help you select the right debt mutual funds for your investment needs and risk concerns.

We look forward to serving your financial needs with our array of products. As always, we assure you of our best services. Please provide us your valuable feedback so that we can further improve our services to serve your investment and financial planning needs.

Happy investing,

Ajoy Agarwal,

(Managing Director)