Dear Investors,

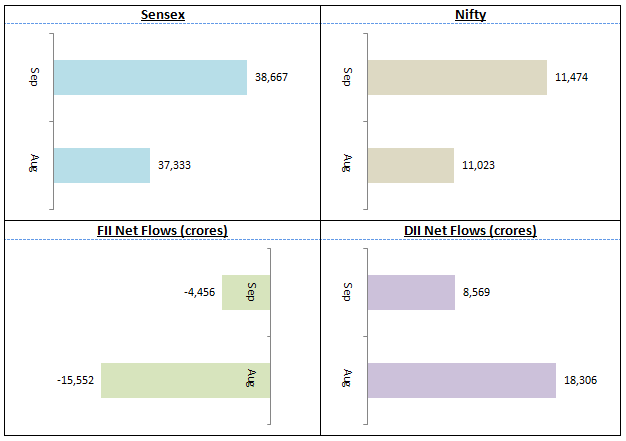

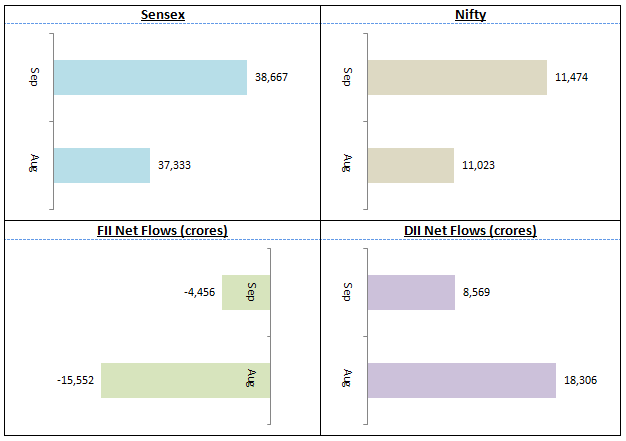

After falling for 3 consecutive months the Nifty reversed its trend and gained around 400 points in September 2019. The most significant event for the stock market in September was the reduction in effective corporate tax rate from 35% to 25%. With this tax cut, the corporate tax rate in India will be lower than countries like China, Japan, South Korea, Indonesia, Bangladesh etc. and is expected to provide a major impetus to investments in India. The Finance Minister’s announcement brought cheer to the market with the Sensex and Nifty gaining around 3,000 and 900 points respectively in just two trading sessions. The Sensex closed the month at around 38,700 while Nifty closed at around 11,475. Though FIIs continued to be net sellers in the month of September, FII selling slowed down considerably reflecting improvement in sentiments.

The rollback of tax surcharge on FPIs (in August 2019) and corporate tax rate cut (in September 2019) are two very positive measures for the stock market, we feel that the Government needs to take more steps to revive economic growth as corporate earnings outlook continues to be weak. The RBI in its last Monetary Policy Committee meeting cut the GDP growth forecast of FY 2019 – 20 to 6.1% from 6.9%. The market is likely to remain range-bound unless we see clear signs of earnings growth revival. Among the major global risk factors, US / China Trade War, concerns about President Trump’s impeachment, crude oil supply disruptions and rising geopolitical tensions in the Middle East will weigh upon the market in the coming weeks and months.

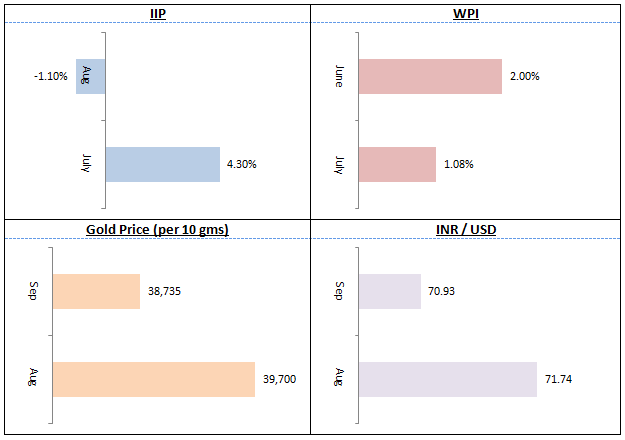

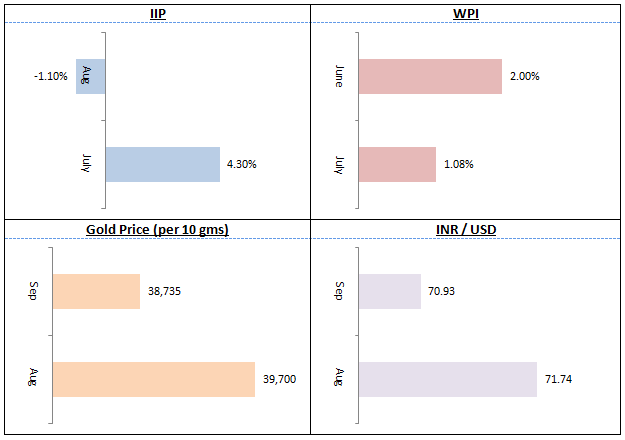

Recently released Index of Industrial Production (IIP) figures, an indicator of industrial / manufacturing activity, show that IIP growth contracted on a month on month basis by 1.1% in August versus 4.3% in July. While IIP growth has been week for several months now, it fell for the first time in more than 2 years, further reinforcing concerns of economic slowdown and dampened demand. WPI Inflation fell 0.33% in September, the lowest in last 3 years, creating room for the Reserve Bank of India (RBI) to reduce repo rate by 25 bps (more than what market was expecting). With GDP growth concerns, the RBI Governor has hinted at further rate cuts. Domestic price of gold fell slightly in September after rising sharply in August, while the Rupee strengthened marginally against the dollar.

The broader market reversed the losing trend but continued to underperform large caps. Midcaps (as represented by Nifty Midcap 100) and small caps (as represented by Nifty Small Cap 100) gained around 2% in the month of September compared to 4% gain made by the Nifty. From an industry sector standpoint, most sectors were in red in June (half year) to date basis except IT, FMCG and Oil and gas among the major sectors. Automobiles, capital goods, manufacturing, telecom, textiles, construction materials, agriculture and real estate were the biggest underperformers on a June to date basis, reflecting the general weakness in the economy.

Amidst the volatility in the secondary market, the primary (IPO) market has emerged as a winner for investors in 2019 with most IPOs seeing major gains. We are in the middle of the auspicious festive season but we do not expect Diwali to bring in a lot of cheer as far as the overall stock market is concerned. We expect the market to remain range bound, albeit less volatile compared to earlier months, as we approach the end of this calendar year. The market will closely watch the Q2 earnings to be released in the coming days / weeks and also global developments, particularly those emerging in the United States.

We have always stressed the importance of a disciplined approach in goal based investing. Asset allocation is very important factor in financial planning and this month we have reviewed DSP Dynamic Asset Allocation Fund which follows a market valuation based asset allocation strategy. Mid and small cap stocks are still considerably lower than their all-time highs and have now started consolidating – this segment presents attractive investment opportunities. At the same time, you should maintain sufficient large cap exposure to provide stability to your portfolio. A multi-cap strategy either through lump sum investments or SIP can yield good returns over long investment horizons.

As far as debt funds are concerned, with the RBI reinforcing its accommodative stance,longer duration funds like medium duration, medium to long duration, long duration and dynamic bond funds can continue to give good returns over long investment tenures (3 years or longer). At the same time, you should be mindful and prepared for volatility because there are concerns about fiscal deficit and bond yields thereof. For investors who prefer stable income and low volatility, accrual based debt funds like low duration funds, short duration funds etc. with high credit quality are preferable investment options. Our financial advisors can help you select the right debt funds suited for your risk appetite and specific your investment needs.

We look forward to serving your financial needs with our product offerings to suit your specific short term, medium term and long term financial goals. As always, we assure you of our best services. Please provide us your valuable feedback so that we can further improve our services to serve your financial planning needs.

Happy investing,

Ajoy Agarwal,

(Managing Director)