The past year and half have been difficult for equity investors. While large caps outperformed the broader market as represented by the Nifty 500 TRI gave just over 5% returns over the last 12 months. The midcap (Nifty Midcap 100 TRI) and small cap (Nifty Small Cap 100 TRI) indices gave negative returns. Volatility has intensified in the last 3 months with the Nifty 50 and Nifty 500 TRI falling nearly 2 - 3%. Despite some relief provided by the Finance Minister's corporate tax announcement, there is a considerable amount of uncertainty in the market due a variety of domestic and global factors.

Weak GDP growth outlook, recessionary conditions in certain industry sectors like automobiles and continuing crisis in the banking sector are weighing heavy on the markets. Several global risk factors like US / China trade war, possibility of President Trump’s impeachment, disruptions in Saudi oil supply and impact of escalating tensions in the Persian Gulf on oil prices are contributing to the uncertainty. As such, we expect volatility to continue in the near term. In our view, investors should stick to their financial plans irrespective of market movements. Asset allocation is an important aspect of financial planning as it helps you balance your risk / return objectives. In volatile and uncertain market conditions dynamic asset allocation is a prudent strategy for investors with moderate to moderately aggressive risk appetites – it limits downside risks to your portfolio and also helps you generate relatively stable return.

DSP Dynamic Asset Allocation Fund

DSP Dynamic Asset Allocation Fund follows a quantitative dynamic asset allocation strategy determining equity and fixed income allocations in its portfolio depending on equity market valuations. A quantitative approach to asset allocation removes biases caused by judgement or sentiments. The scheme lowers its allocation to equity when equity market valuation is high and increases equity allocation when valuation is low. The in-house asset allocation model of DSP Dynamic Asset Allocation Fund determines equity market valuations based on Price to Earnings (P/E) and Price to Book (P/B) ratios of Nifty 50 TRI. The two factor (P/E and P/B) dynamic asset allocation model is a departure from the earlier asset allocation model (based on yield gap).

The model assigns percentile valuation scores depending on Nifty 50 TRI P/E and P/B ratios. For each score the dynamic asset allocation model has pre-determined asset allocations. Equity allocations can range from 20% to 90% in DSP’s asset allocation model. We have seen that, purely valuation based dynamic asset allocation funds often underperform in bull markets since in a market like Indiamarket momentum usually takes stock prices significantly higher despite stretched. In addition to the purely valuation based approach, DSP Dynamic Asset Allocation Fund also used technical analysis signals for small overlay to capture up-trends. Using technical analysis, the dynamic asset allocation adds a small percentage to the core equity allocation (determined by the valuation model) to capitalize on momentum and generate superior returns for investors.

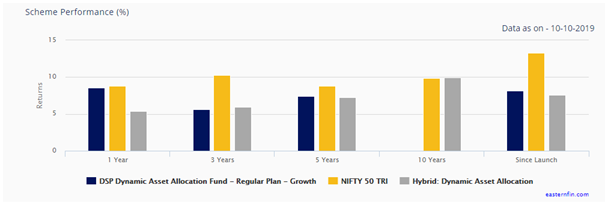

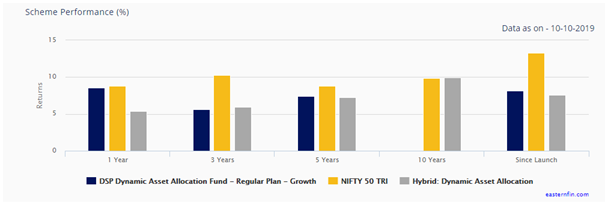

With a tweak to its dynamic asset allocation strategy DSP Dynamic Asset Allocation Fund has seen an uptick in its performance. In the last one year, DSP Dynamic Asset Allocation Fund has figured among the Top 5 Hybrid Dynamic Asset Allocation funds (please see our Top Performing funds based on Trailing Returns). The chart below shows the trailing returns of the scheme over various time-scales (ending 10th October 2019).

Source: Eastern Financiers Research

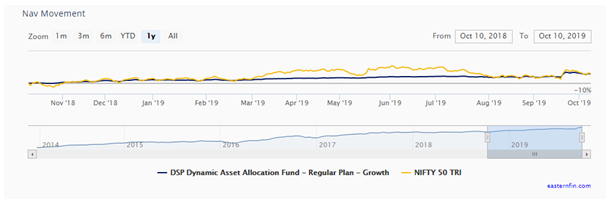

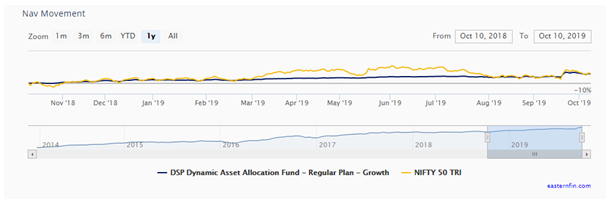

You can see that the NAV movement of DSP Dynamic Asset Allocation Fund (blue line) is much less volatile than Nifty (yellow line), yet it has been able to match Nifty 50 TRI returns in the last one year (notice the blue and yellow lines converging at the end of the period). Lesser volatility and stable returns make this fund ideal investment options for investors with moderate risk appetites.

Source: Eastern Financiers Research

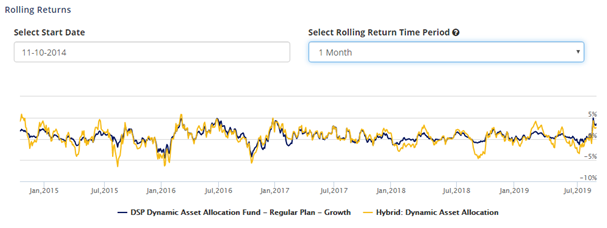

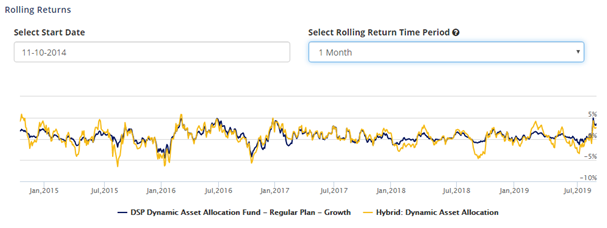

Rolling Returns

While investors should always have a sufficiently long investment horizon for equity and equity oriented hybrid funds, many investors (especially first time or inexperienced investors) find volatility stressful. The monthly rolling returns of DSP Dynamic Asset Allocation Fund over the last 5 years(see the chart below) provide further evidence of how the scheme provides stability to your portfolio across different types of market conditions. Careful analysis of the chart will reveal that, the performance of the scheme in down-market and up-market has improved in the last year or so.

Source: Eastern Financiers Research

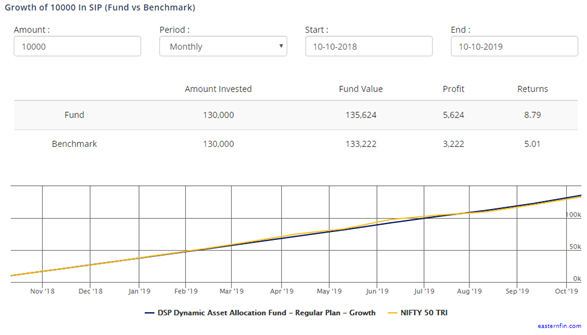

Steady SIP Returns

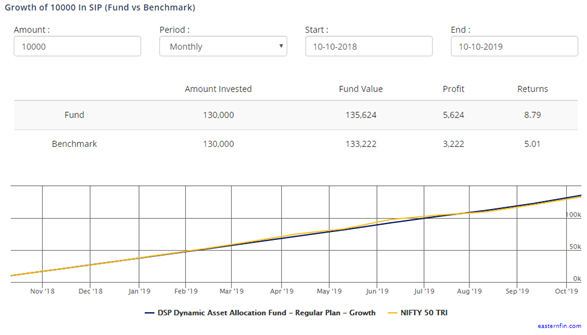

You can invest in the scheme both through lump sum and SIP. The chart below shows the returns of Rs 10,000 monthly SIP in DSP Dynamic Asset Allocation Fund over the last 1 year. You can see that the scheme has outperformed Nifty 50 TRI in terms of monthly SIP returns. Also notice the growth in market value of the SIP is much more linear compared to SIP in Nifty.

Summary - Why DSP Dynamic Asset Allocation Fund?

- Simple Investment for First Timers

- Wealth Creation Ability Through In-Built Scientific Engine

- Potential For Higher Returns in Rising Markets, while preserving capital in Falling Markets

- Unemotional, Rule Based Investing. No Need to Time Markets. Invest In Peace

- Aim to Earn Equity Market Returns at approximately half the risk over the long-term

For investors with moderate to moderately aggressive risk appetites, who are worried about volatility and uncertainty, DSP Dynamic Asset Allocation Fund is a good long term investment option. You can invest in this scheme either in lump sum or from your regular monthly savings through SIP. Please consult with your Eastern Financier’s financial advisor, if you are interested in investing or want to know more about this scheme.