Over the past 20 years, the internet has increasingly been changing our lives. From online banking, shopping and bill payment, tax filing, information and entertainment to staying connected with friends and / or people with similar interests through social media, internet plays a very important role in our day to day lives. While internet has transformed our lives, improving efficiency, helping us stay informed and connected, it also exposes us to risks of cyber crime.

Cyber crime has been growing at an alarming rate all over the world. In India a cyber attack takes place every 10 minutes. Over the past few years 50,000 cyber crime and fraud cases on average were filed every year. Cyber crimes include online banking fraud, credit card fraud, social media (facebook, twitter etc) related harassments, identity theft, data theft etc. Cyber crime not only puts you at the risk of financial loss but also reputational loss and emotional trauma. HDFC Ergo’sE@SecureInsurance covers individuals and family member against loss ordamage arising directly out of theuse of internet. Here are some salient features of E@SecureInsurance:-

- Covers not only financial loss butother expenses including legal expenses up to the policy limit

- Cover not limited to any particular device (covers multiple devices e.g. multiple PCs, phones etc)

- Covers worldwide exposure

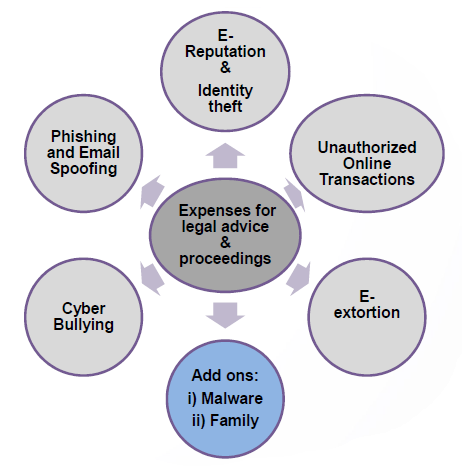

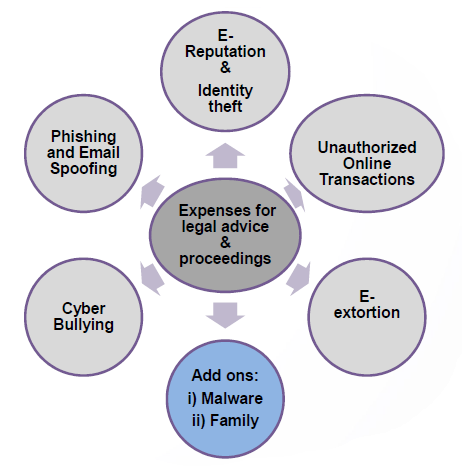

What does E@Secure Insurance cover?

Unauthorized Online Transaction

The policy covers loss (not reimbursed by the bank) due to fraudulent use of a person’s bank account or credit /debit card or e-wallet by a third party for purchases made over the internet. The policy will pay you for losses incurred on account of fraudulent transaction. It will also pay for the cost incurred by you to resolve the breach with the bank. Further, it will pay for the loss of income suffered by you for taking unpaid leave to rectify the records. You can claim up to 100% of your policy limit for unauthorized online transactions. You have to provide evidence that the bank is reimbursing you the loss.

Phishing and email spoofing

The policy covers monetary loss due to unauthorized obtaining of your confidential personal or access information by imitating a website, email or other electronic communication. The policy will pay you for loss of money resulting directly due to phishing and email spoofing (a spoofed email may pretend to be from a well-known shopping website, asking the recipient to provide sensitive data such as a password or credit card number resulting in fraud and financial loss). You can claim up to 15% and 25% of your policy limit for phishing and email spoofing respectively. You should note that payments made towards lottery or unexpected bequeath of wealth or any unsolicited promises are not covered.

E-extortion

The policy covers financial lossdue to extortion threat received from third party over internet. The policy pays for expenses for appointing professional IT security consultants to investigateand restore data & remove the ransom ware. If recovery is not feasible, thenthe policy pays the amount surrendered as an extortion payment with priorconsent. You can claim up to 10% of your policy limit for E-extortion. Please note that loss that occurs within first 45 days of the inception e-extortion threat is not covered.

Damage to e-Reputation

The policy covers damage to personal reputation due to harmful publication (includingforums, blog posts, social media etc) by a third party on the internet. The policy will reimburse expenses incurred for services of IT professionals to suppress and remove the damaging content. It also covers psychiatric consultation fees in case you suffer from traumatic stress due to such harmful online content. You can claim up to 25% of your policy limit for damage to e-Reputation. Please note that loss that occurs within first 45 days since the posting of the harmful content. It also does not cover damage to reputation caused due to non-digital media i.e. print, radio, TV etc

Identity theft

The policy covers direct and indirect expenses to rectify / resolve theft of personal information by a third party over the internet for illegal purposes. You can claim up to 25% of your policy limit for identity theft. The policy will reimburse expenses incurred for rectifying credit records with bank or financial institutions or CreditBureau agencies. It will also pay for the loss of income suffered by you for taking unpaid leave to rectify the credit and other financial records. Further, it also covers psychiatric consultation fees in case you suffer from traumatic stresscaused by such an incident (upto 10%of limit of liability).

Cyber trolling / harassment

The policy covers psychiatric consultation fees in case you suffer from traumatic stress caused by a third party deliberately defaming or harassing you by posting content or unwarranted comments on the internet which results in loss of esteem and / or depression. You can claim up to 10% of your policy limit for cyber trolling / harassments. You should note that loss that occurs within first 45 days since the posting of the harmful content. It also does not cover damage to reputation caused to non-digital media i.e. print, radio, TV etc.

For all the above cyber offences which impact you adversely, you can claim up to 100% of the policy limit towards reimbursement of expenses for legal advice and proceedings. In order to make a policy claim arising out of such malicious incidents, FIR to be lodged with police authorities / cyber cell within 72 hours of discovery.

Policy add-ons

- By paying extra premium, depending on the cover amount, you can cover your family against cyber crime.

- By paying a small additional premium you can protect your digital assets from malware. The policy will cover cost ofrestoration, replacement or recollection of digital assets which are corrupted or destructed by malware (up to 10% of the policy limit).

Range of limit options and affordable premiums

You can choose pre-determined limits ranging from Rs 50,000 to Rs 1 crores. Premiums are affordable ranging from around Rs 1,400 to Rs 25,000 depending on the limit and add-ons selected by you.

Why HDFC Ergo E@Secure Insurance?

- 100% limit for legal protection and unauthorized online transactions

- Covers not restricted to particular device of location

- Cover for your family as an add-on, including teenage children who are often victims of cyber offences

With usage of internet increasing over our lives E@Secure can provide much needed protection against cyber crime. In case you want to know more about HDFC Ergo’sE@Secure and protection plan against cyber crime, contact with your Eastern Financier insurance advisor or call us at 033-40006800.