Historical investment portfolio performance analysis (as per a study done by American fund managers) shows that asset allocation is the most important attribution factor (more than 90%) for portfolio performance in the long run.

Greed and fear are the two dominant emotional factors that drive investment decision making. We tend to invest in stocks when the market sentiment is euphoric (greed is at maximum) and tend to sell stocks when sentiment is one of panic (maximum fear). Maximum greed, in financial terms, is highest risk and a panic situation implies high fear – both are extremely detrimental to interest of investors in the long term. Legendary investor, Warren Buffet advised investors to be “fearful when others are greedy and be greedy when others are fearful”.

ICICI Prudential Asset Allocator fund actively manages asset allocation to equity and debt using the AMC’s in-house valuation model. The scheme uses Equity Valuation Index (based on PE and PB ratio of the market) to manage equity and debt exposures. The scheme increases its allocation to equity (decreasing debt) when the valuation is low and reduces equity allocation (increasing debt) when valuation is high. The scheme is nearly 16 years old. The long track record of the scheme has enabled the fund managers to test their valuation model, fine tune it and make it more efficient. The scheme aims to generate superior risk adjusted returns (limit downside risks) using active asset allocation.

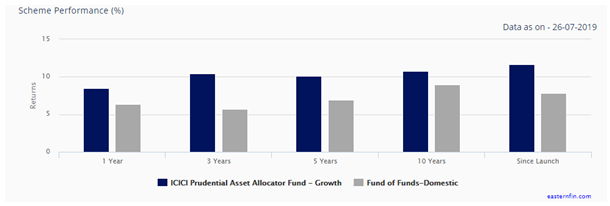

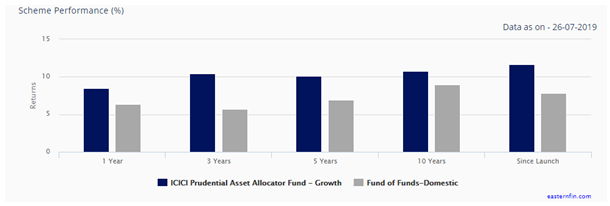

The chart below shows the annualized trailing returns of the scheme over various periods. The fund has given very stable and higher returns compared to FD interest rates across different time-scales.

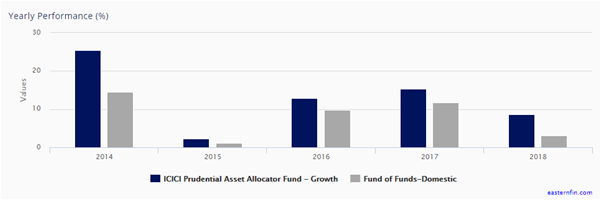

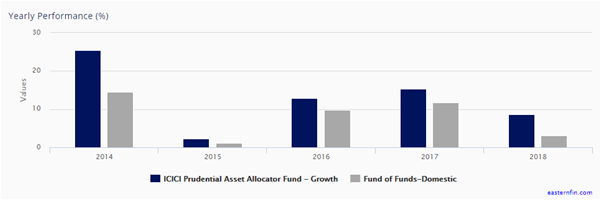

The chart below shows the annual returns of the scheme over the last 5 years. One can see that the scheme was able to protect the investor’s capital even in the years when stock prices corrected sharply or were very volatile.

Portfolio Construction

ICICI Prudential Asset Allocator Fund is a “fund of funds” – one equity fund and two debt funds. The equity fund is ICICI Prudential Large & Midcap Fund (Direct Plan). The debt funds are ICICI Prudential All Seasons Bond Fund (Direct Plan), a dynamic bond fund and ICICI Prudential Floating Interest Fund, a floating rate fund. The scheme actively rebalances its exposure to the equity and debt funds based on their in-house market valuation based asset allocation models. The debt funds in the portfolio provide flexibility to the fund managers to alter their fixed income strategy in different interest rate environments. The dynamic bond fund boosts returns when interest rates are on declining trajectory, while the floating rate fund provides good return when interest rates rise. Current asset allocation to equity is 23%, balance is in debt.

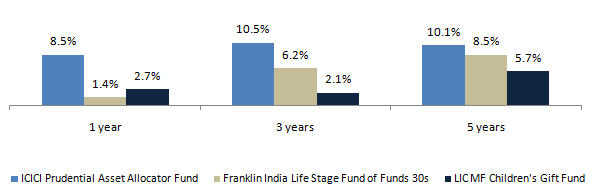

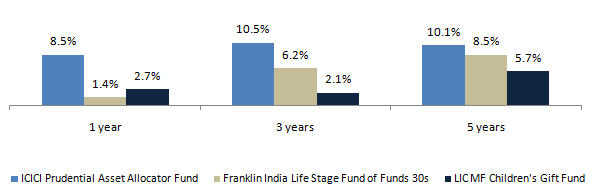

Peer Comparison

The chart below shows the comparison of ICICI Prudential Asset Allocator with some peers.

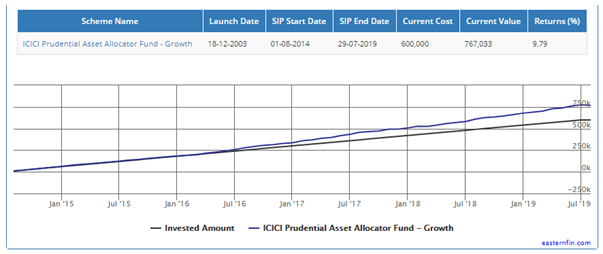

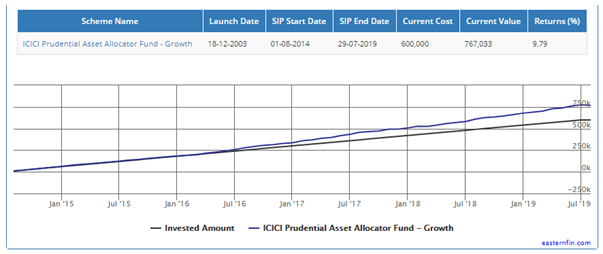

SIP Returns

The chart below shows accumulation with Rs 10,000 monthly SIP in ICICI Prudential Asset Allocator over the last 5 years. Investors got almost double digit returns.

Our take

In the current volatile market conditions, ICICI Prudential Asset Allocator is a good fund for moderate risk takers. Even though Nifty has substantially corrected from its all-time high, the valuations are still not on the higher side of the historical valuation range. The debt allocation of the fund will provide downside protection in volatile condition. In our opinion, investors should have a long investment horizon (3 to 5 years or longer) for this scheme. Since this is a fund of fund, it will be taxed like debt fund. Over 3 years or longer investment tenures, investors will get the benefit of indexation. Therefore minimum 3 year tenure is advised for this scheme.