What is asset allocation?

Asset is the percentage mix of different asset classes like debt, equity, real estate and gold in your total asset or investment portfolio. Simply speaking, asset allocation often refers to the percentage split you should have in your portfolio between debt and equity. In the Indian context, real estate and gold are also very important asset classes. On an average, in India, the allocation to physical assets like real estate and gold is more than financial assets. However, for the sake of simplicity, let us understand optimal asset allocation in context to equity versus debt.

Why optimal asset allocation?

The main purpose of asset allocation is risk diversification which in simple term means not putting all your eggs in one basket. For example - Equity may be the most risky asset class, but it can give the best returns over a long investment time period. Debt instruments like, fixed deposits (FDs), bonds, debentures and debt mutual funds etc. is the least risky asset class, but the returns of debt investments can be limited and within a range.

Depending upon various market conditions, sometime equity outperforms debt in some investment cycles (bull markets) while debt outperforms equity in some other investment cycles (bear markets). Having a mix of both equity and debt instruments in your portfolio in the right proportion can be called the optimal asset allocation which can in turn increase the stability of your portfolio across all investment cycles and also generate desirable returns to meet your long term and short term investment needs.

What should be your optimal asset allocation?

While many financial planners have many views on the optimal asset allocation, there is a very popular thumb rule for optimal asset allocation – It is called Rule of 100. Rule of 100 means,one should subtract ones age from 100 and the result will suggest the maximum percentage of equity exposure one can have in one’s portfolio. Rule of 100 is very simple to arrive at the optimal asset allocation and easy to follow.

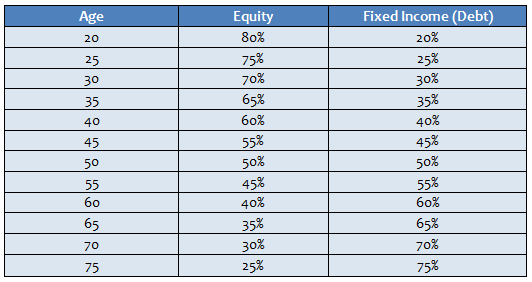

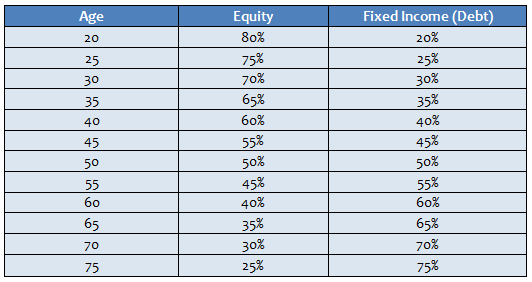

Example - if your age is 35, this rule suggests that 65% of your portfolio should be invested in equities oriented investments and 35% in debt oriented instruments, and for a 60 year old investor, this rule suggests that 40% of the portfolio should be invested in equities and the rest should be in debt oriented instruments and so on. This can also be called as the conventional asset allocation model, and is ideally suited for passive investors. The chart below suggests the asset allocation guidance for different age groups –

However, the optimal asset allocation for each investor is specific to their financial situation and risk appetite for different asset classes. Younger investors can have a higher proportion of equities in their investment portfolio, because they can have longer investment horizon. Older investors, especially those who are close to retirement or retired, may have a higher proportion of debt investment in their portfolios, because their risk capacities will generally be lower.

Suggested reading: How should you select mutual fund schemes

Asset allocation is the most important aspect of financial planning. Asset allocation helps with risk diversification and protects your investments from the vagaries of capital market as it ensures that you take the right amount of risk. Both, too much or too little risk can harm your financial goals. Investors should always give adequate importance to asset allocation and ensure that they have optimal asset allocation irrespective of the market cycles.