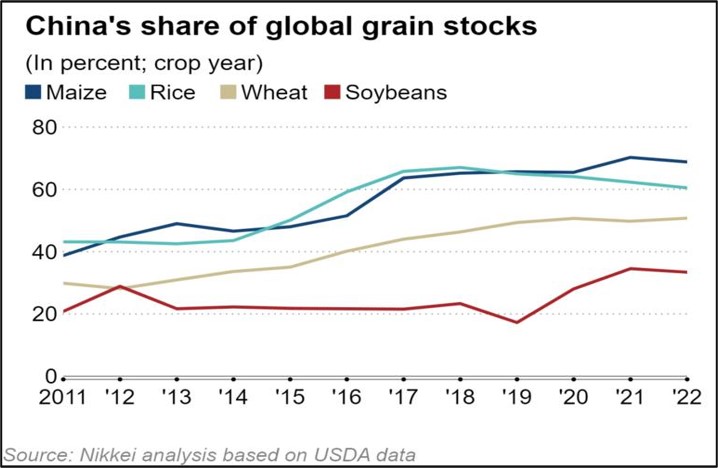

China hoards half of world’s food grain

A country with < 20% of world's population has managed to stockpile > half of globe's maize & other grains, leading to steep price increases. Data from U.S. Department of Agriculture shows China has ~69% of globe's maize reserves in the first half of the crop year 2022, 60% of its rice and 51% of its wheat.

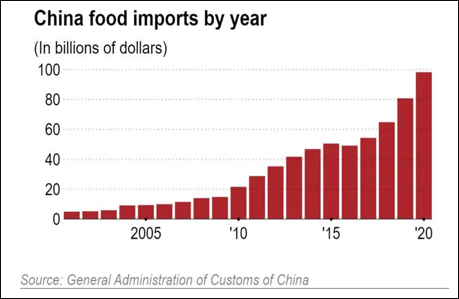

Beijing’s long-known water scarcity problem increasingly appears to have begun to become acute & easiest way to store water is to store agricultural commodities. Secondly, energy is the master resource for most production activities & rising prices would begin to manifest in higher input costs for agricultural commodities.

China's acquisition of the world's food supply has helped push food prices to decade highs. The U.N. Food and Agriculture Organization estimated the food price index is currently at a 10 year high.

While, Chinese state media has denied any food crises (so far), throughout history, food shortages have triggered popular unrest, contributing to uprisings that toppled Chinese dynasties. There are ETFs listed in US focused on Agriculture – DBA available for investment by Indian resident investors.

Basket of Agricultural ETF are also available for investment on - https://www.stockal.com/stacks/stackdetail?name=EFAGRI

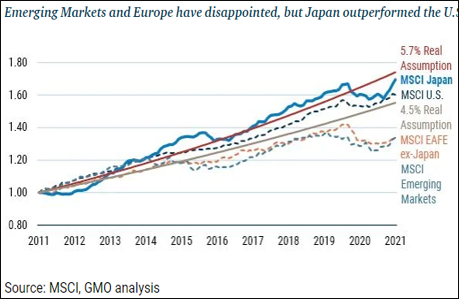

Japan has delivered U.S. like fundamental performance…but trades at a significant discount

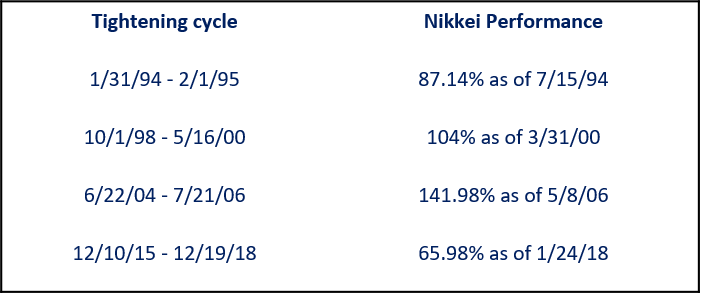

- Compared to 12-month forward P/E of 21.5x for US, Nikkei only commands a P/E of 17.6x. The catalyst for investors to recognize the fundamental performance of Japanese stocks to re-rate upward likely going to be the beginning of Federal Reserve’s tightening cycle. The Nikkei 225 (in USD) actually performs quite strongly when the Fed is raising interest rates.

- Corporate performance across EM & Europe has averaged 3% p.a for last 10 years. Over the same period, however, fundamental performance in Japan has been 5.4% annually vs. 4.8% for U.S (4.2% excluding FAAMG stocks).

- So what changed in Japan – Faced with an aging society, shrinking workforce, rising pension liabilities and anemic growth political leaders implemented policies to make capital (vs. labour) more productive and to enhance returns for shareholders.

- 1994-2004 saw Japanese companies destroy fundamental value, by mid-2006 corporate Japan was back to breakeven on a 10-year basis and since Sept 2011, Japan’s 10-year fundamental performance has been better than the U.S.

There are ETFs listed in US focused on Japan – DXJ available for investment by Indian resident investors.

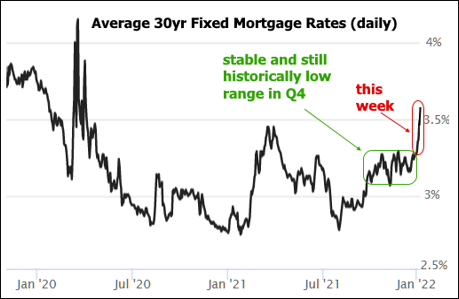

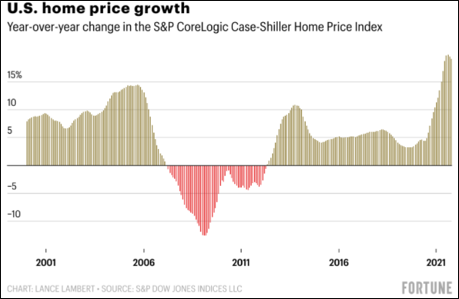

What will higher interest rate mean for buzzing real estate

- Led by ultra low policy rates the US housing market has had a hot year with home sales reaching the highest level in 15 years, with an estimated 6 mn homes sold in 2021.

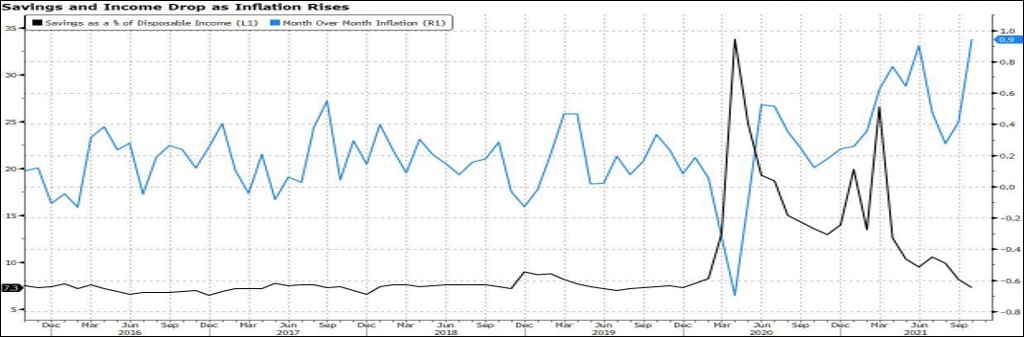

- US saving rate is now at pre pandemic levels of 6%. High savings coupled with low mortgage rates gave a boost to housing sales with ~20% Y-o-Y price rise in Oct’21.

- Rising supply side driven inflation coupled with drop in cash reserves has vast implications for the working class and could prioritize consumer spending over discretionary purchases.

Will Fed rising interest rates in response to inflation prints see mortgage home owners struggle between rising loan payments amid rising cost of living.

Carbon credits : Emitters are net short and free float is shrinking

- Europe has a carbon market since more than 15 years. Companies that emit CO2 in excess of carbon allowances they are assigned need to buy extra in the market, while those that use less are free to sell them. Expectations the EU will tighten supplies over time mean allowances will rise in value.

- In the near term, U.K.’s exit from the EU has removed a large, low-carbon power fleet from the market. That means that the average carbon intensity of the remaining EU power generators is higher. At the same time, the number of tradable allowances in the market is being steadily withdrawn into the so-called Market Stability Reserve, reducing supply and putting upward pressure on prices.

- If the company fails to procure the additional allowance then along with penalty for each shortfall in allowance, the shortfall obligation gets rolled forward to the next period, thus increasing the demand for next period’s limited allowances.

- To add to this, total number of allowances placed by the Europe commission each year reduces and is based on the allowances remaining after Member states auction.

- While the EU ETS reduces its newly issued allowances, their scheme simultaneously encourages outside speculators to buy and hold existing allowances, soaking up supply knowing full well there is a forced buyer on the other side of the trade.

- Absent a political intervention it is difficult to see a scenario wherein a short squeeze on allowances can be avoided.

The Krane Shares Global Carbon ETF (KRBN) which tracks the EU ETC carbon price can be subscribed to by Indian Resident Investors.

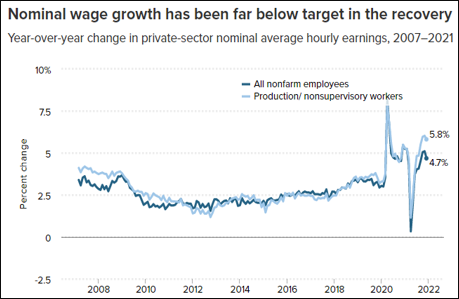

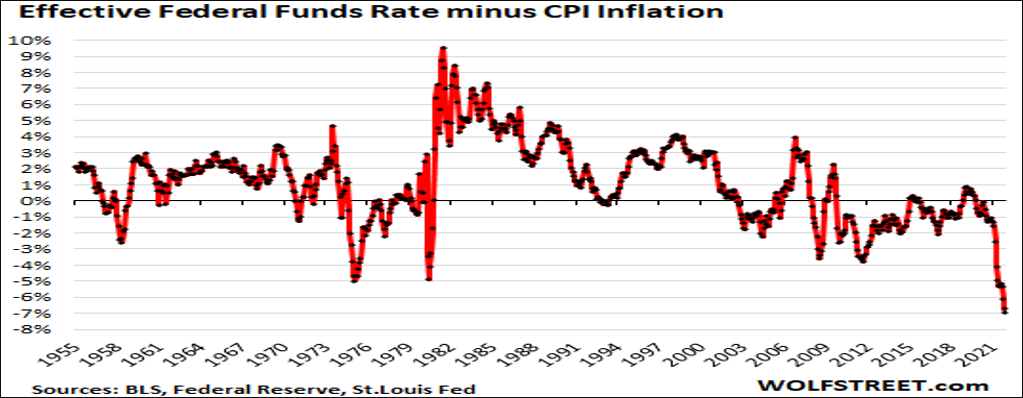

Have we entered Financial Repression? – Inflation exceeds Earnings

- US CPI inflation reading at 7% in December came in at the highest level since past 40 years. We are witnessing a classic negative return trajectory wherein real hourly wages have been lagging inflation for 9 straight months - indicating start to Financial repression.

- The purchasing power of the consumer’s dollar dropped further.

- Financial repression comprises "policies that result in wage earners/savers earning returns below the rate of inflation.“ resulting in negative real rate of return or income pay cut.

- This further widens the divide between top 1% and rest of wealth earners and negative interest rate benefits asset owners over savers.

- If the company fails to procure the additional allowance then along with penalty for each shortfall in allowance, the shortfall obligation gets rolled forward to the next period, thus increasing the demand for next period’s limited allowances.

- To add to this, total number of allowances placed by the Europe commission each year reduces and is based on the allowances remaining after Member states auction.

- While the EU ETS reduces its newly issued allowances, their scheme simultaneously encourages outside speculators to buy and hold existing allowances, soaking up supply knowing full well there is a forced buyer on the other side of the trade.

- Absent a political intervention it is difficult to see a scenario wherein a short squeeze on allowances can be avoided.

The Krane Shares Global Carbon ETF (KRBN) which tracks the EU ETC carbon price can be subscribed to by Indian Resident Investors.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation