Is it the Inflation regime that determines performance of one style over another?

The last decade and a half (2009-2022) has seen the CPI inflation rate average just 2%, despite broad money supply growth averaging 6.5%. Although broad money supply growth provided the liquidity adequate to spur inflation and thereby bond yields, China provided the deflationary impulse in goods prices, which channeled the money into financial asset inflation and pushed up the prices of real estate, bonds and equities leading to a low yield environment.

Beijing’s long-known water scarcity problem increasingly appears to have begun to become acute & easiest way to store water is to store agricultural commodities. Secondly, energy is the master resource for most production activities & rising prices would begin to manifest in higher input costs for agricultural commodities.

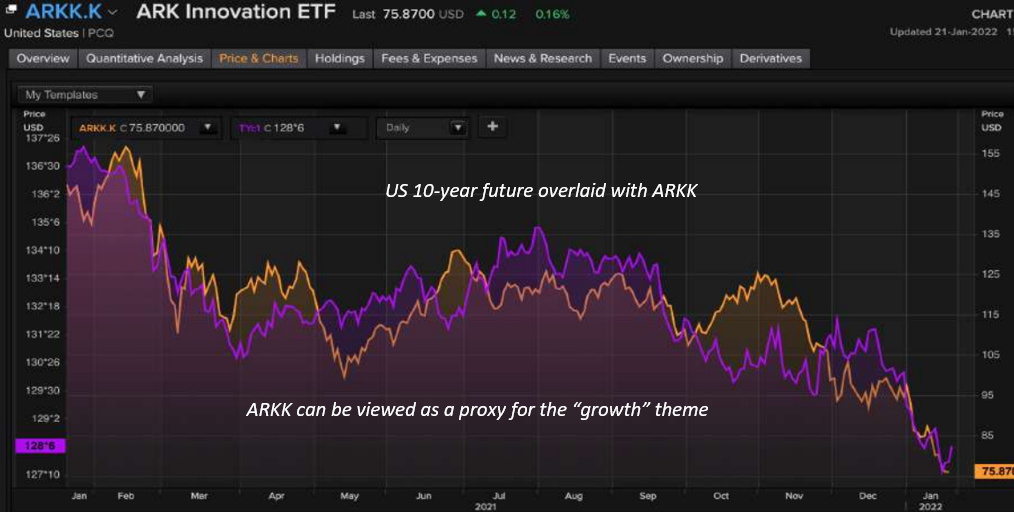

Higher bond yields (lower bond prices) mean bear market in “growth”. The key to understanding how low the Nasdaq/FAANG stocks can go is understanding how high bond yields can go, and one of the key to understand this is how high crude oil can go.

It will be Main St not Wall St, that is likely to be the main beneficiary from the switch in the source of money supply generation from central bank QE to commercial bank loan growth (as PPP repayments and savings rate dries up, rising nominal growth lures corporates to shift to bank lending).

In a deflationary world, you can pay almost any price for future growth. When inflation rages to a point that the Fed is forced to act, all you want is current cash flow, not 2050’s cash flow discounted back.

Whilst CPI inflation is likely to fuel rising rates it will also most likely prove a drag on financial asset prices, starting the mean reversion circle which could trigger a rotation out of over-owned disinflation assets like bonds, tech stocks, consumer discretionary towards nominal GDP boom beneficiaries in the real economy, like cyclicals, banks, energy, commodities and price-makers in the value space.

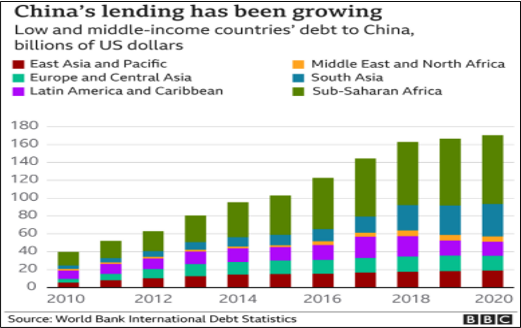

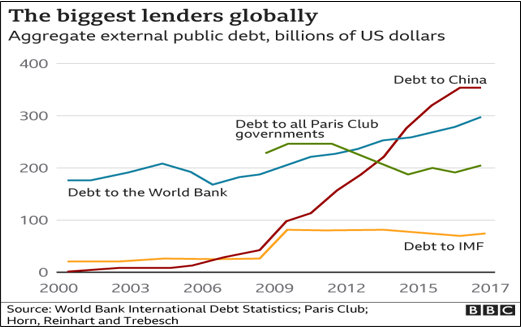

China : What’s the link between burdening poor countries with Debt and OBOR?

- Is China following the same tactics as West (via IMF, World Bank and CIA) i.e. lending to struggling; but, otherwise resource rich developing nations at unsustainable terms (rates are about 4x that of a typical loan from World bank/repayment tenure of ~10 years vs. 28 years by other lenders).

- Half of China’s lending to developing countries is not reported in official statistics as its kept off government balance sheet and directed directly to state owned companies, banks, private institutions etc.

- SThere are ~40 low and middle-income countries, according to AidData, whose debt exposure to Chinese lenders is more than 10% of the size of their annual economic output (GDP) as a result of this "hidden debt“.

- Much of the debt owed to China relates to large infrastructure projects like roads, railways and ports, and also to mining and energy industry, under China’s OBOR initiative.

- What happens when these loans get converted to equity due to non payment?

- China Merchants Port Holdings is now running Sri Lanka’s Hambantota Port on a 99-year lease, after the country converted its loans of $1.4 bn into equity in 2017, thereby smoothening Beijing’s foothold in Indian Ocean.

- While, West is struggling with domestic politics & ‘Power’ issues, China is going full force to fill this void. Cuba is the latest one to sign OBOR with China. The country holds ~ 5.5 mn tones of nickel reserves, ~6% of world share. Surprisingly, thus far they’ve only managed to produce 49,000 tones in 2020.

There are ETFs listed in US focused on Japan – DXJ available for investment by Indian resident investors.

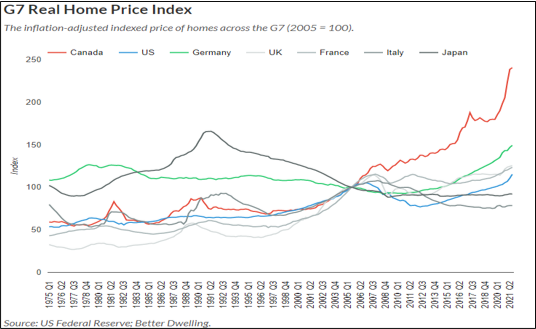

Canada – Will Government compromise the currency to combat real estate “Hyperinflation”

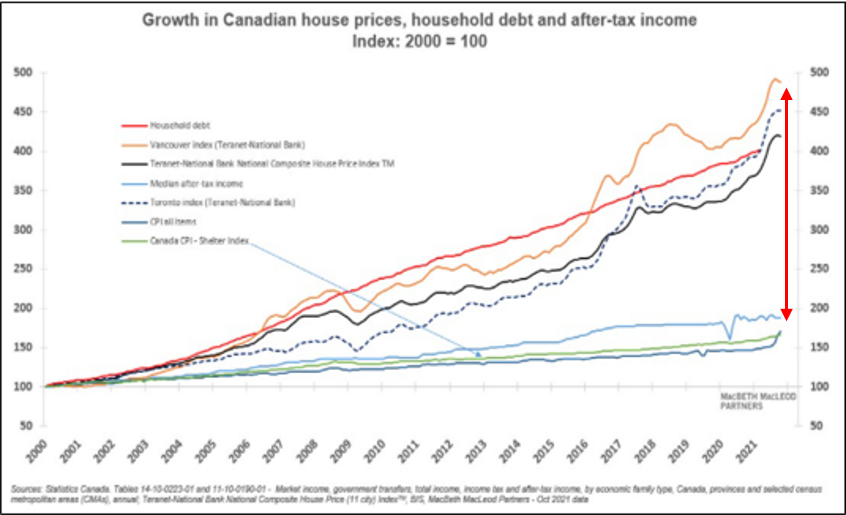

- In Canada, real estate prices have grown almost double the rate of the US over the past year. Since 2005, home prices have grown over 900% faster than American prices. The 21.4% annual growth seen in Canada last quarter is nearly double the 11.6% observed in the US over the same period.

- Between January and August of last year investors (more than first time home buyers as well as people moving between homes) were responsible for a quarter of house purchases, driving up the prices. This rising cost of housing has increased the amount of private debt held by individuals. Until, interest rates remained low this debt has been sustainable; however, the possibility of hikes now threatens to impact the viability of this debt for borrowers.

- In the first three quarters of 2021, residential construction accounted for a larger share of Canadian GDP than did business investment. In the 50 years prior to the pandemic, business investment was typically about twice as large a share of the economy as housing—a “normal” year would see about 12 per cent devoted to private capital spending and six per cent to residential construction.

Two outcomes for Canada in next 5 year -

- Raise the rates sharply and try flattening out real estate (possibly flat returns from real estate for next 10 years and a sluggish economy with 10% plus unemployment)

- Raise rates slowly and reluctantly. Real estate continues to rise but inflation will become so entrenched that CAD falls sharply.

Brazil – developing country offering positive real rates

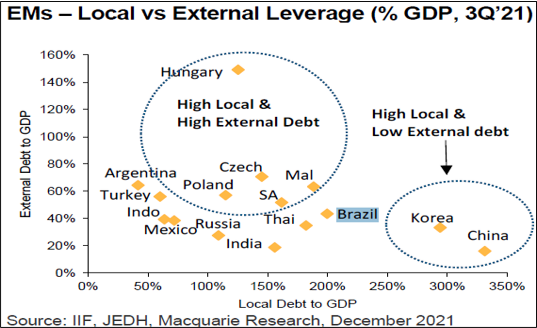

- With a policy rate of 10.75%, and a December inflation rate of 10.1%, Brazil is one of a few countries were the policy rate is above the rate of inflation, and therefore in real terms no longer negative, and therefore no longer stimulating inflation. By contrast, the Fed is a quadrillion miles behind.

- The central bank said that the next rate hike might be smaller, on hopes that inflation is showing signs of responding, thereby completing the rate hiking cycle.

- Brazil’s economy has three things going in its favor this time around than in 2013 - country’s external balances are more favorable (CAD is expected ~0.5% of GDP in 2021, much better than the 3.2% in 2013), currency weakness is behind us (between Jan - Oct this year, the real fell by 3.1% against USD vs. decline of 10.8% during the same period in 2013), proactiveness in hiking rates this year to counter rising inflation.

- Given inflation and GDP growth from 2020 to 2021, Brazil’s public debt/GDP actually looks significantly better now (than in 2020), at "just" around 82% of GDP.

There are ETFs listed in US focused on Brazil – EWZ available for investment by Indian resident investors

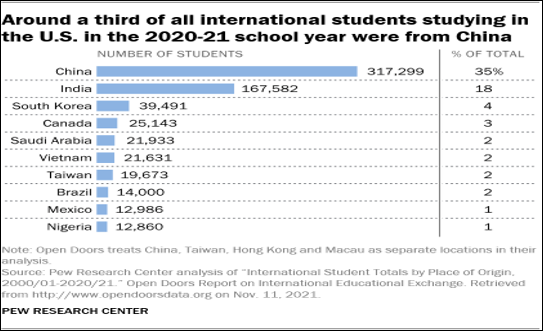

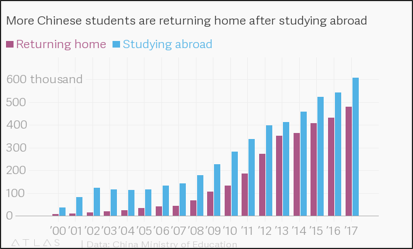

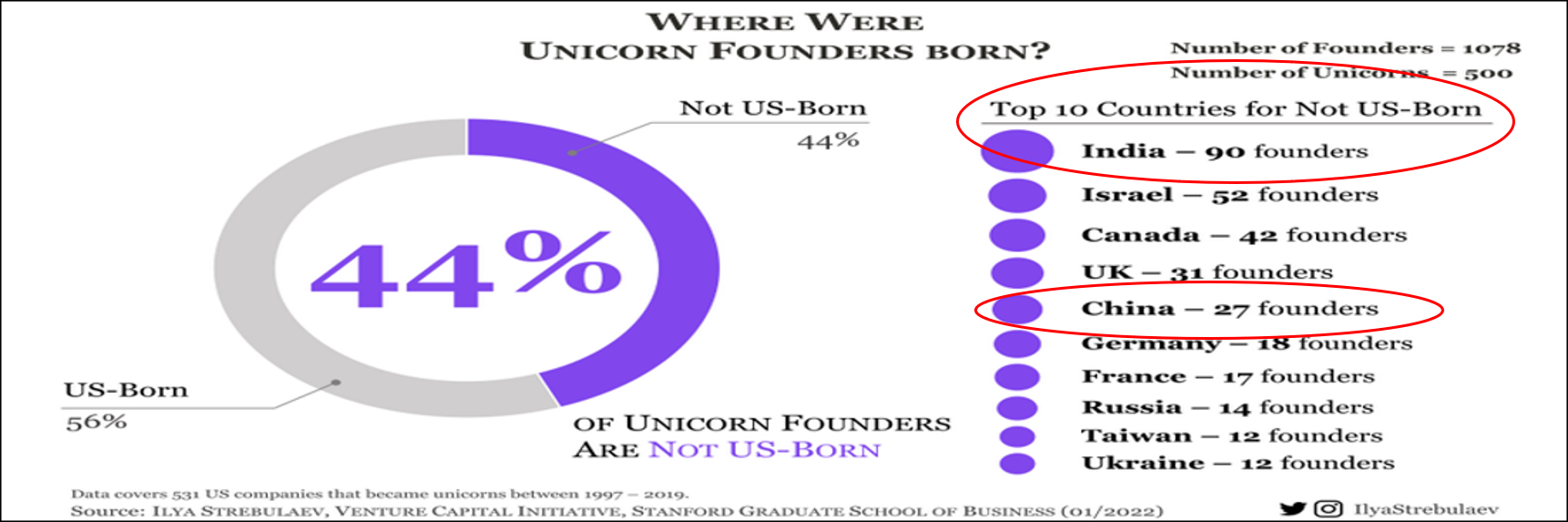

From Brain Drain to Brain Gain – The differentiating case of India and China

- Indian network has contributed to the emergence of a globally competitive software services industry, however there is little evidence of the return of entrepreneurship that could accelerate the upgrading of India’s capabilities. India witnessed the sharpest increase in people migrating overseas, at nearly 10 million (one crore), between 2000 and 2020, according to the “ International Migration 2020”

- In contrast earlier, Chinese scientists would seek research work overseas, but today Chinese postdoctoral researchers often get experience in the West & then head home where boom in AI & quantum computing coupled with the Chinese government's pro-science policies helps set them up in world-class facilities.

- In the World Banks’ ease of doing business report 2020, China ranks 31st out of 190 countries, while India ranks 63rd. Some of the core areas which needs substantial improvements are infrastructure, education, introducing better public-private partnerships in areas like healthcare, further liberalizing financial markets and working on environmental issue.

Without investment in physical infrastructure, it will be difficult increase the per capita GDP of India as difference between haves & haves not can be bridged by increasing manufacturing jobs. While, India has managed to export its white-collar jobs; growth impetus for a country would depend on the per capita income for its unskilled labor which in case of India needs a strong push given huge size of its unskilled population.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation