Nuclear – Viable long term solution

- Energy as a sector usually gets low ESG scores or is left out of ESG funds entirely; however, energy touches almost every part of our lives, and fossil fuels make up the majority of the world’s energy usage.

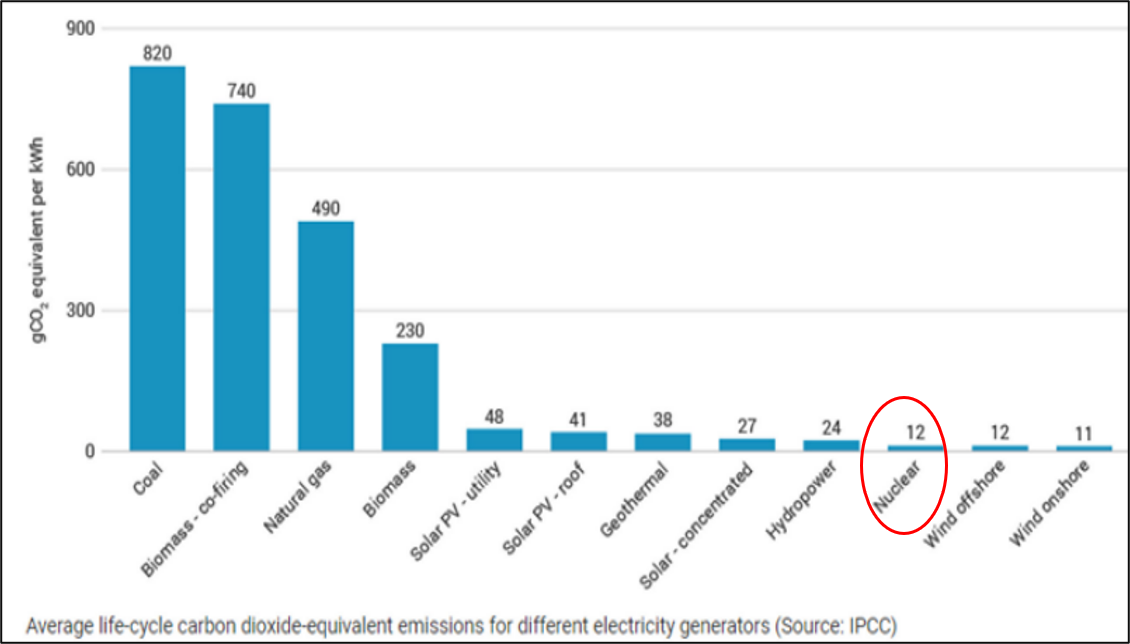

- Coal is clearly dirtiest form of energy, and many would hope to replace coal with cleaner natural gas or renewable forms of energy, such as wind or solar power. Yet many don’t consider the carbon footprint of “renewable” power.

- There is nothing renewable about solar & wind. The solar panels & windmills have a lifespan just like all machinery and need to be replaced, which will require more materials to be mined since recycling is impossible. Likewise, hydroelectricity, while clean, can have ecological impacts, such as diverting rivers or changing fish habitats.

- Nuclear power seems to us to be a very viable option for clean power. It is clean, cheap, and provides base load power.

There are Nuclear and Uranium themed ETFs like URA and URNM available for investment by resident Indian investors.

Breaking Down Cybersecurity

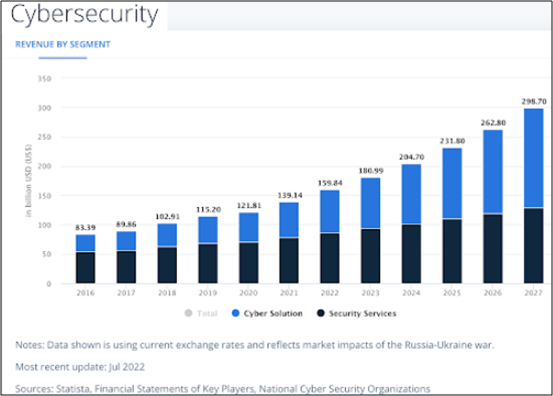

- Three most targeted industries are finance, manufacturing & energy - IBM research. In industrial-critical infrastructure sectors alone, spending on cybersecurity is expected to reach $23 bn by end of this year & $36 bn by 2027 - ABI Research.

- Attacks increased 31% from 2020 to 2021 and the number of attacks per company increased from 206 to 270 year-over-year.

- Economic impact of cybercrime (stolen data, theft of IP, etc.) is on pace to reach $10.5 tn annually by 2025, up from $3 tn in 2015.

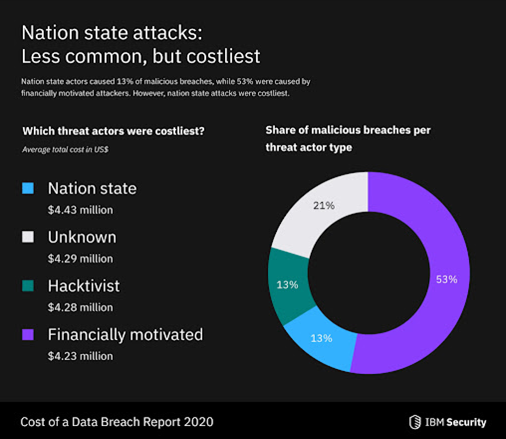

- The average cost of a data breach has hit $4 million which might be small for a blue chip firm; but it’s enough to knock a small or medium-sized business, the target of 60% of cyberattacks, on its back.

This is obviously not an industry with a supply problem. Russia’s war in Ukraine, the US’ tense relationship with China, and the overall retrenchment from the era of globalization all point to plenty of reasons to be vigilant. Because of the ever-present need for defense mechanisms, analysts have even proclaimed the industry as “recession-proof.”

There are global cyber security themed ETFs like HACK available for investment by resident Indians.

New Global Reserve Currency?

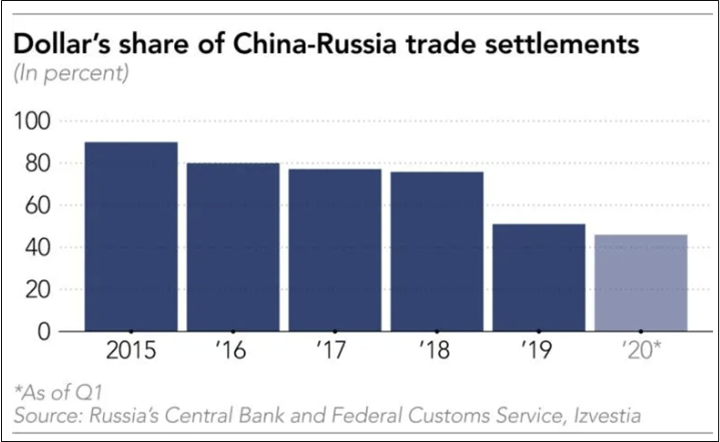

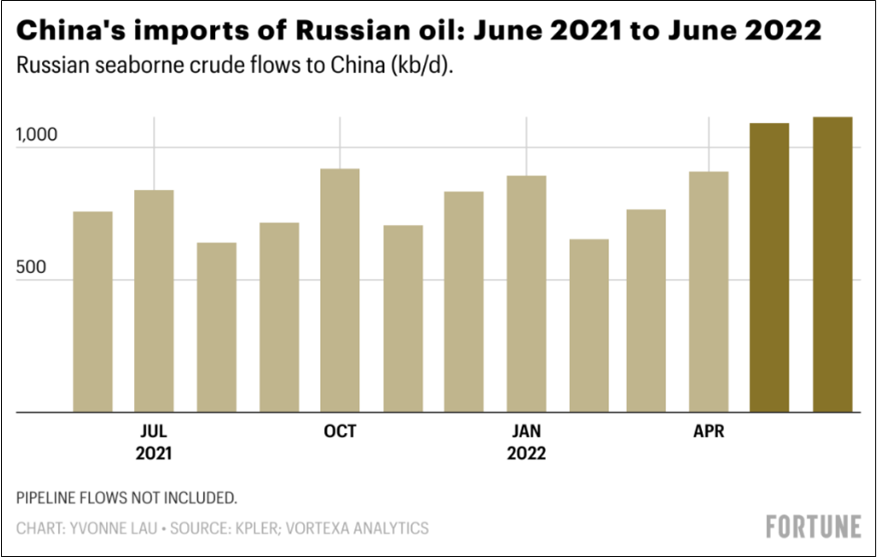

- Trade between Russia and the BRICS countries increased by 38% & reached $45 billion in first 3 months of the year. Meanwhile, Russian crude sales to China have hit record numbers, edging out Saudi Arabia as China’s primary oil supplier.

- Contacts between Russian business circles & business community of BRICS countries have intensified. Negotiations are underway to open Indian chain stores in Russia [and to] increase share of Chinese cars, equipment & hardware on our market.“ – Putin

- “The issue of creating an international reserve currency based on a basket of currencies of our countries is being worked out,” Vladimir Putin at BRICS

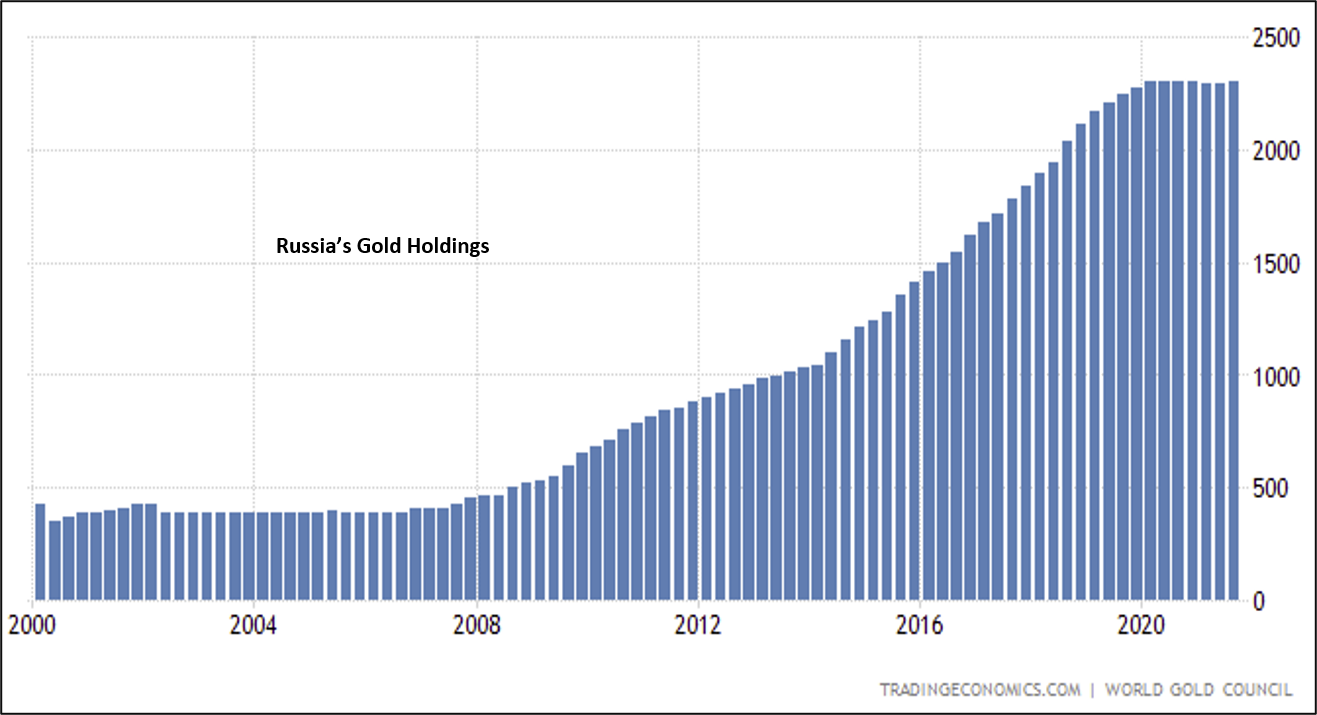

Russia seems was preparing for this since 2014

The developments further the long held belief that a gold backed global reserve currency is on its way.

Real Assets vs. Financial Assets

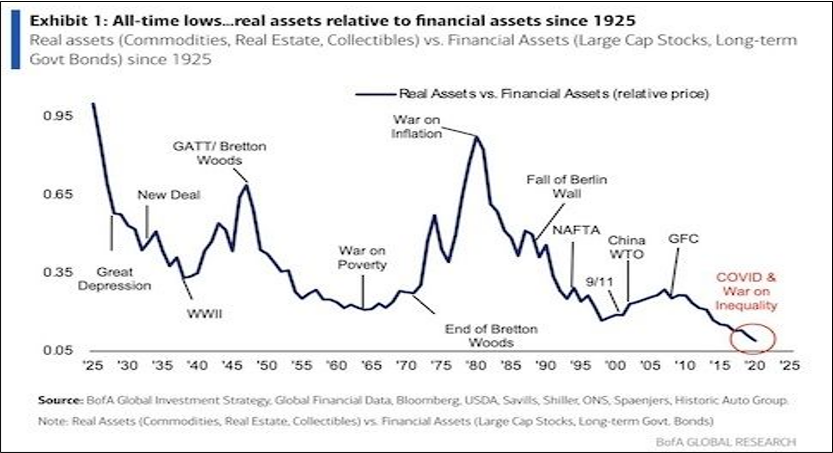

- Since the late 1800’s, all three of the major crashes (1929, 1960s, 1990s) took place while commodity markets entered these phases being significantly undervalued, and in all situations over the following decade commodity markets became wildly overvalued.

- The thing that is consistent through each of those three periods is that commodities were wildly undervalued going into each crisis, which is where we are today.

- 1929 to 1940 – Deflationary bust, consumer price fell by 20% in this decade. A simple portfolio with 25% each into energy, metals, precious metals and agriculture would have returned 122% in this period vs -50% for Equity markets.

- 1970 – 1980 – Inflationary Bust, with real rate of inflation of ~80% in this decade. A similar commodity focused portfolio would have returned 400% massively outperforming the stock market

- 2000s – 2010 – The commodity portfolio would have returned 360% vs. 35% for equity over the same time frame.

There are Real assets focused ETF like RAAX available for investment by resident Indian investors.

Is this the time to exit Commodities?

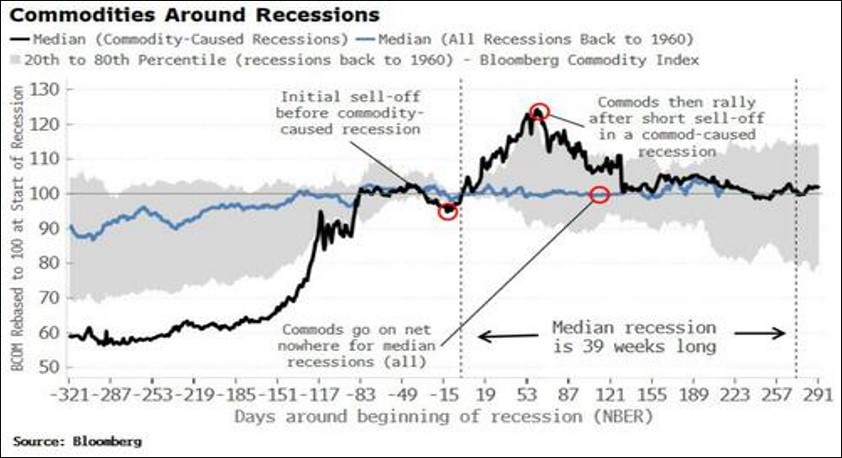

- In this slide, we have discussed - Why slowing growth along with fear of recessionary outcome should don’t be the reason for selling commodities; especially when the inflation prints continue to be sticky.

- Commodities are not equities. Unlike Equities, they do not sell off before the recession begins, bottom during the recession and start to rally before the recession ends. Instead, commodities rally into the recession and then are flat over its duration.

- Recessions caused by rise in input prices (1973-75) saw this cyclical sector rally after the recession begin; as the initial correction in commodity prices after slowdown actually acted to ease the growth problem, allowing investing activity to partially recover, which was enough to lead to re-rally in commodities.

- Thus even if we get a recession – commodity-triggered or not – it does not make sense to fully divest oneself of commodities or equities such as energy and materials.

There are Energy themed ETFs and ETNs like OIL, XLE, OIH and Material themed ETF like XLB available for investment by resident Indian investors.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation