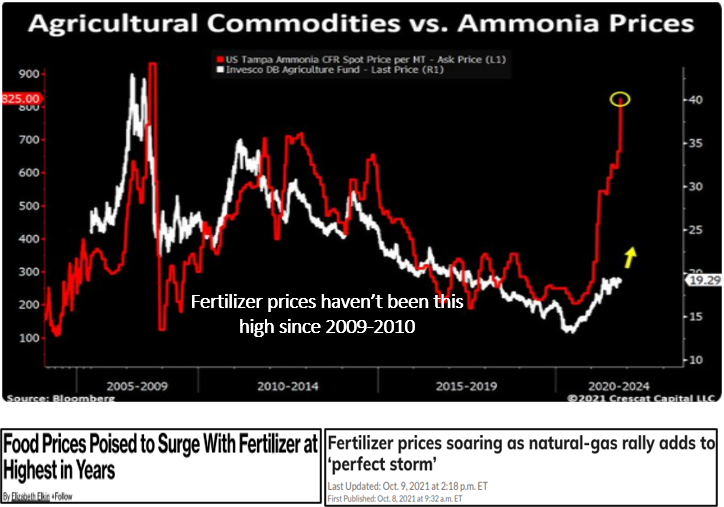

Rising Fertilizer Prices – Perfect Storm of Events!!

- Extreme weather, plant shutdowns, new government sanctions has hit the chemical fertilizer market, slamming farmers already crumpled under the strain of rising production costs.

- Prices for major fertilizer products have increased over 50% in the last year. High prices lead to projections of record-high production costs in 2022 (though still short of all-time high levels set in 2008).

- Sky-rocketing prices of fertilizers are complicating planting decisions for US farmers for upcoming 2022-23 season with some mulling shifting to other crops.

- Pockets of discontentment are growing again. Unrest in South Africa triggered by arrest of former President Jacob Zuma in July turned to food as people looted grocery stores and restaurants

With prices for fertilizers at their highest levels since the financial crises, it could mean weaker harvests and bigger grocery bills next year, just as the world’s supply chains start to recover from the pandemic.

Mosaic Company - Largest producer company in US of phosphate & potash nutrients is available for investment by Indian Resident investors under LRS.

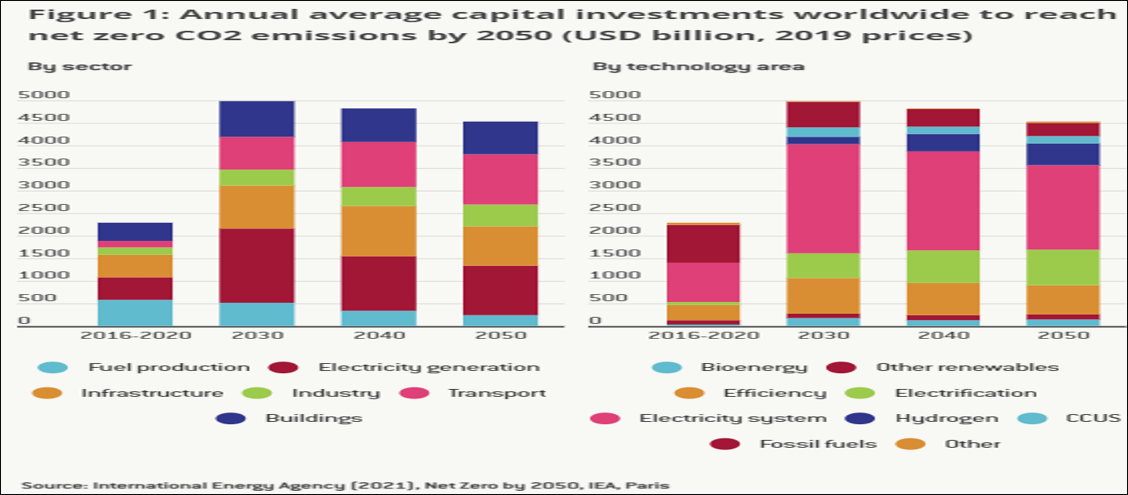

COP26 – What are the ‘Real’ costs of transition to Net Zero

- World leaders gathered at the 2021 United Nations Climate change conference (COP26) to make proclamations and largely non binding commitments to reduce hydrocarbon reliance.

- Reaching net zero will require $5 trn to be invested every year for 30 years, according to BofA. The total number $150 trn is 3x the total US Covid-19 stimulus bill for this decade, 2x the total global GDP & yearly investment of $5trn is higher than total US tax intake.

- What would $5trn be spent on - replacement of carbon-emitting technologies

- It isn’t who attended and what they said, but who DIDN’T attend. Xi, Putin, Erdogan and Bolsonaro – skipped the summit. Do we see any alliances forming?

- We believe that this trillion of dollars of new “green energy” debt will be inflated away with Central Banks support. Greenflation is baked into our future.

What is it going to take to achieve ‘Net Zero’?

Our two cents on this, it is going to take a deep seated global financial crisis/financial repression that will be stagflationary with energy, food & resources reaching skyrocketing levels & living standards dipping nosediving levels.

There are ETFs listed in US market on clean energy (ICLN), Solar (TAN), Electric vehicle (DRIV) that can be subscribed by resident Indian investors.

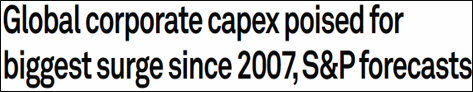

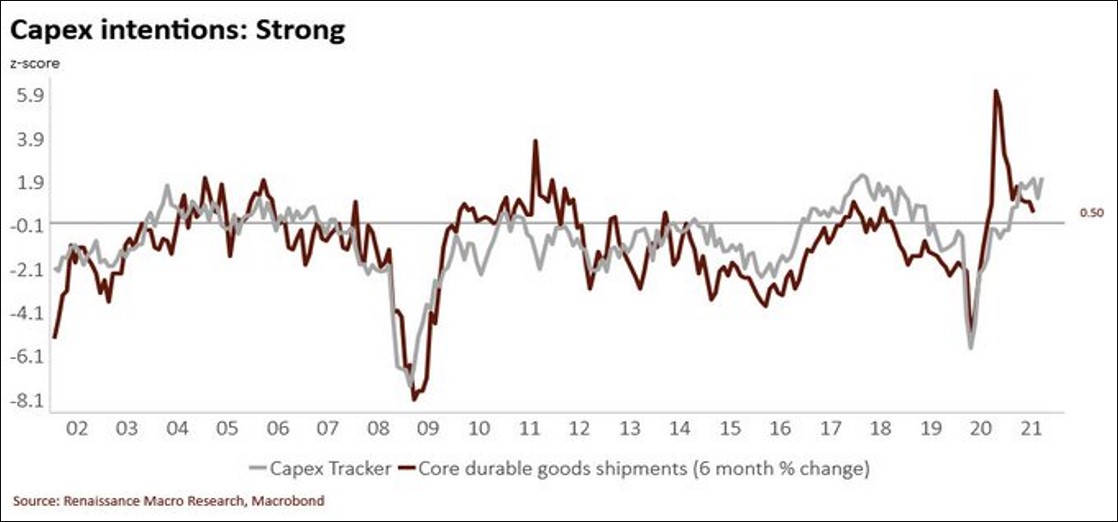

Has the Process of money moving to Real Economy already started?

- Fiscal Stimulus finds its way into real assets; while, monetary stimulus typically funnels its way into financial assets like stocks, bonds and real estate.

- Do we already see signs of the liquidity created by a Monetary stimulus started to move to Real economy with heighted fiscal spending?

- In the U.S., business spending on equipment, structures & software has averaged 13.4% p.a through the 2nd quarter - strongest pace since 1984. Spending on equipment alone was ~14.4% over the past year, more than 2x the average of 2009-2019 expansion.

- The investment trend is driven by factors such as supply chain diversification due to deglobalization, Net Zero policy, accelerated automation in the services sector as workforces age, pent up consumer spending, rebounding commodity prices etc.

- Real interest rates will remain negative for the next couple of years and this builds an investment case for assets protecting real purchasing power. Interest rate-sensitive sectors, such as capex and housing could see continued upside in the quarters to come.

The upcoming infrastructure plan has focus on areas like transportation, manufacturing, housing and water infrastructure. There is a US listed ETF – PAVE available for investment by resident Indians, which focuses on companies with investment into sectors mentioned above.

Farmland moving out of Cultivation

- President Joe Biden wants to combat climate change by paying more farmers not to farm. The goal is to add 4 million acres of farmland to the existing 21 million land to the Conservation Reserve Program, which takes land out of production to blunt agriculture’s environmental impact.

- Even though the USDA this summer more than doubled key incentive payments for the program that encourages farmers and ranchers to leave land idle, high commodity prices are keeping it more worthwhile for growers to raise crops.

- To date, the administration has focused on voluntary, incentives-based programs to address climate change and the environment in the farming sector. But, will low number of farmers opting for these programs will these be made mandatory?

- Dutch politicians are considering plans to force hundreds of farmers to sell up and cut livestock numbers, to reduce damaging ammonia pollution.

- In the Netherlands, there is already a contraction of 3% a year in the agricultural sector, as many farmers face legacy issues, and it is predicted that in 10 - 15 years, 40% - 50% of cultivation will have stopped anyway. In such scenario, plans for forced expropriation may be disastrous.

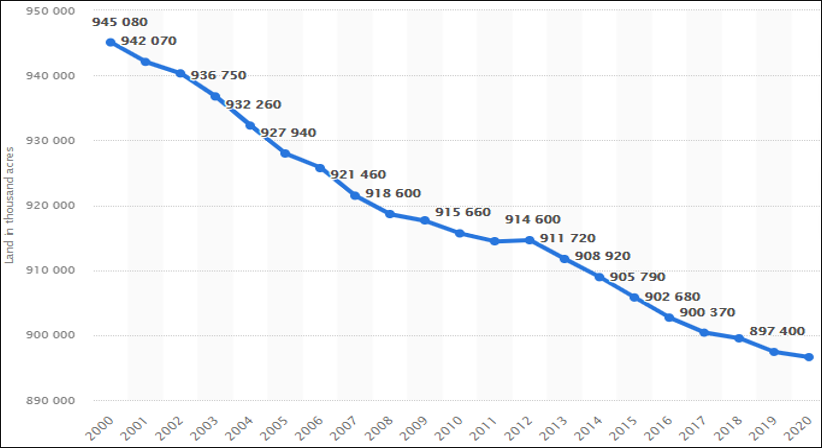

Total area of land in US farms: 2000 - 2020 (in 1,000 acres)

Supply side issues, deglobalization, rising fertilizer prices is expected to push food prices higher. In such a scenario, pulling land out of cultivation adds to the perfect storm.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation