Carbon Credits : The New Asset Class?

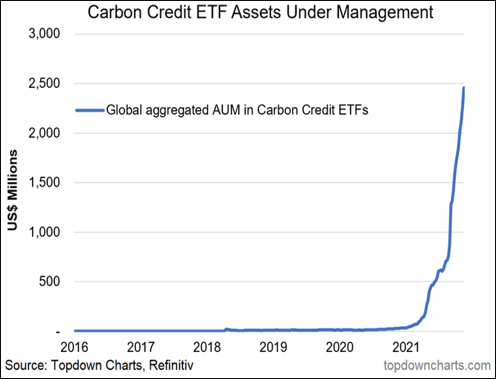

- New asset class that has born out of regulation – Carbon credits is witnessing surging fund flows in an ESG dominated volatile situation this year.

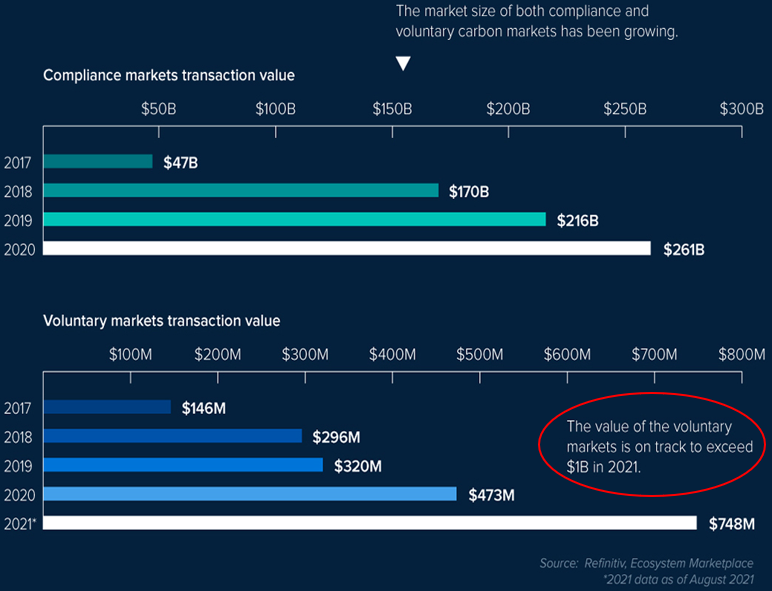

- Number of companies with net-zero targets has jumped ~200% between 2019 & 2020, up from 500 to 1,565. As per McKinsey’s estimates the market for voluntary carbon credits could be worth upward of $50bn in 2030 (Source: Visual capitalist)

- The buyers of this credit are starting from energy & utility firms to corporate entities looking to put their green foot forward, to retail & speculative investors trying to catch the parabolic rise as price & volatility increases.

- Carbon credits are an allowance that works on a ‘cap & trade concept’ regulators cap the amount of carbon emissions & then allow emitters to trade the credits.

The Krane Shares Global Carbon ETF (KRBN) which tracks the EU ETC carbon price can be subscribed to by Indian Resident Investors.

Check this at - https://www.easternfin.com/international-investing

Water ETFs: $111 Billion For Water Infrastructure

- By 2025, it is estimated that 66% of the world will live in water-stressed areas according to the World Resources Institute. This is not just usual drought of California, North India (whose groundwater loss can be seen from space) or the Arabian Peninsula either, but a worldwide mismatch that will see a 40% gap between demand and supply emerge over the next 15 years.

- A significant issue in the Western world comes in the form of an ageing infrastructure that is prone to springing leaks. In the US, 13.7% of daily household water usage is lost through leaks, while almost a quarter of the UK’s public supply goes the same way.

- Barclays Capital analysts forecast global freshwater requirements for food production to increase 40% by 2030. The global consumer staples sector faces a $200bn impact from water scarcity and is the most exposed of all sectors to the water risk.

There are ETFs listed in US focused on water space – PHO, FIW and CGW, available for investment by Indian resident investors via portal like Stockal.

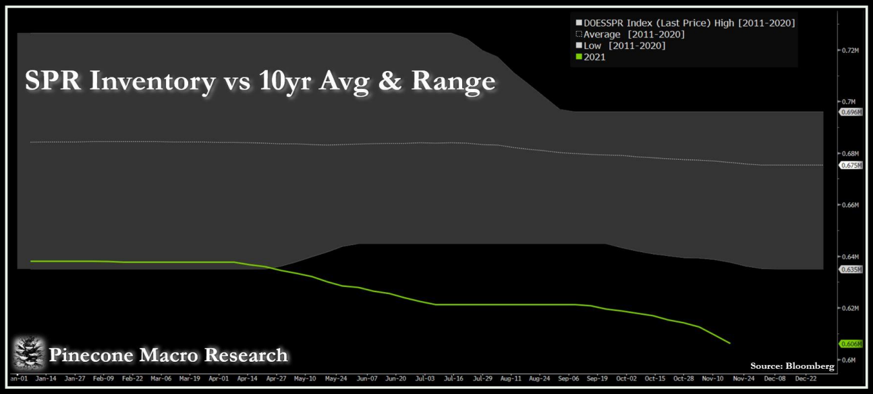

SPR release by US: Do we see triple digit in Oil coming soon?

- The US has already released a significant amount of oil from SPR with drawdowns accelerating lately – falling off a cliff in 2021. The most US can even sell is ~50-60 mpd which is only enough to soak up a few hours of global demand. Total global demand is touching 100mbpd. Total US demand is 20mbpd.

- The Strategic Petroleum Reserve (SPR) is an emergency stockpile of petroleum maintained by the United States Department of Energy (DOE). It is the largest known emergency supply in the world.

The upcoming infrastructure plan has focus on areas like transportation, manufacturing, housing and water infrastructure. There is a US listed ETF – PAVE available for investment by resident Indians, which focuses on companies with investment into sectors mentioned above.

Disclaimer

The above material is neither investment research, nor investment advice.

This document may contain confidential, proprietary or legally privileged information. It should not be used by anyone who is not the original intended recipient. If you have erroneously received this document, please delete it immediately and notify the sender. The recipient acknowledges that Eastern Financiers Ltd ("Eastern")or its subsidiaries and associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in document and further acknowledges that any views expressed in this document are those of the individual sender and no binding nature of this shall be implied or assumed unless the sender does so expressly with due authority of Eastern or its subsidiaries and associated companies, as applicable. This document is not intended as an offer or solicitation for the purchase or sale of any financial instrument / security or as an official confirmation of any transaction.

Investment Disclaimer

Investment Products are not obligations of or guaranteed by Eastern Financiers Ltd or any of its affiliates or subsidiaries, are not insured by any governmental agency and are subject to investment risks, including the possible loss of the principal amount invested. Past performance is not indicative of future results, prices can go up or down. Investors investing in funds denominated in non-local currency should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorized or to any person to whom it is unlawful to distribute such a document or make such an offer or solicitation