Dear Investors,

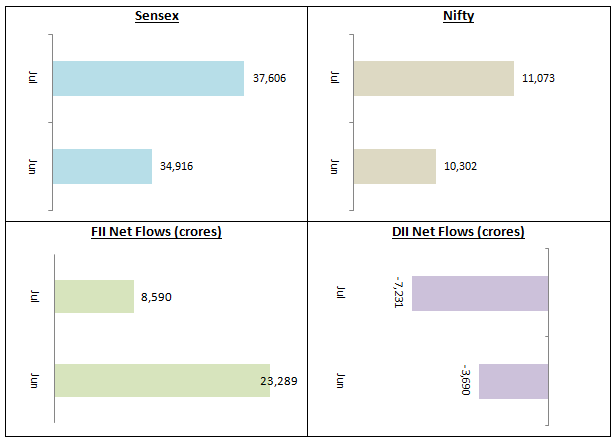

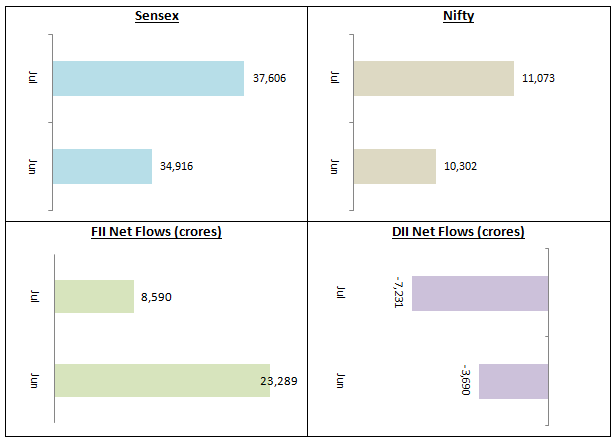

The stock market saw two months of successive gains in June and July 2020. In July, Nifty continued to show strength gaining 7.5% and closing above the important psychological level of 11,000. Sensex clocked similar gains closing the month well at 37,606. Foreign Institutional Investors continued to be bullish in the month of June with net purchases of Rs 8,590 Crores though this was much lower than the net purchase seen in previous month. Domestic Institutional Investors continued to be net sellers to the tune of Rs 7,231 Crores. Relatively less net purchase by FII and continued DII selling indicates that valuations are beginning to get overheated. The COVID situation in India continues to be a cause of concern with rising infections though recovery rates are also improving rapidly. Q1 results in FY 2021 were a mixed bag with some companies beating Street estimates while others posting poor results as expected due to the pandemic. In general the market appears to be bullish, but there are valuation related concerns may cause volatility in the coming weeks and months.

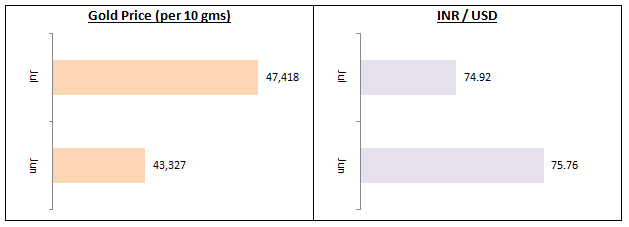

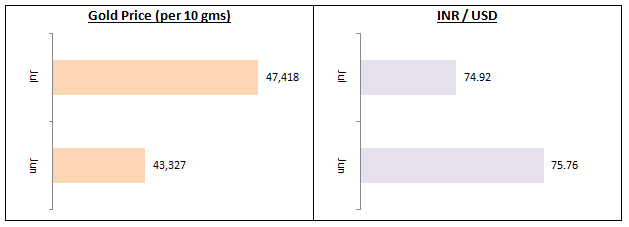

The Government did not to report the IIP and WPI numbers for April because of the lockdown. The IIP and WPI numbers for April would anyways have been irrelevant because there was virtually noeconomic activity in that month due to lockdown. The Government decided to withhold official IIP numbers in May as well, because there were considerable restrictions on economic activity even in the month of May due to COVID though the Government announced some relaxations. According to quick estimates released by the Ministry of Statistics, IIP contracted sharply in May also, though the contraction was not as drastic as seen in April. In the coming months, we will not do a month on month IIP or WPI comparison till the COVID situation is stabilized because these figures will be irrelevant due to the continuing restrictions and re-imposition of lockdowns in many states. However, internally we will continue to keep track of these key macro-economic data and inform our investors when we see the eventual turnaround. Gold continued its impressive run in Julygaining more than 9% in the month, while the Rupee strengthened slightly against the US Dollar.

In the broader market midcapsfollowed the large cap trend clocking decent gains. I have mentioned over the last few months that midcap valuations are attractive in our view and that you may tactically invest in lump sum (in addition to SIP) to take advantage of these valuations over long investment horizon. However, I must also stress on the importance of large caps in a well-rounded portfolio. Diversified equity funds which invest across market caps like multi-cap funds or large and midcap funds are good long term investments in the current scenario. As always, we recommend SIP mode of investment for your long term goals. You should continue with your SIPs irrespective of market movements.

The RBI in its August monetary policy meeting kept repo rate unchanged. While the fundamental policy stance of RBI is accommodative in the current economic conditions, the pace as well as the quantum of rate cuts may be weaker in the future. In view of the economic uncertainty due to COVID and also the levels to which rates have already been cut, we recommend shorter duration funds for investors who do not have long investment tenures. Money market funds, low duration, short duration and corporate bond funds of high credit quality are suitable for investors who want to avoid interest rate risk, if yields creep up in the short term.

If you have long investment tenures (at least 3 years) and higher appetite for volatility, then you can invest in PSU and banking funds, dynamic bond funds and long duration funds for superior long term returns as well as tax benefits (due to indexation). As mentioned several times in my letters to you, we in Eastern Financiers give utmost importance to credit quality because safety of your money and good returns is our highest priority. Our experienced financial advisors will help you in selecting the right schemes according to your investment needs.

These are difficult times but our lives cannot stop. We have to learn to live with this pandemic till it gets over and make sure that we plan for our long term future and financial security. We are at your service and look forward to servicing all your financial needs. Do let us know of your suggestions and things we can do better in servicing your needs.

Best Regards,

Ajoy Agarwal,

(Managing Director)