Dear Investors,

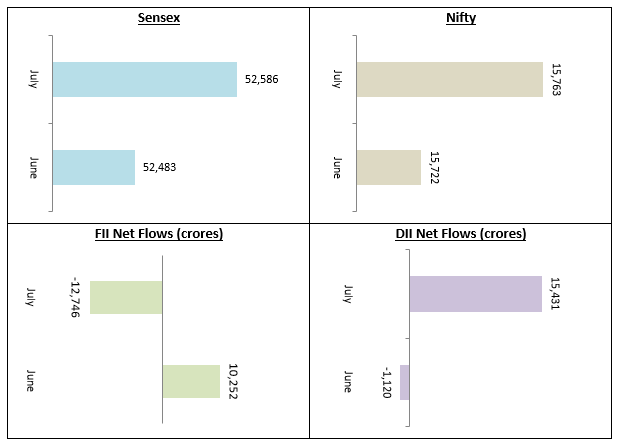

The stock market traded sideways in the month of July 2021. Both the Nifty and the Sensex ended the month almost flat at 15,763 and 52,586 respectively. While FII sentiments turned net sellers in July, with net sales to the tune of Rs 12,700 Crores, the DIIs turned buyers in July. Q1 earnings released by companies were generally positive from an investor sentiment standpoint, with many companies exceeding analyst estimates. However, there were some misses as well. Overall, corporate earnings performance in the first quarter was encouraging from the point of view of current price levels in the market; there are clear signs of recovery. Market has been consolidating and in our view, is poised to go higher from current levels.

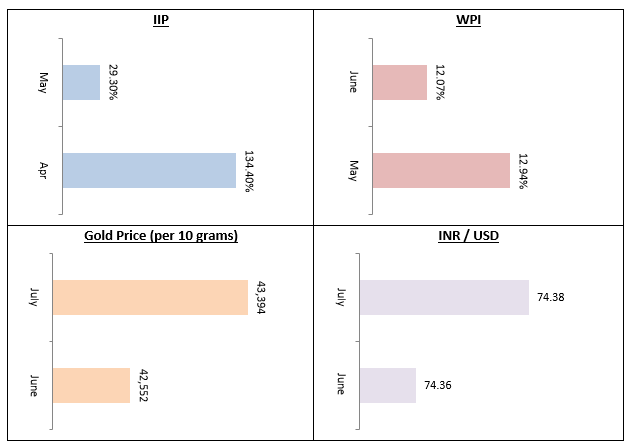

The Index of Industrial Production (IIP) jumped by 29.3%, primarily due to low base effect. With the festive season approaching and pent up demand in consumers, we expect industrial output to grow faster in the coming months. WPI inflation eased a bit to 12.07%, after creeping up 12.94% in May. Gold price rose by about 2% in July. The INR remained flat in July. Overall, we see 3 major risk factors in this market, impact of COVID third wave (if any), trajectory of international crude oil prices and interest rates in the US. If there is no adverse news on any of these fronts, the market will trend upwards. However, the market may react negatively to adverse news on these fronts.

As the Indian economy recovers from the impact of COVID-19, the long term prospects of equity, as an asset class is promising. We think that midcaps and small caps are likely to outperform in the medium term (2 – 3 years). You should continue to invest in midcaps and small caps through the SIP route. You can also take advantage of market corrections to invest in lump sum. While midcaps and small caps are attractive now, you should not ignore large caps from an asset allocation standpoint.

As far as debt funds are concerned, it is prudent to invest in shorter duration accrual funds in these conditions, given the uncertainty on the inflation trajectory. The Reserve Bank has injected massive amount of liquidity in the financial system which has kept the yields of very short duration funds like overnight, liquid and ultra short duration funds low. For higher yields, you may invest in money market and low duration funds. However, you should have investment tenure of at least 1 year for these funds. For investors with minimum 3 year investment tenures, high credit quality funds of short to medium duration profiles like, Short term debt funds, Banking and PSU debt funds etc will be good investment choices.

Conclusion

It is important that you invest according to a financial plan and remain disciplined in your investments. Our financial advisors can help you in planning your investments for your short term, medium term and long term needs. August is an auspicious month in our country as it marks the beginning of the long festive season and also the anniversary of our Independence. Wishing all our investors a very happy Raksha Bandhan, Krishna Janmashtami and Independence Day.

Best Wishes,

Ajoy Agarwal,

(Managing Director)