The Budget 2026 was along expected lines, barring the hike in STT (which was not expected) and no adjustment on capital gains. Given the geopolitical uncertainties the Government has turned the focus towards strengthening the economy internally and strive towards self-sufficiency in critical areas (defence, infrastructure, manufacturing etc). The Budget focused towards job creation and across both manufacturing and services while keeping fiscal consolidation. The fact that nominal GDP growth for FY27 is projected at 10%, is pragmatic to start with, although it leads to higher fiscal deficit numbers as well as market borrowing. One of the major short-term dampeners which spooked equity markets is 150% and 50% increase in STT for Futures and Options to 0.05% and 0.15% respectively. However, the Budget has proposed to tax Buybacks as capital gains vs deemed dividend earlier (which is positive). More importantly, at a time when FIIs are unsure to make a comeback, India has lured Persons Resident Outside India (PROI), by raising the aggregate investment limit for NRIs and OCIs in listed Indian companies from 10% to 24% (limit for an individual NRI in a company is increased to 10% from 5%).

Six-Pillar Growth Strategy: Focus areas include manufacturing, MSMEs, infrastructure, financial stability, urbanisation and innovation

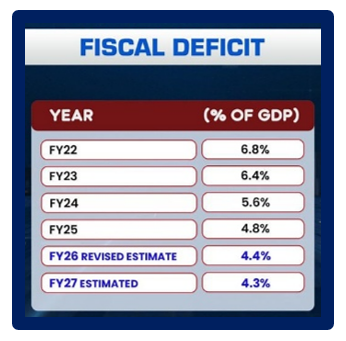

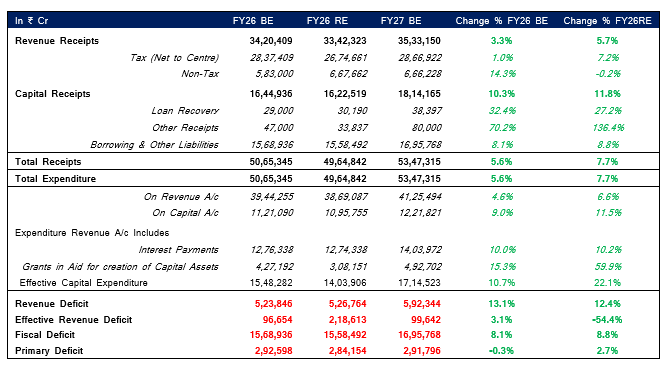

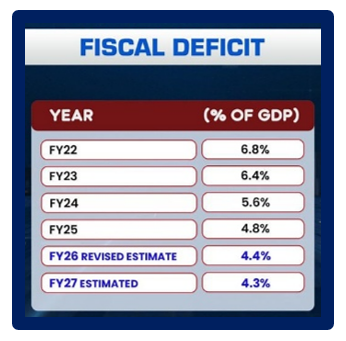

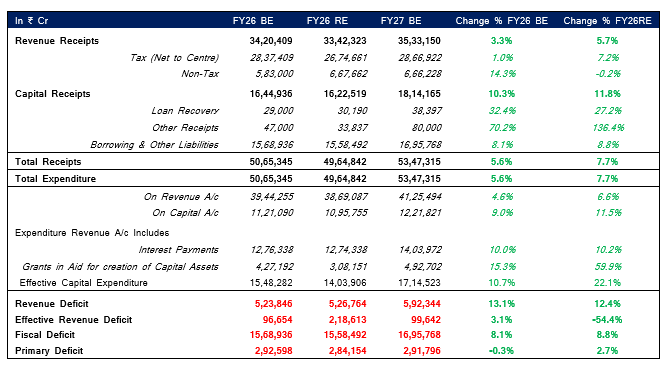

Fiscal Discipline Maintained: Fiscal deficit continues to narrow, FY27 estimated at 4.3% of GDP. FY27 Divestment Target At Rs 80,000 Cr Vs Rs 33,837 Cr FY26.

Infrastructure & Capital Expenditure: Total capital expenditure has been proposed to be increased to ₹12.2 lakh crore. The focus would be on roads, railways, logistics, ports and urban infrastructure. Infrastructure Risk Guarantee Fund would be introduced to attract private investment.

Strengthening Defence: India's military has been given ₹2.19 lakh crore (¬22% increase)- for modernization in FY27, against capital outlay of ₹1.8 lakh crore in FY26. Capex allocations include ₹63,733 cr for aircraft and aero engines. Additionally, budgetary allocation for defence services (revenue), i.e., the portion of the defence budget set aside for day-to-day operations, including maintenance, recurring expenses like ammunition, fuel, repairs, etc, and salaries of support staff – has been hiked by 17.24%. Overall, the defence budget for FY27 has been increased to Rs 7.85 lakh crore.

The general theme for the Union Budget has been on employment generation and focus on infra spending wherein corporate sector-engineering and construction, capital goods, cement, metals, railways, logistics and power in particular will be beneficiaries. However, couple of broad themes which stood out from the Union Budget are:

Focus on Manufacturing and self-sufficiency

The clear focus of the Union Budget 2026-27 was on making India self-reliant amid the troubling geo-political set up. Government wants to scale up manufacturing in 7 strategic and frontier sectors and beyond:

- Biopharma SHAKTI (Strategy for Healthcare Advancement through Knowledge, Technology and Innovation) with an outlay of ₹ 10,000 crores over the next 5 years to build the ecosystem for domestic production of biologics and biosimilars.

- India Semiconductor Mission (ISM) 2.0 to produce equipment and materials, design full-stack Indian IP, and fortify supply chains

- Increase in allocation towards The Electronics Components Manufacturing Scheme from ₹22,919 crore in April 2025 to ₹40,000 crore to capitalize on the investment commitments received so far

- Establishment of Rare Earth Corridors to promote mining, processing, research and manufacturing across mineral-rich States of Odisha, Kerala, Andhra Pradesh and Tamil Nadu to compliment the Scheme for Rare Earth Permanent Magnets launched in Nov'25

- Scheme to reduce dependency on imported chemicals and to establish 3 dedicated Chemical Parks, through challenge route, on a cluster-based plug-and-play model.

- Building capacity on capital goods:

- Hi-Tech Tool Rooms will be established by CPSEs at 2 locations as digitally enabled automated service bureaus that locally design, test, and manufacture high-precision components at scale and at lower cost.

- A Scheme for Enhancement of Construction and Infrastructure Equipment (CIE) to strengthen domestic manufacturing of high-value and technologically-advanced CIE.

- Scheme for Container Manufacturing with a budgetary allocation of ₹10,000 crore over a 5 year period.

- Strong integrated programme on the Textile Sector with proposal to set up Mega Textile parks in challenge mode.

- Creation of "Champion SMEs": creation of ₹10,000 crore SME Growth Fund and another ₹2,000 crore top-up of Self-Reliant India Fund to continue support to micro enterprises

Focus on Services sector and focus to transform India in a data center hub

Union Budget 2026-27 had greater focus on AI, on jobs and skill requirements to transform India into a global leader in services, with a 10% global share by 2047. Government has focused greatly on tourism Medical Tourism, Animal Husbandry and Orange Economy sectors and majorly zeroed in on tourism as a potential to play a large role in employment generation, forex earnings and expanding the local economy. However, one of the major announcements which stood out is Tax holiday up to 2047 for foreign cloud companies operating from data centres located in India

According to the Budget 2026-27, foreign companies offering cloud services worldwide will receive a tax holiday until 2047. The FM also proposed to provide a safe harbour of 15% on cost in case the company providing data centre services from India is a resident entity to a foreign company (who is providing cloud services to any part of the world outside India). Under this, foreign cloud providers would be required to serve Indian customers exclusively through an Indian reseller entity rather than contracting directly with them. This reseller would typically be an Indian subsidiary of the foreign cloud provider or an Indian IT, telecom, or cloud services company authorised to distribute cloud services domestically.

The economic impact of the proposal would be significant, driving substantial foreign direct investment into data centres, boosting demand for power, renewable energy, fibre networks, and construction, and generating both direct and indirect employment. Besides, the tax holiday together with the safe harbour provisions addresses the concerns of the Big Tech firms like Microsoft, Google, and Amazon who have already invested ~USD 80 bn in India in last few months. They had earlier expressed concern over "permanent establishment" ambiguities wherein foreign cloud firms using Indian data centers faced double taxation and profit attribution disputes.

More importantly, this would have huge second order implication on the power sector and allied sectors.

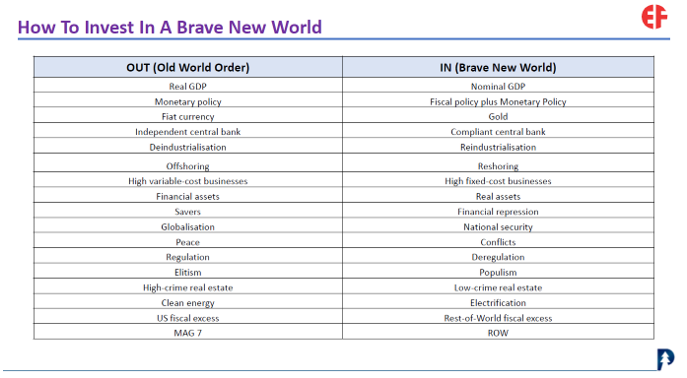

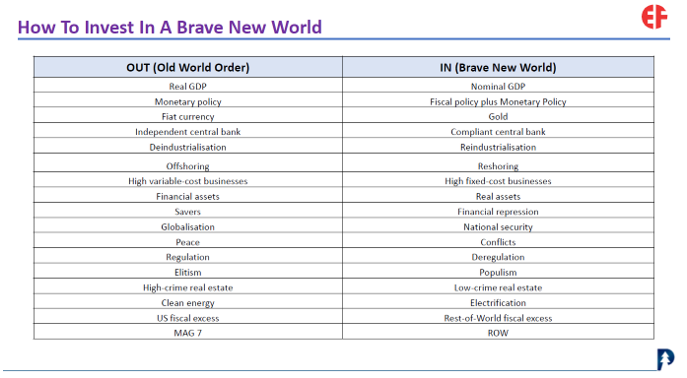

Source: Pinetree Macro, EF

Essentially, the Union Budget is in line with the changing world order wherein in a Brave New World, real assets hold significance than financial assets. Reshoring and reindustrialization are the other two themes which also stands out from the Union Budget.

The Union Budget and the Government hence is focusing on mining of critical minerals, strong focus on manufacturing and skilling and focus towards cutting down on import dependence in key sectors.

Besides, Government's focus on India to turn into a global data center hub will pave way for higher demand for power and other allied sectors – power equipment, data center cooling and infrastructure, all liked with broader theme of electrification.

Together with this the defence Indianization story and defence exports is for real and the Government continues to increase capital allocation content in there due to national security.

Hence, we continue to remain constructive on the following key themes:

- Defence Indianization

- Electrification & allied sectors

- Domestic Manufacturing

- Metal & Mining (with new vigor on critical minerals)

Research Team

Partha Mazumder (partha@easternfin.com)

Sanjukta Majumdar (research@easternfin.com)

Sayantina Mallick Chowdhury (sayantina@easternfin.com)

Disclaimer

Eastern Financiers Limited (hereinafter referred to as 'EFL') (RA Registration No: INH000022756, Type: Non-Individual) is a Member registered with SEBI having membership of NSE, BSE, MCX. It is also registered as a Depository Participant with NSDL. It is also having AMFI certificate for Mutual Fund Distribution. The associate of EFL is engaged in activities relating to Insurance Broking. No disciplinary action has been taken against EFL by any of the regulatory authorities. EFL/its associates/research analysts do not have any financial interest/beneficial interest of more than one percent/material conflict of interest in the subject company(s). EFL/its associates/research analysts have not received any compensation from the subject company(s) during the past twelve months. EFL/its research analysts have not served as an officer, director or employee of company covered by analysts and has not been engaged in market making activity of the company covered by analysts. This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. EFL or any of its affiliates/group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. EFL has not independently verified the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While EFL endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory compliance or other reasons that prevent us from doing so. The report is for information and education purposes only. It must not be construed as any solicitation of any investment or any BUY/ SELL/ HOLD recommendation. Investments are subject to market risk. The user must do his/ her own research before taking any investment decision. Eastern Financier Limited is not liable for any consequence of any action taken by the user on the basis of this report.