Dear Investors,

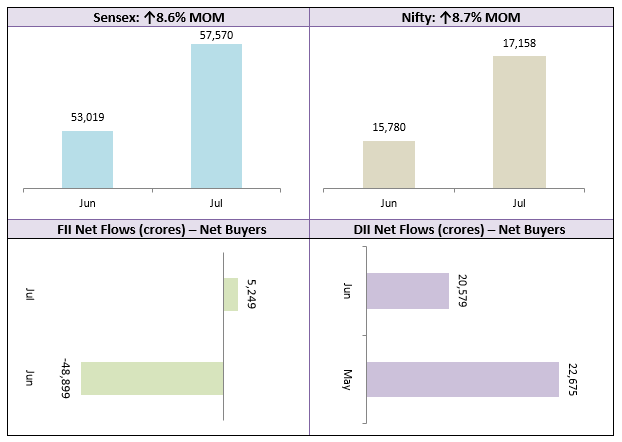

Equity market rebounded strongly in July after global inflation showed signs of cooling off. Nifty gained 8.7% to close the month above the important 17,000 level. The Sensex closed July close to the 58,000 level. The broader market also rebounded strongly after months of weakness with the Nifty 500 gaining 9.5% in the month of July. After months of selling, FIIs turned net buyers in July which shows confidence about India among global investors.

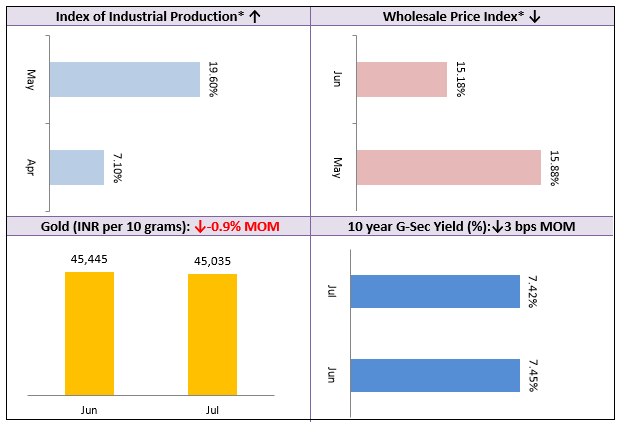

Q1 corporate earnings released so far have largely been in line and above Street expectations. In the large cap space, BFSI companies have outperformed in terms of earning growth while the IT pack has been slightly disappointing. Most of the mechanical indicators signal bullishness in the market. With inflation cooling off and industrial growth recovering, the medium to long term outlook of Indian equities is strong.

That said investors must be judicious in the market. While Indian equities seem to have consolidated and seem to be in the initial stages of a new bull market, global concerns remain. The US economy contracted for the second consecutive quarter, sparking fears of a recession. Unemployment rate in the US is still quite low and that is causing the US equities to rally. However, if the US does go into a recession, there will be an impact on global equities, because global markets are interconnected. Therefore, investors should be prepared for short term volatility and have long investment horizons. As always, asset allocation is very important in any market cycle.

As far as debt and money markets are concerned, short term yields firmed up, while the 10 year yields have eased slightly. For conservative investors money market mutual funds can be good investment options for minimum 1 year investment tenures. These funds can benefit in rising interest rate environment as they can re-invest their maturity proceeds in higher yielding instruments. For 2 – 3 year investment tenures corporate bond funds and Banking & PSU funds can be good investment options, but you should be prepared to remain invested for 3 years. Long term investors (more than 3 year investment tenures) roll down target maturity funds can be good investment options as you can lock-in current yields for your investment tenures.

The month of August usually marks the onset of the festive season in India. I, on behalf of my team wish all our dear investors in advance, a very Happy Raksha Bandhan, Krishna Janmashtami and Independence Day.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!