Dear Investors,

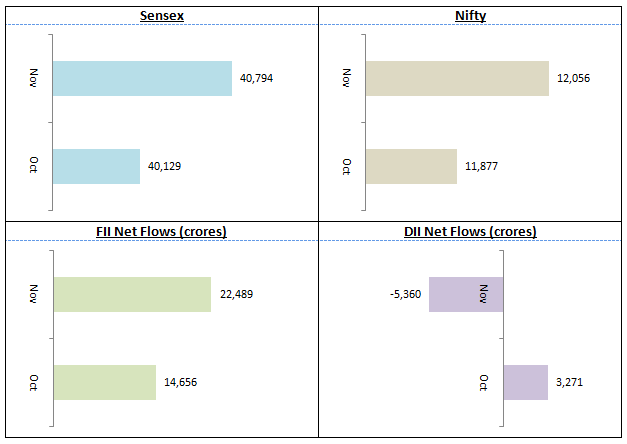

Nifty closed November above 12,000 which is close to its all time high; Sensex closed the month at around 40,800. FIIs continued to be net buyers in the month of November continuing the trend set in September when the Government made important policy announcements including reduction in corporate tax rate. After a long time, DIIs turned net seller in November which may be reflecting concerns about valuations and weakness in the economy. The Nifty seems to be consolidating around the 12,000 resistance level, but we are seeing buying support at lower levels.

The Reserve Bank of India (RBI) in its December 5 monetary policy committee (MPC) meeting cut the FY 2019 – 20 GDP growth forecast sharply to 5% (versus 6.1% in the previous MPC meeting in October). We are seeing the slowest GDP growth in India since 2013. Despite growth concerns RBI kept the repo rate unchanged in the last meeting due to inflationary concerns. As far as corporate earnings are concerned, we saw double digit earnings per share (EPS) growth in the Q2 earnings season, but this was largely due to the corporate tax rate cut. Revenue growth remained sluggish and saw slippages in many sectors. EPS growth cannot be sustained unless we see recovery in demand and sales. As per market research agencie’s reports, consumer goods sale in the Diwali festive season was largely disappointing and rural consumption growth is now at its lowest point in last 7 years.

We think that the stock market over the next month or so will be guided more by global factors like US / China trade talks, UK election results and Brexit conditions. Generally, we see a slowdown in market activity in December 2019 and early January 2020. From mid or end January onwards, the focus will shift towards the Union Budget in February.

In the broader market Nifty Midcap 100 outperformed Nifty 50 for the second consecutive month in November. The long drawn correction in midcaps has brought down valuations and now midcap valuations have reverted back to their historical trend of discount to large caps. Though midcap valuations are certainly not as cheap as 2008 or 2013, these valuations in the past provided a good entry point for investors to get good returns over long investment tenures (for midcaps we usually recommend minimum 5 years investment horizon).

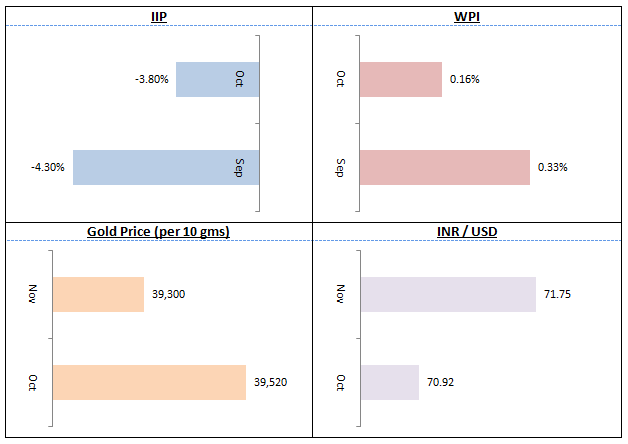

Index of Industrial Production (IIP), an indicator of industrial / manufacturing activity, contracted 3.8% in November, the third consecutive monthly fall confirming. WPI Inflation,which fell to 0.33% in September, came in at 0.16% in October. However, November CPI data indicates a worrying trend. November CPI rose to 5.5% from 4.6% in October due to rise in food (particularly vegetable) prices. Falling growth (in terms of IIP) and rising retail inflation (CPI) have raised concerns about stagflation, but it is too early to come to any conclusion.

Gold, which has been the best performing asset class in the last 1 year, remained almost flat in November. Since gold has run up significantly we expect upside to be capped in the near term, but we also do not see gold prices falling too much due to concerns about the economy in the near term. The Rupee weakened slightly against the dollar and closed November at 71.75. We in Eastern Financier’s do not see a sharp turnaround in growth in the near term and urge equity investors to have long investment horizon.

With Nifty at its all time high and corporate revenue growth outlook remaining weak, large cap valuations look a bit stretched. As such we expect limited upside in large caps in the near term. However, with attractive investment opportunities in the midcap segment, multi-cap funds which have the flexibility to invest in both large and midcaps are good investment options with a 5 year investment horizon. For investors with moderate to moderately high risk appetites, dynamic asset allocation funds and aggressive hybrid equity funds are good investment options. In our blog this month, we have reviewed DSP Quant Fund a thematic fund which follows a large and midcap investment strategy using a quantitative approach with minimal human intervention. Quant funds are very popular in the West and investment experts feel that these funds will become increasingly popular in India as well.

The 10 year Government Bond yield can be volatile in the coming months due to concerns about inflation and fiscal deficit. India has already crossed its full year fiscal deficit target and there are 4 months left in this financial year. There are concerns about global rating agencies downgrading in our sovereign rating. While we are hoping that our sovereign rating does not get cut, there will be volatility in long duration debt funds, dynamic bond fund and longer term gilt funds(over the last few days, we saw spike in 10 year bond yield and volatility in the longer duration debt fund categories). As far as fixed income is concerned, short duration accrual based debt funds with low credit risk are suitable investment choices for conservative investors with 2 – 3 year investment horizon. For shorter investment tenures, liquid funds, ultra-short duration funds and low duration funds are more suitable options.

We look forward to serving your financial needs with our product offerings to suit your specific short term, medium term and long term financial goals. We in Eastern Financiers always look at the holistic financial well being of our esteemed customers. Every customer has financial needs according to their specific situations and our financial advisors will help you with solutions to your specific needs. In our blog this month, we have also reviewed ICICI Pru Precious Life plan, a term life insurance policy for people with pre-existing medical conditions. We are committed to providing financial solutions according to you and your family’s situation. As always, we assure you of our best services. Please provide us your valuable feedback so that we can further improve our services to serve your financial planning needs.

Happy investing,

Ajoy Agarwal,

(Managing Director)