Dear Investors,

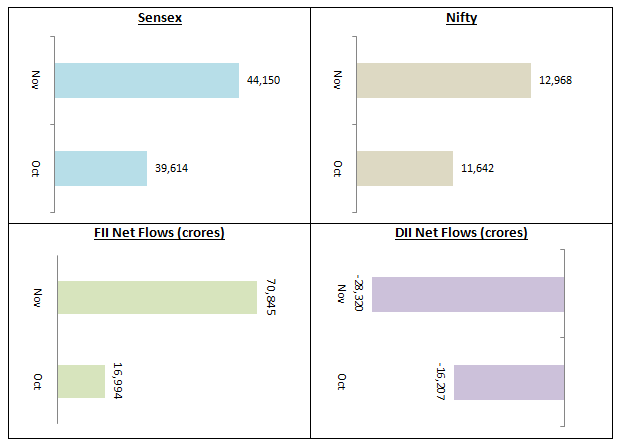

The stock market clocked impressive gains in the month of November 2020 on the back of strong FII buying. The FIIs pumped in net purchase of Rs 70,845 Crores in November resulting in both Nifty and Sensex scaling their all-time highs. Nifty closed the month very close to the psychological 13,000 level, while the Sensex closed the month at 44,150. The market sentiment remains positive and we expect the market to continue its winning streak as we prepare to go into the New Year. There is good news about various COVID-19 vaccine trials. It also seems that the worst of the economic recession is behind us and we can look forward to 2021 with optimism.

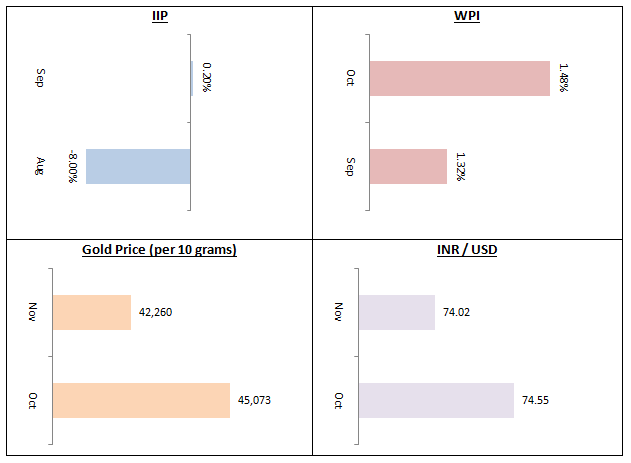

There was good news on the IIP front in October. After months of negative growth, IIP returned to the positive territory in September, an indication of green shoots of recovery. We expect this to translate into better Q3 earnings for companies but we will have to wait till January 2021 to see how corporate earnings are trending. WPI inflation crept up to a 3 month high in October due to rise in food prices, particularly vegetables. The RBI maintained status quo on interest rates in the December monetary policy committee meeting. Gold prices fell by 6% in November.

In my letters over the past 15 months, I have been indicating that gold has been the best performing asset class, but now it seems that after a great 2 year run from the middle of 2018, the Gold rally has moderated. Given the low interest rate scenario, as well as expectation of money printing by the global central banks, our view is that investors can invest in Gold and Silver for hedging their portfolios and also for asset allocation purposes. As you may know that over several decades we have seen gold and equity outperforming each other in different periods – therefore, it makes sense to have position in both the asset classes depending upon your risk taking appetite and investment time horizon.

As far as the broader market is concerned, midcaps and small caps once again outperformed large caps in the month of November. We have seen small / midcaps outperforming large caps several times since the market began recovering from the March bottom. I have mentioned several times in my last few letters that we expect small / midcaps to outperform large caps during the recovery from the bear market bottom. We have seen similar trends in past bear markets also. You can tactically increase your allocations to midcap and small cap funds. If you are investing in midcap and small cap funds through SIP, you can consider increasing your SIP instalments.

We are also suggesting Aditya Birla Sun Life PSU Fund for our investors as we think that high quality PSUs are now available at good valuations.You need to keep your overall asset allocation in mind, when you make investment decisions. Our financial advisors can help you make the right investment decision according to your asset allocation and risk profile.

The yield curve continues to be steep despite RBI’s actions signalling inflationary expectations. Economists around the world expect yield curves of most markets to steepen further. Given the outlook on the yield curve, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Banking and PSU debt funds etc. will be good investment choices for investors with investment horizon of at least 2 – 3 years. If you can remain invested for 3 years or more, you also get benefits of indexation in capital gains tax. Credit quality is of utmost importance especially in the current economic situation. Our financial advisors will help you select high quality debt funds that are suitable for your specific needs.

We are ending the year on a much more positive note than what we had anticipated in the first quarter of this calendar year. I take this opportunity to wish our esteemed customers a very happy and prosperous New Year in advance.

Best Wishes,

Ajoy Agarwal,

(Managing Director)