Dear Investors,

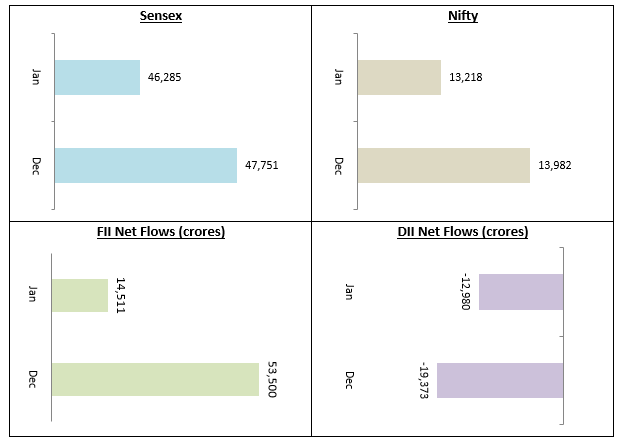

After three months of consecutive gains, the Sensex and Nifty ended January slightly lower on a Month on Month basis. The Sensex closed January 3.1% lower, while Nifty closed the month about 5.5% lower. Some amount of profit booking was expected after the stock market saw record levels by the end of 2020. FIIs continued to remain bullish with net purchase of Rs 14,511 crores. We expect FII flows to continue for the next few months with the US Dollar weakening against other currencies. DIIs continued to be net sellers in this market with net sales of Rs 12,980 Crores.

After two months of positive growth, the Industrial Production (IIP) contracted by 1.9% in November 2020. Many economic experts were not surprised by negative IIP growth numbers in November. The reasons for IIP contraction can be attributed to the base effect and seasonality in demand. The IIP numbers in September and October were a result of pent up demand in the aftermath of COVID-19 lockdowns and also the festive season in India. Some moderation in demand and economic growth was expected.

With roll-out of COVID-19 vaccine and gradual pickup of economic growth in the country, we expect the IIP numbers to stabilize in the current month. After returning to positive growth in September, IIP showed further signs of picking up with 3.6% growth in October. WPI inflation eased to 1.22% in December primarily driven by lower food prices.

Gold prices eased by about 2.3% in January, while the Rupee gained slightly against the dollar. The Union Budget of 2021 was positive for the markets. The market appreciated the Government’s decision to let fiscal deficit to balloon to spur GDP growth.

The Budget also provided a clear roadmap to bring the economy back to the path of fiscal consolidation by 2026. The disinvestments proposed by the Government in this Budget if executed as planned are also expected to bring excitement in the stock market. Please read the Budget highlights.

The broader market outperformed Nifty in January. I have mentioned several times in my last few letters that we expect small / midcaps to outperform large caps during the recovery from the bear market bottom. We expect this trend to continue in the coming months and quarters.

You can tactically increase your allocations to midcap and small cap funds through lump sum or through STP / SIP. You should always have long investment horizons for midcap and small cap funds. You should continue to invest through SIP for long term goals. Our financial advisors can help you make the right investment decision according to your asset allocation and risk profile.

On the fixed income front, the RBI is continuing with its accommodative monetary policy stance in 2021, based on the commentary from the first Monetary Policy Committee meeting this year. Debt funds especially longer duration funds gave good returns in calendar year 2020. However, investors should temper their expectations in 2021. The Government has an aggressive borrowing program for the coming fiscal year to fund its spending on infrastructure and other sectors.

So, one should expect bond yields to firm up. Since longer duration funds can be volatile if yields harden, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Banking and PSU debt funds, high quality short duration funds etc. will be good investment choices for conservative investors with tenures of at least 2 to 3 years. Our financial advisors will help you select high quality debt funds that are suitable for your specific needs.

Conclusion

Overall, our investment outlook on financial markets for 2021 and beyond is favourable. Our financial advisors can help you with all investment and other financial needs. I reiterate my commitment for the highest standards of service. Please provide us your valuable feedback so that we can further improve our services.

Best Wishes,

Ajoy Agarwal,

(Managing Director)