Dear Investors,

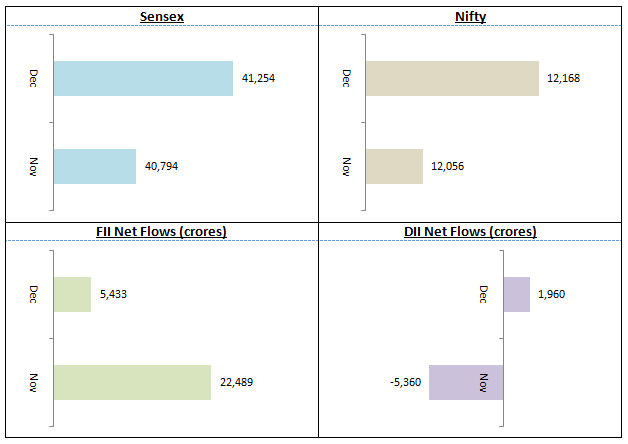

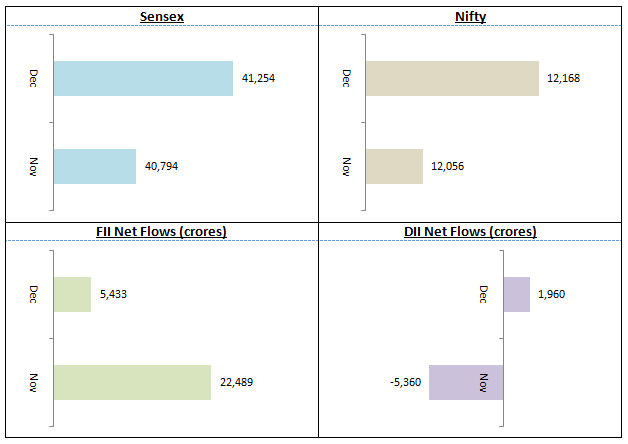

India’s leading stock market benchmark index Nifty closed 2019 at 12,168 giving 12% annual return. While the leading indices closed the year on a good note, the market was very volatile during the year. The market recovered in the last 3 – 4 months and is now at its all time high. Sensex closed the year at around 41,254. There were several important events throughout the year, the most important being the Lok Sabha elections which returned BJP led NDA to power in the Central Government with a thumping majority.

While the Government continues to enjoy considerable popularity among the people, 2019 saw the Indian economy slowing down considerably. The Reserve Bank of India (RBI) in its December 5 monetary policy committee (MPC) meeting cut the FY 2019 – 20 GDP growth forecast sharply to 5% (versus 6.1% in the previous MPC meeting in October). This is the slowest rate of GDP growth in India since 2013. Corporate earnings were a mixed bag in the first two quarters of the financial year. We saw some earnings growth recovery in Q2, but it was driven largely by the Corporate Tax by the Government rather than top-line growth.

Despite slowing economy the Government enjoys the confidence of the market including foreign investors. FIIs continued to be net buyers in the month of December (Rs 5,433 crores net). Though FII volumes were lower in December, it was expected because of the holiday season in the West. After turning net seller in November, DIIs again turned buyers in December (Rs 1,960 crore net). Overall for 2019, FIIs made net purchases to the tune of Rs 88,175 crores; DIIs made net purchases of Rs 49,100 crores.

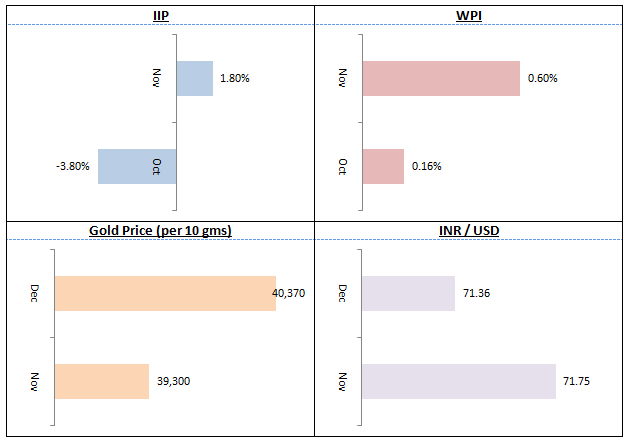

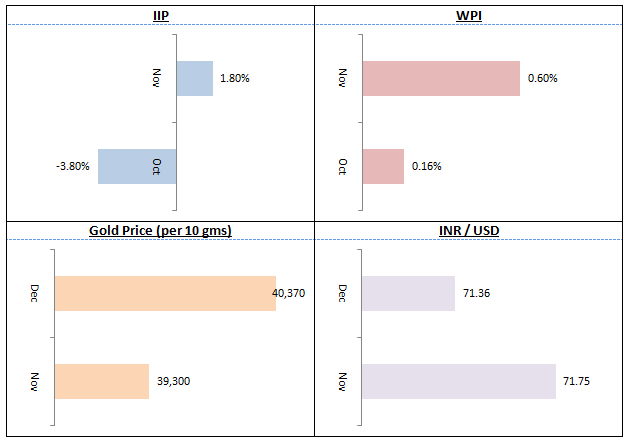

Index of Industrial Production (IIP), an indicator of industrial / manufacturing activity grew 1.8% in November after three consecutive monthly contractions. It is too early to say, whether the November IIP numbers indicate green shoots of recovery. As mentioned earlier, the market is awaiting the Budget and not reading much in the economic data. WPI inflation,which came in at 0.16% in October, crept up to 0.6% in November. CPI data indicates a worrying trend as food inflation (particularly vegetable prices) is appearing to be quite sticky. Onion is not the only culprit - recent data shows that food inflation is spreading across a larger basket of items including other vegetables, pulses and even cereals (e.g. wheat, rice etc). Inflationary concerns will limit RBI’s ability to reduce interest rates for spurring economic growth.

Gold, which was the best performing asset class in 2019 (25% return), resumed its upward trend (growing almost 3%) after remaining almost flat in November. Since gold has run up significantly we expect upside to be limited in the immediate term, but we expect Gold to remain strong due to concerns about the economy. On the global front, US economic data continues to be strong. We also saw easing off in US / China trade war and tensions not escalating beyond a certain point in the Persian Gulf region despite US airstrike against a senior Iranian general. If global risk factors continue to remain stable, it will be good for Indian economy and stock market. The Rupee strengthened slightly against the dollar in December, but the INR / USD outlook continues to remain weak due to macro factors. For the same reason, we think Gold may continue to outperform in the near term.

The most important event which the market is anxiously waiting for is the Budget, which will be tabled in the Parliament in a few days. The Government has a very challenging job in its hand balancing economic growth concerns and fiscal deficit. Creeping retail inflation, particularly food prices over the last 2 months is likely to be another source of concern for the Government and RBI. There are no easy solutions for the Government and we think that the Government will have to take some tough measures in the Budget to revive economic growth. Also recovery in FY 2021 is likely to slower than expected with World Bank cutting India’s GDP growth forecast for FY 2020-21 and FY 2020–22. We advise investors to have reasonable expectations for equity in 2020, with focus on disciplined investing (SIP), asset allocation and sufficiently long investment horizons.

With Nifty at its all time high and corporate revenue growth outlook remaining weak, large cap valuations look a bit stretched. As such we expect limited upside in large caps in the near term. The broader market remained weak throughout 2019, with midcaps ending almost flat and small caps ending the year lower. However, both midcap and small caps seem to have bottomed out and are now consolidating. The deep price corrections in midcaps and small caps over the last 2 years seem to have created attractive investment opportunities. In our blog this month, we will discuss in more details why this may be a good time to invest in midcap funds.

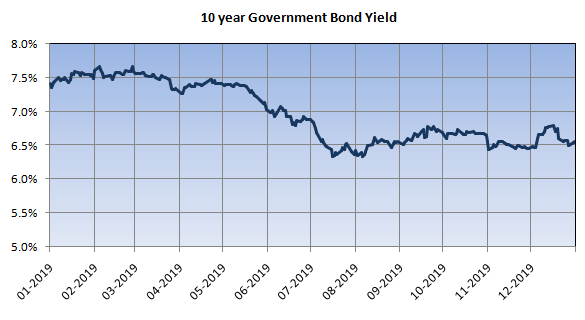

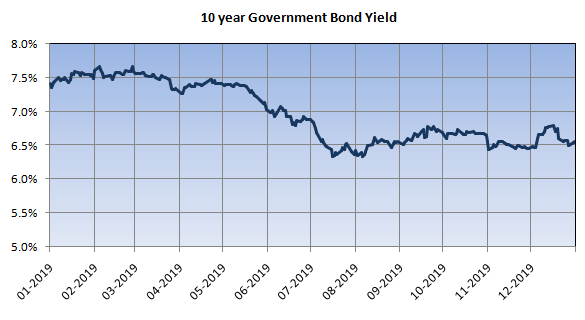

Medium to long duration, long duration and dynamic bond funds were the stand out performers over the past 12 months with G-Sec yields falling by around 100 basis points. But yield seems to have bottomed out over the last 3 - 4 months due to concerns about fiscal deficit (after corporate tax cut) - India has already crossed its full year fiscal deficit target. There are also concerns about inflation. The Budget will give some definite direction to the bond market, but due to the macro risk factors, we suggest a cautious approach for conservative debt fund investors. Accrual based debt funds like short duration funds, banking and PSU funds, low duration and ultra-short duration funds suitable investment choices for conservative investors with 2 – 3 year investment horizon. For shorter investment tenures, liquid funds, ultra-short duration funds and low duration funds are more suitable options.

Though I write mostly about capital market and investing in my monthly e-mail, I and my team feel that life and health insurance are very important financial needs and should be addressed with highest priority as far as financial planning is concerned. Accordingly, we cover an insurance product which may be suitable for your specific needs in every month newsletter. In our blog this month, we have reviewed One Health insurance plan, a comprehensive one-stop health insurance policy from Magma covering a wide range of health-care needs. We in Eastern Financiers always look at the holistic financial well being of our esteemed customers. Our insurance advisors are always on the standby to help you with your life and general insurance needs with the best solution suited for your specific needs.

We wish all our esteemed customers a very happy, healthy and prosperous 2020. We look forward to continue our association in this New Year and beyond, serving your diverse financial needs with our range of product offerings to suit your specific needs. While we strive to provide best services, we are committed to improving our services on an ongoing basis and seek your valuable feedback in this regard.

Happy investing,

Ajoy Agarwal,

(Managing Director)