Dear Investors,

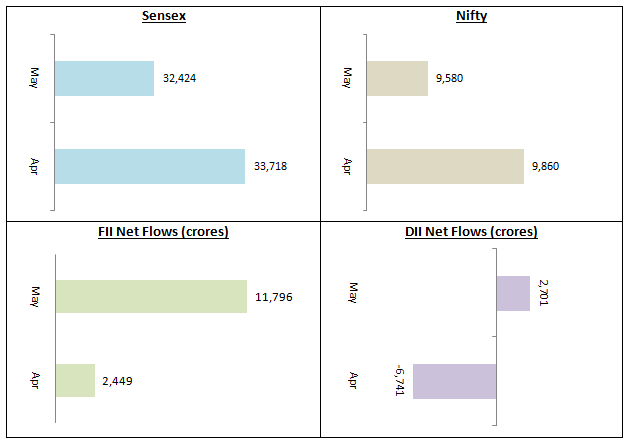

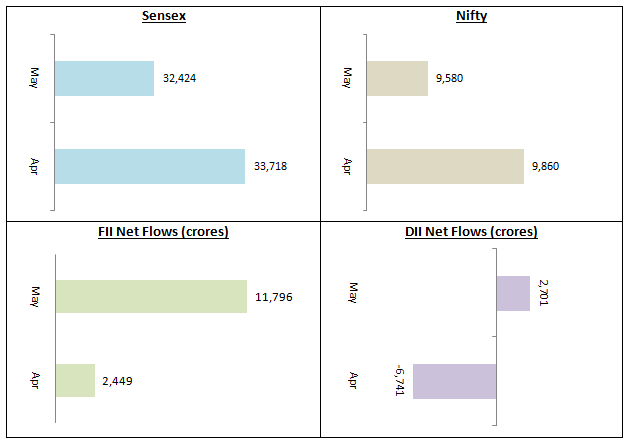

On 23rd March PM Narendra Modi announced a nationwide lockdown to slow down the spread of COVID-19 pandemic in India. The lockdown continued till the end of May, though easing of certain restrictions in the non-containment zones were allowed from 17th May onwards. Since the most major economic centres in the country are part of containment zones, economic activity continued to be severely curtailed even in the month of May. To provide growth stimulus to the economy the PM announced an overall financial package of Rs 20 lakh crores which included the spending in relief package announced by the Finance Minister in April and also measures taken by the RBI. The Sensex and Nifty remained choppy but range-bound in May ending the month slightly lower (3 – 4%) compared to April.

After several bearish months, FII buying activity rebounded in the month of May, reflecting global, especially US market trends. DIIs were net sellers in April but turned buyers again in May. Nifty price movement in April and May seem to indicate that the market is finding some kind of support at the 8,800 levels, but as mentioned in my last month’s letter, it will be premature to conclude that the bear market is nearing its end. India’s GDP growth slowed down sharply in Q3 FY 2020, when we had just 7 days of lockdown. Our Q1 FY 2021 GDP is expected to contract considerably and we are likely to see contraction even on a full year basis. The Government has allowed gradual re-opening of the economy from 1st June but the pace of economic recovery will depend on a variety of factors, the most important factor being the gradual flattening of infections curve and also how Government / RBI measures lead to demand recovery.

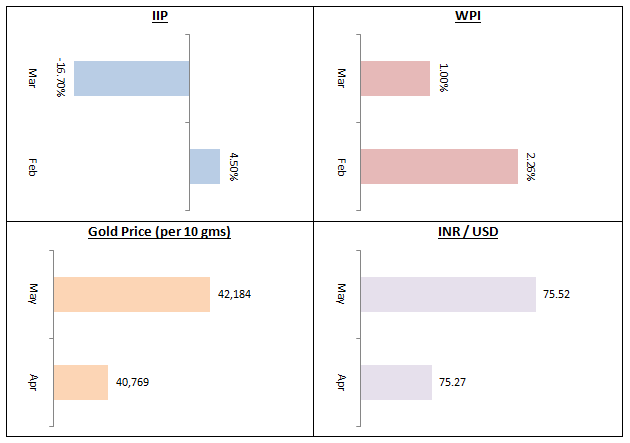

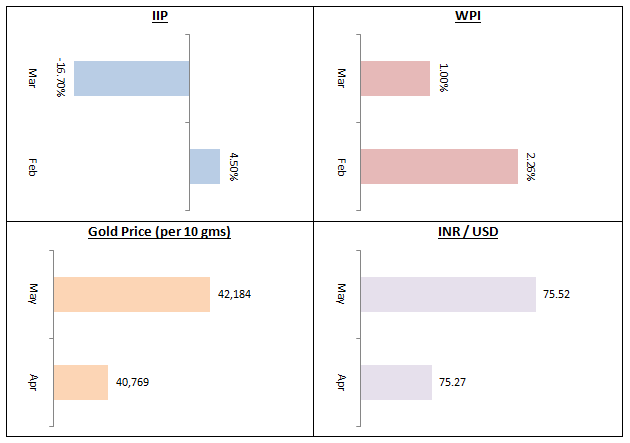

We expect the market to remain range-bound with an upward bias in June. Q1 corporate earnings to be declared in July and global cues will provide further direction to the market in the second quarter of this fiscal. Wholesale Price Index (WPI) inflation eased further in March to 1% aided by low crude prices. Easing inflation provided Reserve Bank of India (RBI) with ammunition to considerably ease monetary policy in April and May to provide more liquidity in the banking system to improve the credit environment in the economy. The RBI has reduced repo rate by 115 basis points since the beginning of COVID-19 outbreak, including a 40 bps rate cut in last monetary policy review in May. Even though repo rates are at historic low, the RBI Governor has hinted at further rate cuts if inflation eases.

Index of Industrial Production reversed its positive trend from January and February, contracting by 16.7% in March. The contraction in IIP was expected because many companies were working with reduced staffing even before the lockdown was announced on 23rd March. April IIP figures are likely to be even worse as industrial activity came to a virtual standstill due to the lockdown. Gold rallied 6% in April and rose another 3.5% in May to close at Rs 41,184 / 10 grams in line with short term outlook on Gold. Our outlook on Gold will remain positive, till we seen strong signs of recovery in the equity markets. We expect Gold to continue perform well over the next 2 – 3 months. Rupee closed lower by 30 bps to US Dollar in on a month on month basis in May, largely in line with expectations.

As mentioned in my last few letters to you, though we expect choppiness in the market, we think this is a good time for investors to tactically (lump sum) invest in equity funds at every major dips. Investors are also advised to continue their SIPs in large cap and large oriented diversified funds (e.g. large and midcap funds, multi-cap funds etc). Though midcaps and small caps have fallen more than large cap over the last over the last 30 months, they may take longer to recover compared to large caps. It is advisable to invest in midcap / small cap funds through the SIP / STP route. If you are investing in midcap or small cap funds through SIP, you may consider increasing your instalment amounts, since mid / small caps are trading at attractive valuations. However, you must have a long investment horizon for midcap and small cap funds.

You may like to read – Why should you invest in equity mutual funds now

With RBI aggressively reducing interest rates and reiterating its accommodative policy stance to support the economy, longer duration debt funds like gilt funds, dynamic bond funds and other longer duration funds can give good returns over a sufficiently long investment horizon. However, these funds may show volatility because India’s sovereign rating has been downgraded, which may have an effect on yields. However over a sufficiently long investment, we expect yields to come down, interim volatility notwithstanding. As such longer duration funds can give good returns in the long term but you should have investment tenures of at least 3 years. Historically, longer duration funds have outperformed when equities have underperformed in bear markets. Also, you can avail of long term capital gains tax advantage of debt funds over 3 years plus tenures.

Suggested reading: Are Debt Mutual Funds safe: Good funds to invest now

You can also have a look at Arbitrage Funds with a minimum investment horizon of 3 – 6 months. Read our latest article to know more about Arbitrage Funds.

If you have low risk appetite or want to invest for shorter durations (1 to 3 years), then accrual based debt funds like ultra short duration funds, money market funds, low duration funds and short duration funds of high credit quality, corporate bond funds (which invest primarily in highly rated papers), banking and PSU funds (which inherently have good credit quality) etc, are suitable investment choices. As mentioned in several of my previous letters to investors, credit risk is something that investors should watch out for.

The month of April was distressful for many debt fund investors, particularly those who had invested in certain schemes which were shutdown (redemptions not allowed). I had mentioned in my last monthly letter to you that the steps taken by RBI will take care of investor concerns about liquidity of their investments. I am happy to tell you that the AMFI has reported normalcy coming back to debt funds in the month of May. AMFI reported on 1st June that inflows into debt funds in the month of May have doubled compared to that in April.

Our financial advisorsare on the standby to serve your financial needs in these difficult times. As mentioned, best wealth creation opportunities are often found in bear markets as history has shown us on so many occasions. These difficult times for our society as a whole,serves also as a reminder about the importance taking care of our critical financial priorities like our life and health insurance. Please do not hesitate to contact your financial advisor if you need any assistance. As always, we assure you of our best services.

Stay safe,

Ajoy Agarwal,

(Managing Director)