Dear Investors,

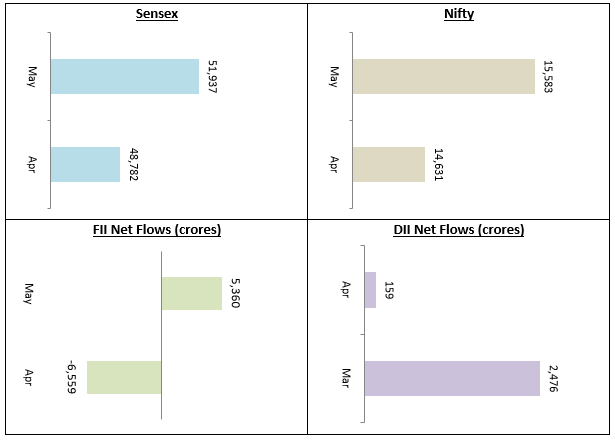

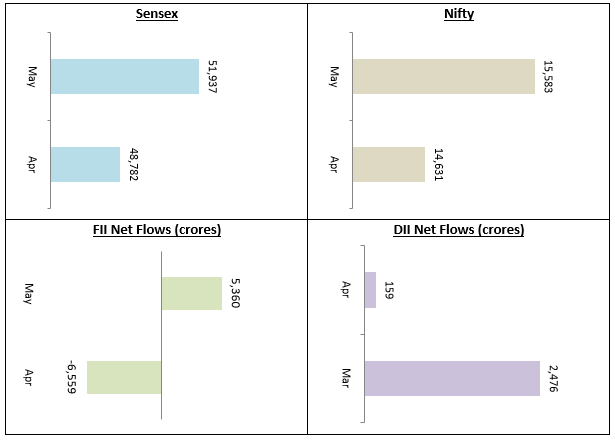

The stock market closed the month of May in the positive territory despite grim news on the COVID front. Both the Sensex and Nifty gained 6.5% and closed the month above the psychologically important 50,000 and 15,000 levels respectively. The performance of the stock market may indicate disconnect between Dalal Street and the real economy since almost the entire country was under lockdown in May, but the performance of market indicates that the market has discounted the bad news and is now looking ahead. By end of May there was strong evidence that the second wave of COVID had peaked and the number of daily cases also started declining steadily.

FIIs, who had turned net sellers in April, became net buyers in May indicating risk-on in the market. At the time of writing the letter, we are pleased to note that the number of cases and fatalities have declined sharply across the country. The vaccination drive which slowed down in May has again started picking up. Several states have announced easing of restrictions and we expect a gradual return to normalcy in the coming weeks. Q1 corporate earnings are due in the month of July and it will provide direction to the market over the next 3 – 4 months.

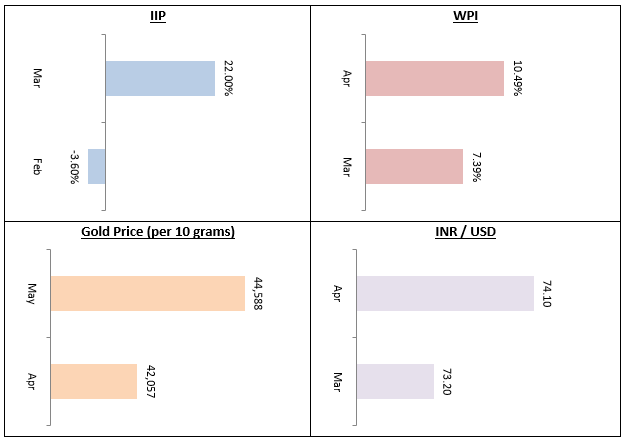

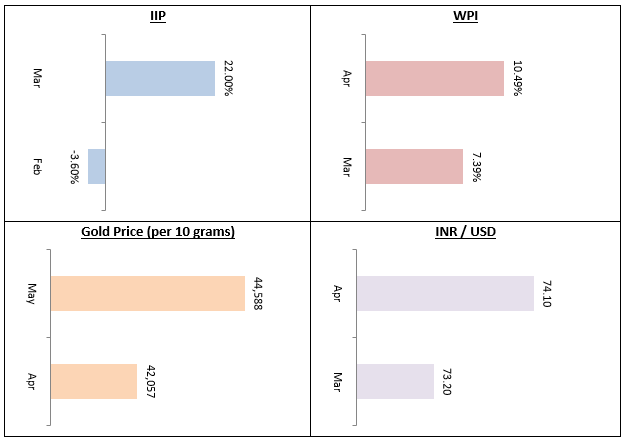

The Index of Industrial Production (IIP) jumped by 22% in March, after contracting 3.6% in January. But not much should be read in these numbers because it is primarily due to low base effect. The first wave of COVID began last March and the Prime Minister announced lockdown in the last week of March. The WPI inflation crept up further to 10.49% in April. The RBI has held the repo rate flat in its last Monetary Policy Committee (MPC) meeting but further rate cuts are unlikely in the near term due to inflation and global factors.

Gold strengthened further by about 6%, closing over Rs 44,500 / per 10 grams. Gold, as an asset class, is usually counter-cyclical. As economic growth picks up after lockdowns are relaxed or lifted, we expect Gold to peak. However, Gold is a very useful asset class for asset allocation and hedging equity risks. The risk of third COVID wave is undeniable. Most epidemiologists believe that the third wave may not be as severe as the second wave if the Government is able to vaccinate large number of people before the onset of the third wave. But the role of Gold in asset allocation may come into play once again if equity markets turn volatile for whatever reasons. On the currency front, the Indian Rupee (INR) gained about 2% against the US Dollar (USD) in May signalling confidence in the economy.

As mentioned earlier, the second COVID wave has peaked and the numbers (of cases and fatalities) have come down sharply over the past few weeks. Though large parts of the country are still in some form of lockdown, we expect restrictions to be gradually lifted in the coming weeks. Not much can be read from the Q1 results since most of the country was under lockdown for the major part of Q1. But management's guidance on future earnings will be important and will set the tone for the market. We are bullish on equities from a medium to long term investment perspective. We recommend that investors should continue to invest in equity funds through the SIP route for their long term financial goals.

The 10 year G-Sec yields eased in May after creeping up in March and April. However, despite RBI's efforts to manage the Government bond yields, there is considerable uncertainty in the current economic situation. In the current interest rate and credit environment, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Banking and PSU debt funds etc will be good investment choices for conservative investors with tenures of at least 3 years. Over 3 years plus investment tenures, you can enjoy indexation benefits in debt fund taxation. For shorter investment tenures, ultra-short duration funds, money market funds and low duration funds etc may be a god choice depending on your investment needs.

Conclusion

The previous two months have been very difficult times for our country, for individuals and their families. Thankfully the situation has improved now. There may be more pain in the future e.g. third COVID wave, bad news on the economic front, volatility in the market etc, but you should stick to the fundamentals of investing i.e. remain disciplined, invest for the long term and focus on asset allocation. Our financial advisors can help you with your different investment needs. We are committed to the highest standards of customer service. I will welcome any suggestion that can help us serve you better.

Best Wishes,

Ajoy Agarwal,

(Managing Director)