Dear Investors,

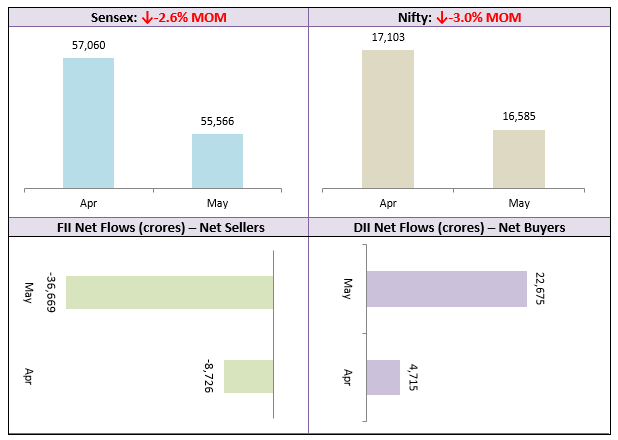

Equity market remained volatile in May 2022 due to inflation concerns and the trajectory of interest rates. In its monetary policy meeting, the RBI hiked repo rate by 40 bps and the RBI Governor has indicated that more rate hikes are on their way. FII selling continued due to rising US dollar and bond yields, leading to Nifty breaching the 16,000 level. Nifty and Sensex closed the month 2.5 – 3% down to its March close. The broader market underperformed the headline indices with Nifty 500 closing the month nearly 5% down. The market consolidated towards the end of the month, with Nifty closing above the 16,500 level.

In the primary market, the LIC IPO was supposed to be the biggest event of the year. The IPO was oversubscribed by nearly 3 times. Investors who may have subscribed to the IPO hoping for listing gains would have been disappointed as LIC listing was at 8% discount to the IPO price. Nevertheless, the LIC IPO was a success given the huge interest shown by investors. We do not think that the lacklustre listing of LIC will dampen the spirits in the IPO market.

A lot of the bad news e.g. inflation, slower GDP growth etc., has already been priced in by the market. The market will now take cues from the actions of the US Fed in the near term. We expect market to remain volatile. We see support coming in for Nifty around the 16,000 level and some profit booking around the 16,500 – 16,600 levels. Nifty may remain range bound till we get to the next Fed meeting scheduled in the middle of June. Investors should continue their SIPs and tactically add equity to your asset allocation at lower levels.

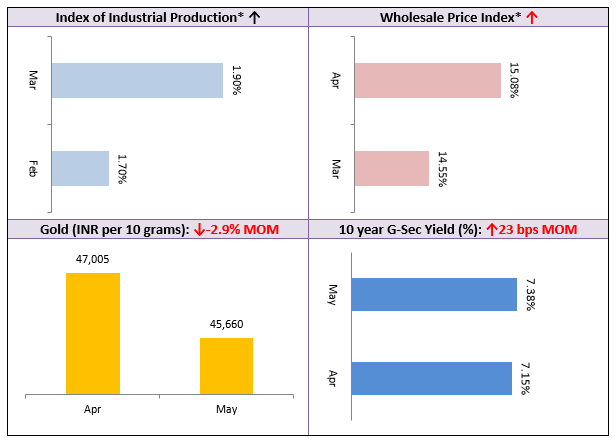

Bond yields have been rising for a few months now. The 10 years Government Bond yield rose by another 23 bps in May. The 10 years bond yield is now around 7.4% and we expect bond yields to rise further. In such interest rate environment, longer duration funds are likely to underperform. As far as the shorter end of the yield curve is concerned, the 91 days T-Bill yield rose by 93 bps in May. In this interest rate scenario, shorter duration funds can give higher returns because they can re-invest the proceeds from the maturing securities in higher yields. Liquid and ultra-short duration funds can be suitable investment options for up to 12 month tenures. For fixed income investments over long tenures company FDs of high credit quality can be good investment options.

My team will be committed to working on identifying the best investment solutions for your specific needs, keeping current market conditions in mind.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!