Dear Investors,

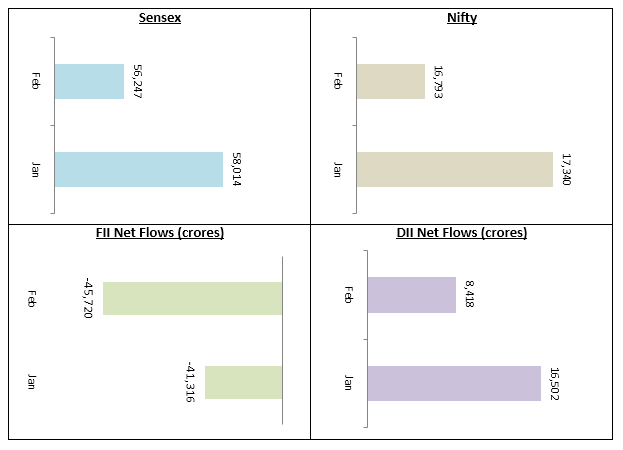

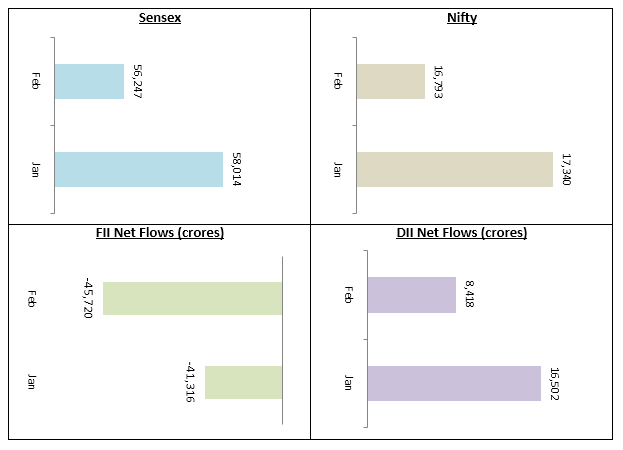

February 2022 was a volatile month for equity markets around the world. After weeks of simmering tension between Russia and Ukraine, the Russian President Vladimir Putin, ordered his armed forces to invade Ukraine on 24th February 2022. Stock markets crashed after the invasion. Both Sensex and Nifty closed February 3% down month on month. FII selling continued relentlessly in February; the month saw Rs 45,720 crores of net outflows. As far as the broader market is concerned, midcaps saw deeper cuts compared to large caps.

The United States and European countries have announced economic sanctions on Russia, a major producer and exporter of crude oil and natural gas. The economic sanctions on Russia, limiting its crude exports has sent crude prices sky-rocketing. The Brent crude oil spot price crossed $100 a barrel in February and is now above its 9 year high.

The Chairman of US Federal Reserve Jerome Powell has indicated a 25 bps interest rate hike. This will have an impact on emerging markets, including India. The surge in crude oil prices will have a severe effect on Indian markets, since our economy is already reeling under high inflation. The Nifty has already fallen 10% off its all time high and deeper corrections cannot be ruled out in the coming days and weeks. The Government will review the timing of LIC IPO, which was earlier expected in this month. We expect to volatility to continue in the near term and advise caution to our investors.

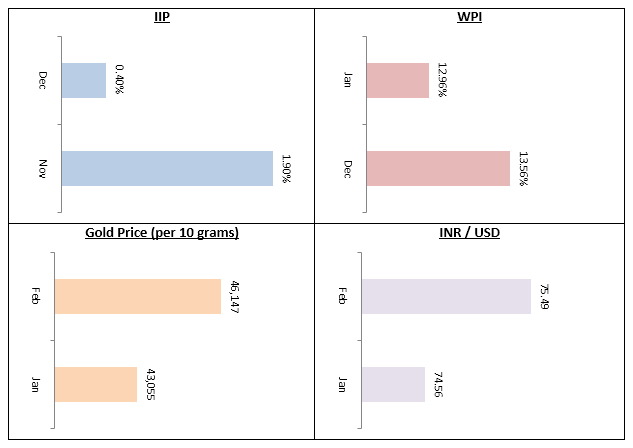

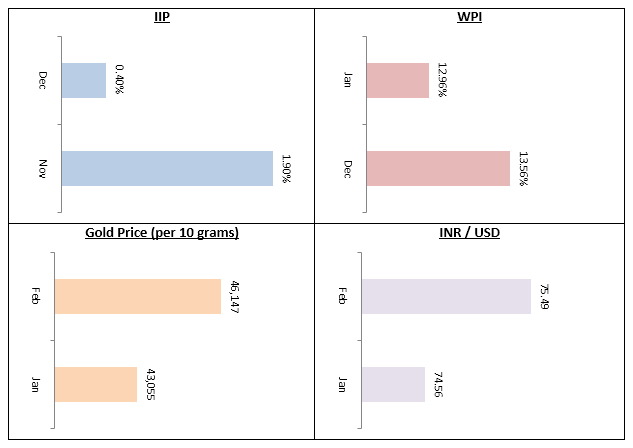

The Index of Industrial Production (IIP) slipped to 0.4% in the month of December. In my previous letter, I had mentioned that India will have a gradual economic recovery in the Post COVID scenario. WPI inflation cooled off somewhat to 12.96%, but is expected to spike again due to the surge in crude prices. Inflation is a major risk for equity market in India now.

The RBI Governor has so far kept the repo rate unchanged, but global events may force RBI to hike interest rates in India. Risk sentiments are not very favourable for equity at this moment. Gold prices surged by 7% in February. We may see Gold rising further, if geo-political uncertainty continues. We have stressed a number of times that asset allocation is very important, when the market outlook is uncertain. You should review your asset allocation with your Eastern Financier’s financial advisor and discuss if some rebalancing is required. However, you should never sell in panic. You should also continue your SIPs; SIPs in volatile markets work to your advantage due to Rupee Cost Averaging of purchase prices.

Bond yields have been rising since the Finance Minister presented the Union Budget 2022 in the Parliament. Russian invasion of Ukraine have taken the 10 year yield to its monthly high. We expect bond yields to rise further due to high commodity prices and rate actions of the US Fed. In these conditions, short duration accrual based debt funds of high credit quality may be a good investment option. You can see NAV volatility even in short duration funds and should have minimum 2 to 3 years investment tenures. If you have shorter tenures, then you should invest in ultra-short duration or low duration funds.

Conclusion

The world is facing an unprecedented crisis, just as we were on the recovery path from the COVID-19 pandemic. If you have children or relatives who are still in Ukraine, we pray for their safety and / or safe return to home. Let us hope that we have a peaceful resolution of this crisis. We expect the market to bounce-back if some kind of resolution is reached; the Government’s economic policy will provide tailwind to equities, when the market recovery takes place. So there is no reason to panic. We also want to remind our investors that 31st March is the last date for making tax saving investments for this financial year. Please contact your Eastern Financier’s financial advisor, if you have not done your tax planning.

Most families will be celebrating the auspicious festival of Holi on the 19th of this month. On behalf of my team, I wish our esteemed investors and their families a very happy Holi in advance.

Best Wishes,

Ajoy Agarwal,

(Managing Director)