Dear Investors,

Global equities declined in February after rallying in January. Hawkish statement by the US Federal Reserve weighed heavy on the markets. Though the Fed reduced its rate hike by 25 bps from 75 bps to 50 bps, Fed’s statement, “Inflation has eased somewhat but remains elevated” was interpreted by the market as Fed’s intent of keeping interest rates high, longer than the market has been anticipating. Strong labour market data from the US increased the odds of Fed continuing to hike interest rates. Emerging market equities underperformed as the US Dollar continues to strengthen.

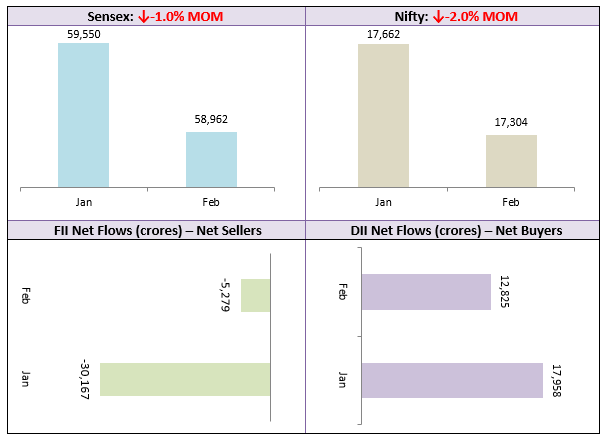

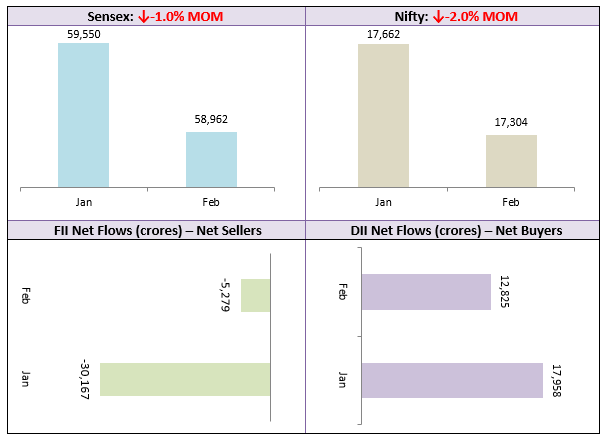

The Adani saga continued to weigh heavy on the equity market in India. Adani stocks saw further corrections in February and it also dragged down banking sector stocks. The Sensex closed February down nearly 600 points month on month (1% down), while the Nifty was down more than 360 points (2% down). The broader market remained weak, underperforming Nifty. FIIs continued to sell in February primarily due to global market outlook, though the Adani saga may also have played its role.

We think that the market is now looking to move ahead from the Adani woes and will attempt a bounce back in March. The bear grip on Adani stocks, especially Adani Enterprises and Adani Ports is also weakening, as both these stocks look to have bottomed out for the time being. Over the next couple of months, the market will be looking for global cues especially from the US market. Overall, we think that the market will remain volatile but range bound.

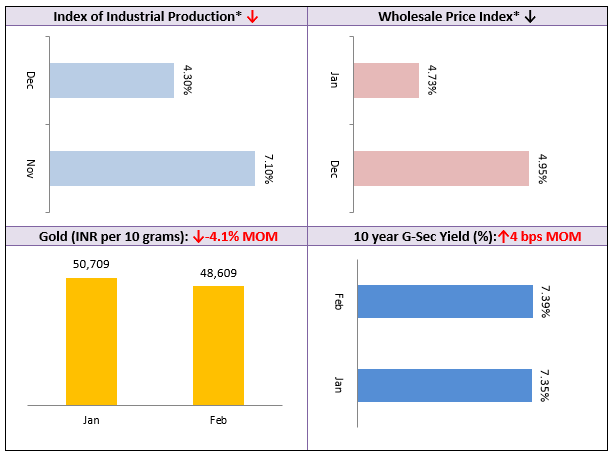

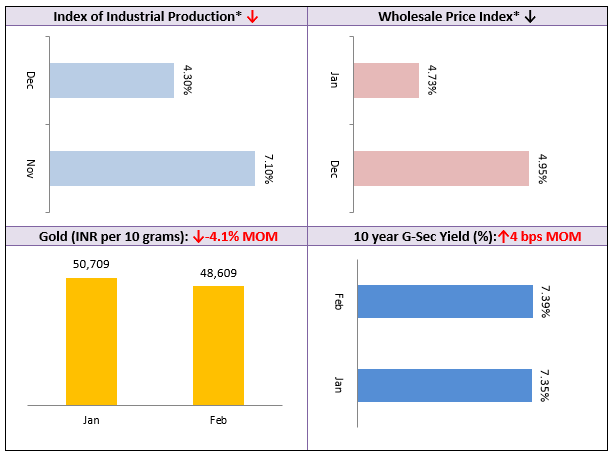

The tone of Reserve Bank of India’s monetary policy committee meeting in February was hawkish, but the bond market seems to believe that we are coming to an end to the rate tightening cycle in India. The 10 years bond yield crept up by just 4 bps in February. Since long term yields are attractive, investors can take advantage of higher yields by investing in target maturity funds or dynamic bond funds. Short term yields have hardened more than long term yields in the last one month. So investors with shorter investment horizon (1 to 2 year) can take advantage of these high yields by investing in money market, low duration and short duration funds. The average yields of these funds are in the range of 7.2 – 7.3%.

As we approach the end of this financial year, we would like to remind investors to complete their tax planning for the year sooner than later. We look forward to serving all your investment and other financial needs to the best of our abilities.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!