Dear Investors,

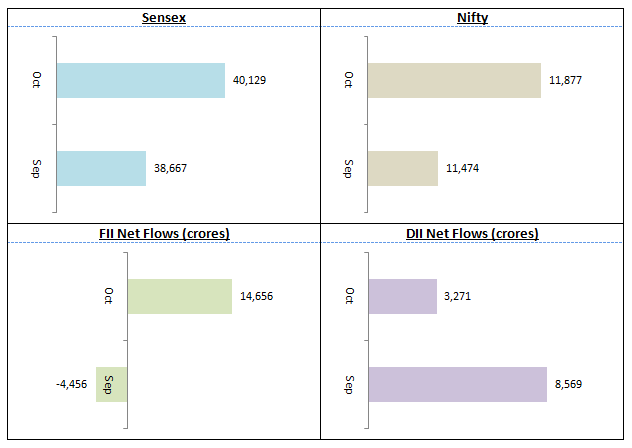

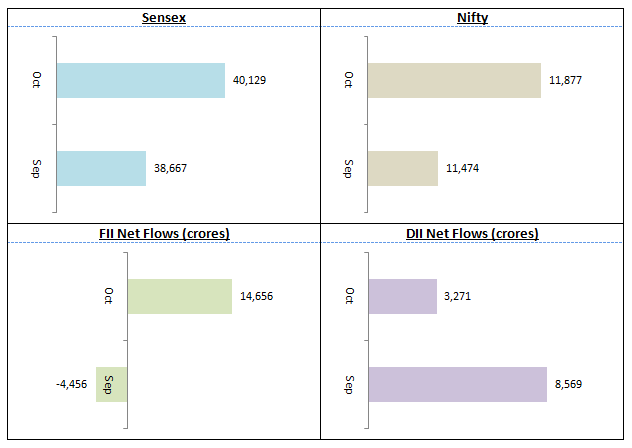

Nifty continued its winning streak in October 2019 gaining around 400 points. The Sensex closed the month at 40,129 very near its all time high. After 3 months, FIIs turned net buyers in the month of October. The market trend in October confirmed the change in sentiments after the policy announcements by the Government in September. However 12,000 on the Nifty, for the time being, looks like a stiff resistance level since we saw a considerable amount of profit booking near the 12,000 level. Slowing economic growth concerns prompted the Reserve Bank of India to cut the policy interest rate by 25 basis points in its monetary policy committee meeting in October. The RBI in its last Monetary Policy Committee meeting cut the GDP growth forecast of FY 2019 – 20 to 6.1% from 6.9%.

We are in the middle of the Q2 corporate earnings season and so far it has been a mixed with some revenue slippage. We think that the large cap market is likely to remain range-bound on the upside unless we see clear signs of earnings growth revival. However, mutual fund activity in October indicates good investment opportunities in the broader market, especially in the midcap segment. Midcaps (as represented by Nifty Midcap 100) after a fairly long time outperformed large cap, gaining around 5% in October compared to Nifty’s 3.5% gain. Small caps continued to be laggards. With midcaps trading at a healthy discount to Nifty we think that investors who are underweight on midcaps in their investment portfolio can look to tactically increase their allocations in midcap mutual funds with a sufficiently long investment horizon or invest in midcap funds through SIP. Multi-cap funds which invest across market cap segments are also good investment options.

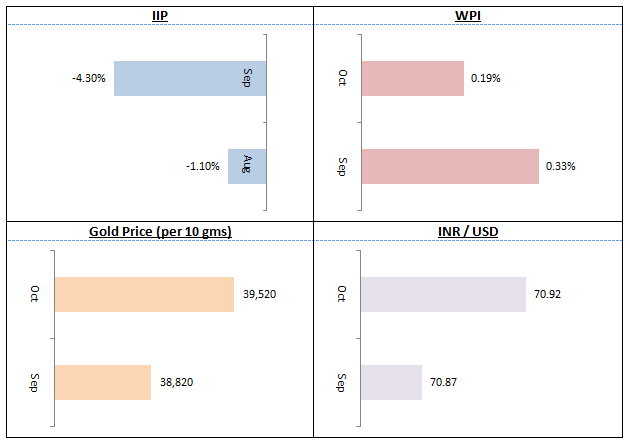

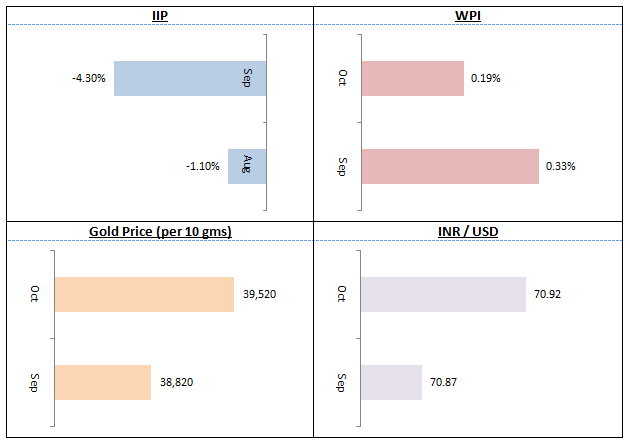

Index of Industrial Production (IIP), an indicator of industrial / manufacturing activity, contracted 4.3% in September, the second consecutive monthly fall, after 1.1% decline in August, further reinforcing concerns of economic slowdown. Recently released monthly sales figures showed that the recently concluded festive season was not able to bring much cheer to the dampened consumer demand. We expect IIP to remain weak in October as well. WPI Inflation,which fell to 0.33% in September, came in at 0.19% in October. However, there are inflationary concerns in the recent week with rising vegetable prices. We will have to wait till the next monetary policy meeting to understand RBI’s stance of inflation.

Gold has been the best performing asset in the last 1 year, with gold index funds giving more than 20% returns. Gold resumed its multi month winning run in October after falling slightly in September. We in Eastern Financiers, think that Gold is one of the best hedges against equity risk, and we recommend our investors to look at gold index fund / ETF investments from an asset allocation perspective. With equity market sentiments reviving and Gold having run up considerably, upside in the near term may be limited though we expect Gold price to strengthen further in the next few months since the Indian Rupee continues to remain weak versus the US Dollar.

I have stressed on the importance of credit risk as a real concern in fixed income investments, a number of times in my last few monthly commentaries. In normal markets, higher interest accruals or returns arising out of higher credit risk was not considered by investors as major risk as issuers were able to raise money to pay off their debt obligations. However, with banks saddled with NPAs refusing to lend now, there is a serious liquidity crisis and defaults are on the rise. Bloomberg reported a record $1.1 billion of default by Indian companies so far in 2019. Even liquid funds, which were traditionally thought to be very safe investments, have not been spared in the current credit risk environment. We in Eastern Financiers, think that interest rate risk is temporary but credit risk is permanent. We do not want our valued customers to lose their hard earned money due to credit risk. As such, we think that Arbitrage Funds are good short term alternative investment options. This month we have reviewed IDFC Arbitrage Fund which you can go through.

Longer duration debt funds like Gilt funds, long duration funds, dynamic bond funds and medium to long duration funds have delivered strong returns in the last 12 months and can continue giving good returns due to RBI’s accommodative interest rate policy stance. At the same time, there are concerns about fiscal deficit after the Government reduced the corporate tax rate. Though 10 year Government bond yields came down in October after spiking a bit in September, you should have appetite for moderate risk and sufficiently long investment tenures (at least 3 years) if you want to invest in longer duration debt funds. For investors who prefer stable returns, we recommend accrual based debt funds like low duration funds, short duration funds etc with high credit quality. Our financial advisors can help you select the right debt funds suited for your risk appetite and specific your investment needs.

We look forward to serving your financial needs with our product offerings to suit your specific short term, medium term and long term financial goals. As always, we assure you of our best services. Please provide us your valuable feedback so that we can further improve our services to serve your financial planning needs.

Happy investing,

Ajoy Agarwal,

(Managing Director)