Dear Investors,

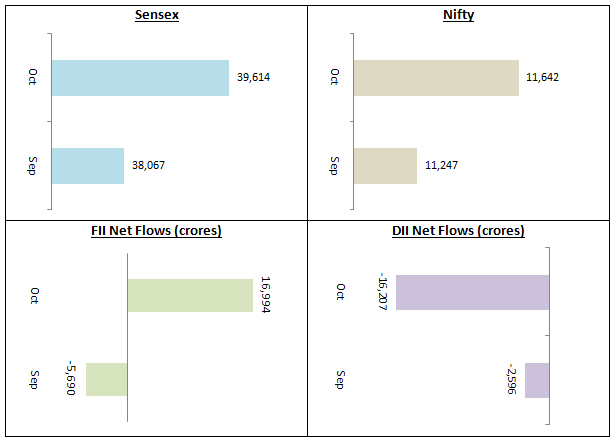

In the run up to the US Presidential elections, the stock market was volatile but ended the month with 3.5 – 4% gains for Nifty and Sensex. Nifty closed the month at nearly 400 points higher at 11,642,while Sensex closed the month at 39,614. After being net sellers in September 2020 FIIs again turned net buyers to the tune of nearly Rs 17,000 Crores in the month of October. DIIs continued to be net sellers in October. In its monetary policy meeting in October the RBI kept the repo rate unchanged and expects the economy to contract by 9.5% in this fiscal year.

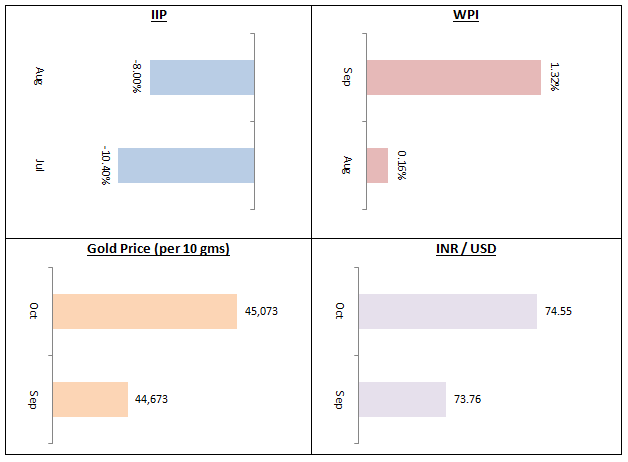

We do not have the new IIP and WPI numbers at the time of sending this newsletter, but we do not expect a significant improvement in the IIP figures in September. WPI may have crept up a little in October as evidenced by the rise in food prices, particularly vegetables. Gold prices firmed up by about 1% in October, while the Rupee depreciated by 1.1% against the US Dollar. Despite slow economic recovery, we expect equities to do well because markets are forward looking and the gloomy economic outlook for this fiscal seems to have been discounted in stock prices. Midcaps and small caps took a breather in October after outperforming large caps over the past few months. As mentioned in my previous letter, you can allocate a portion of your equity portfolio to midcap funds and small cap funds, keeping in mind your overall asset allocation.

Overall, even though the general trend of the market will be upwards, we expect to see choppiness in the market in the coming months with some profit booking at higher levels. Investors should have long investment horizons for equity funds.

Debt funds saw record inflows in the month of October. Given the expected shift in the yield curve as indicated in the minutes of meeting of RBI’s monetary policy committee, accrual based high credit quality funds of short to medium duration profiles, e.g. corporate bond funds, Short term debt funds, Banking and PSU debt funds etc. will be good investment choices for investors with investment horizon of at least 2 – 3 years. If you can remain invested for 3 years or more, you can also get benefits of indexation. Credit quality of debt funds is of utmost importance especially in the current economic situation. Our financial advisors will help you select high quality debt funds that are suitable for your specific needs.

Wishingour esteemed customers very happy and auspicious Deepawali.

Happy investing,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!