Dear Investors,

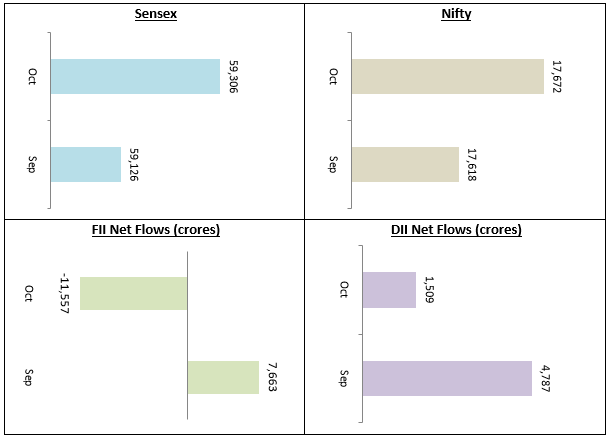

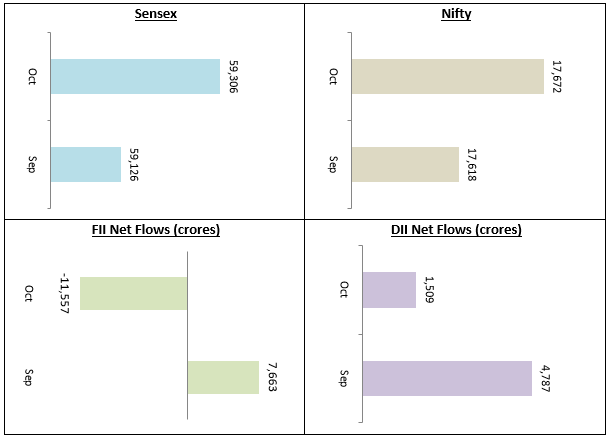

The stock market was volatile in October 2021 primarily due to developments in the US. US President Joe Biden’s plan of passing $1.75 trillion spending bill met with political resistance within the Democratic Party, causing nervousness in the markets. As negotiations dragged on in Washington DC between the White House and House Democrats, the Nifty fell by nearly 1,000 points over the last few trading sessions of the month erasing nearly all the gains made earlier in the month. The Sensex closed October almost flat at 59,306. The political developments in the US spooked the FIIs who pulled out around Rs 11,500 Crores (on a net basis) from the Indian stock market. Global macros are a cause of concern with high inflation and rising US Government Bond yields. With valuations in the expensive zone and US bond yields rising, FIIs are likely to be cautious about Indian equities. We expect market to be volatile with an upward bias over the next couple of months.

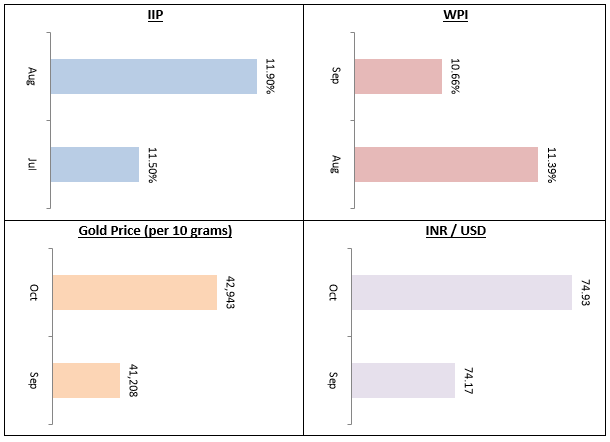

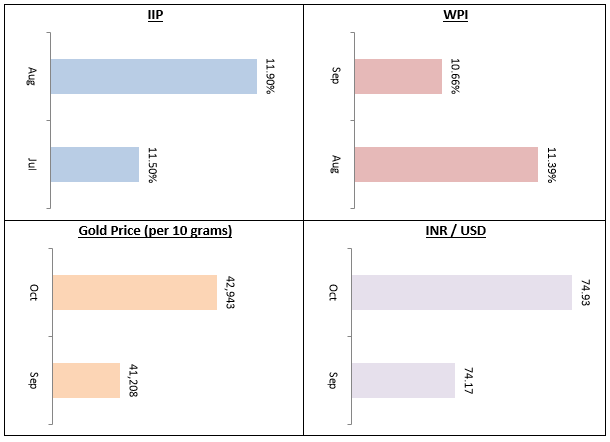

The Index of Industrial Production (IIP) rose by 11.9% in August on the back of 11.5% growth in July. This is positive for the stock market and we expect to the see the effect of higher industrial production on corporate earnings in the coming quarters. WPI inflation moderated to 10.66%. The Reserve Bank of India expects inflation to remain choppy and gradually return to normal levels. High commodity prices (especially crude oil) globally and strengthening US Dollar will put upward pressure on G-Sec yields; debt fund investors should take this into consideration when planning their investments.

Gold prices rallied in the international markets in the month of October before cooling off towards the end of the month. With the wedding season in India approaching, we expect Gold to extend its gains further. The INR depreciated by nearly 1% versus the US Dollar in October primarily due to high global commodity prices and other factors. As we approach the end of this year, all eyes will be on the US Federal Reserve meeting in November. It is expected that the Fed will chart its course for the post COVID scenario and will taper its bond buying program. However, given the uncertainties, the pace at which the Fed tapers the stimulus will be keenly watched and may have an impact on the financial markets. We will be following the Fed’s moves and update you in the next newsletter.

As far as debt funds are concerned, uncertainty about global commodity prices and inflation persists. The 10 year G-Sec yield was seen creeping up in the month of October. While debt markets will be closely following Fed’s policies in the coming weeks, we think it is prudent to invest in shorter duration accrual funds in these conditions to minimize interest rate risks. The Reserve Bank has injected massive amount of liquidity in the financial system which has kept the yields of very short duration funds like overnight, liquid and ultra-short duration funds low. For somewhat higher yields, you may invest in short duration funds. Medium duration funds having decent credit quality papers in their portfolio can also be considered with an investment horizon of 3 years & above.

Conclusion

As we celebrate Deepawali, we approach the coming year with a lot of optimism. After nearly 18 - 19 months of uncertainty and various restrictions due to the pandemic, most people have now returned to their normal lives, both in terms of their personal and professional lives. The Government has achieved an important milestone of giving 100 Crore doses of the COVID vaccine. Based on initial reports, the festive season sales has been good for many industry sectors. As the economy picks up in the coming months and quarters, the long term outlook for investors is very positive. On behalf of my team, I hope the Festival of Lights bring health, prosperity and happiness to you and your family. Wishing all our esteemed customers a very Happy and Auspicious Deepawali.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!