Dear Investors,

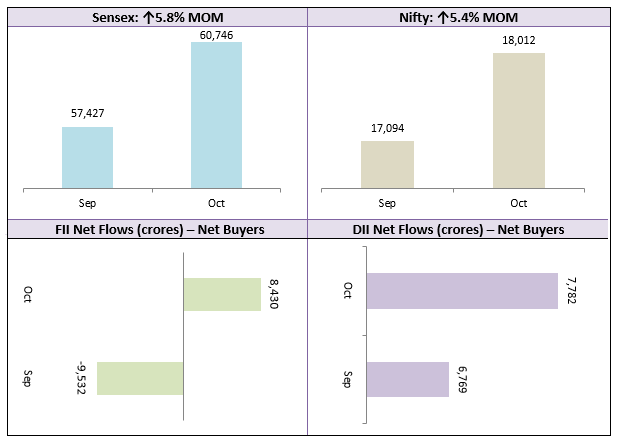

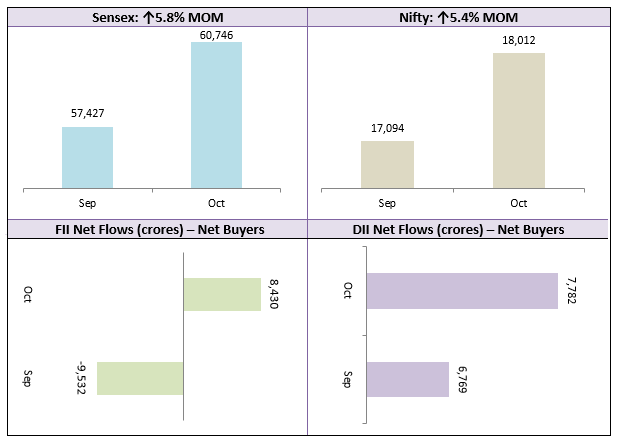

Equity markets led by the US rebounded in October 2022. The Sensex and Nifty rallied 5 – 6%, closing above the very important psychological levels of 60,000 and 18,000 respectively. Investors in the US, where inflation is a major concern are expecting, inflation to moderate in the near future which could signal a reversal in the Fed’s policy stance and some visibility on the end of the interest rate cycle.

While the Fed hiked interest rate by another 75 bps in November 2022, this was in line with investor expectations. While the Fed Governor’s comments can be interpreted as hawkish, many experts are also interpreting his comment on resizing rate hikes to be dovish. The market is expecting the rate hikes to get smaller at some point of time, which would then signal an end to the interest tightening cycle. The US job market surprisingly remains quite strong, which means slowdown or recession will be quite mild.

China’s zero COVID policy and repeated lockdowns are weighing heavily on its factory output and economic growth. With regime change in Brazil and geo-political crisis in Russia / Ukraine, India remains the bright spot in Emerging Markets pack. FII flows in India picked up in October, with FIIs buying nearly Rs 8,500 crores of Indian equity on a net basis. We expect this trend to accelerate further in the coming months.

The Q2 corporate earnings season is currently underway, and the earnings of the Nifty heavyweights e.g. RIL, ICICI Bank, HDFC Bank, Infosys etc. are largely in line with Street expectations. Global brokerages are seeing early signs of capex recovery in India, which will act as a booster to equity market. While we expect the market to remain volatile till we have visibility on the end of the interest rate cycle, we think that Indian equities are in the early stages of the next bull market. Midcaps and small caps outperform in the early to mid stages of bull market. You can increase your portfolio allocations to mid and small caps to capitalize on the growth recovery.

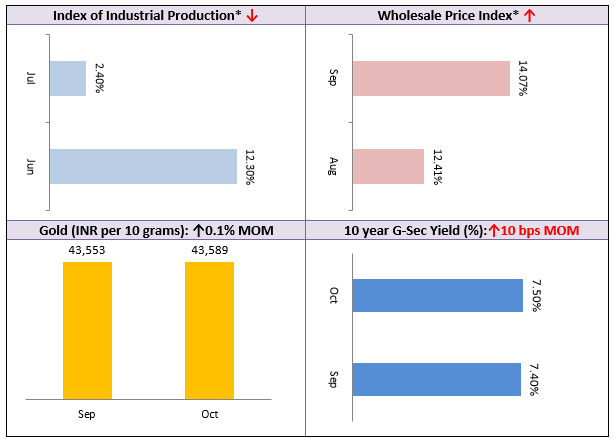

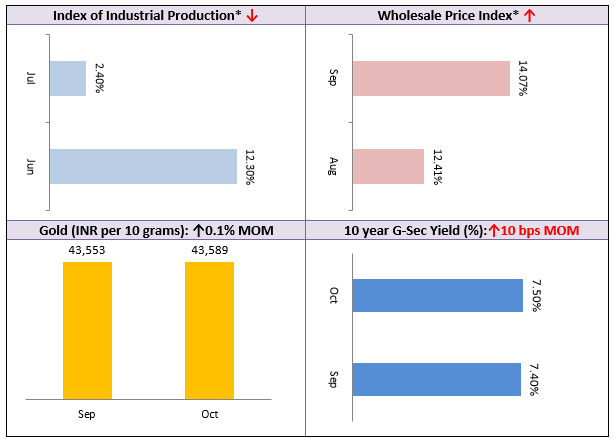

As far as debt funds are concerned, the short term yields are quite attractive and shorter duration accrual based debt funds will be more suitable for conservative investors. Yields towards the longer end of the curve are still hardening, so funds which invest in long duration bonds may be more volatile in the short term.

I hope that our investor family had a very Happy Diwali. I, on behalf of my team, wish you a healthy and prosperous New Year.

Best Wishes,

Ajoy Agarwal,

(Managing Director)