Dear Investors,

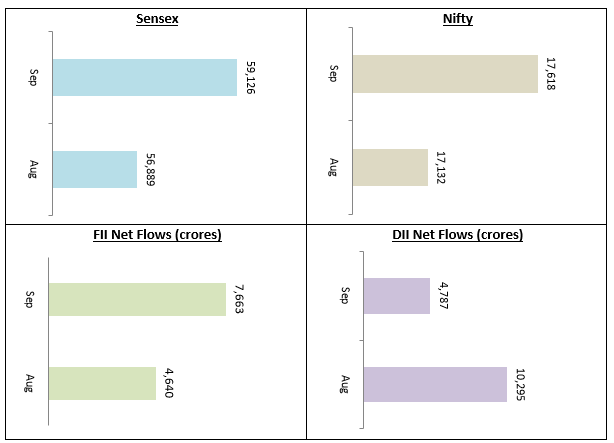

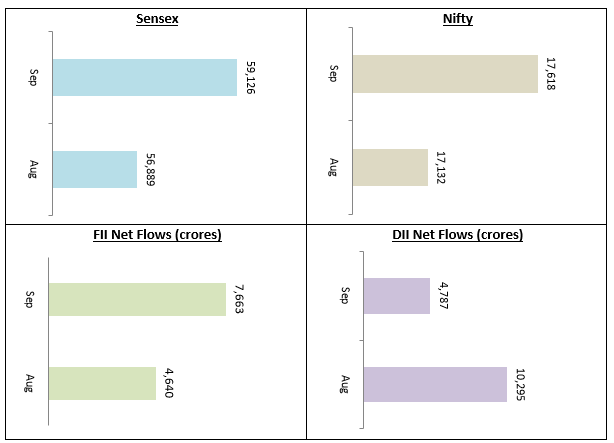

The Sensex and Nifty continued its bull run in September 2021. Both the Nifty and the Sensex rose by 3 - 4% in August, ending the month above 17,600 and 59,000 levels respectively. FIIs continued to be bullish about Indian market, with net purchase to the tune of Rs 7,663 crores in September. DIIs were also net buyers in September with net purchase of around Rs 4,800 crores. Overall, the sentiment in the market is bullish and we expect the leading indices to go higher in the near term.

After a volatile performance in August, the broader market also clocked handsome gains in September with Nifty Midcap 150 Index gaining nearly 7%, and the Nifty Small Cap 250 Index gaining nearly 6%. Overall, we expect bullish sentiments to continue over the next few months, but investors should understand that valuations look expensive at these levels and therefore, you should invest with long investment horizon.

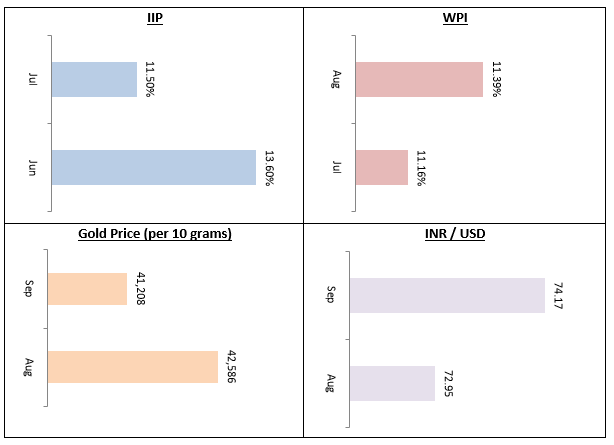

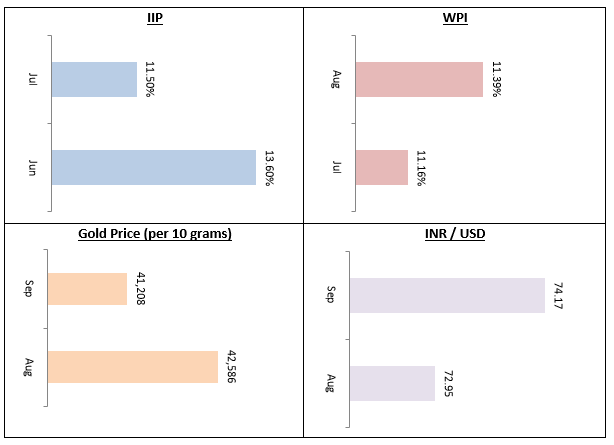

The Index of Industrial Production (IIP) rose by 11.5% in July and we now see the IIP is near the pre-pandemic level. WPI inflation spiked to 11.39% in August, but Reserve Bank of India expects inflation to moderate slowly. High inflation is currently a global phenomenon and investors, particularly debt fund investors, must take this into consideration.

Gold prices continued its declining trend in September and it may decline further in the coming months. The INR depreciated by nearly 2% versus the US Dollar in September primarily due to high global commodity prices and other factors. We expect the three major risk factors mentioned in my earlier letters i.e. impact of COVID third wave (delta variant), trajectory of international crude oil prices and the Fed's monetary policy in the US will continue to remain important.

If we compare Nifty level at the end of September with pre-pandemic levels (Jan 2020), the Nifty has risen by 47%, while the IIP is yet to return to pre-pandemic levels. So at these market levels, prices seem to have run ahead of fundamentals. In high markets, asset allocation is the investor's best friend. You should review your asset allocation now to see if it is at the desired or optimal level based on your risk appetite. If you think your asset allocation is skewed towards the riskier side, you should rebalance your asset allocation. You should consider factors like taxation, loads etc when rebalancing. You should consult with your Eastern Financier's financial advisors, to review your asset allocation and make suitable decisions. For your long term financial goals, you should continue to invest through SIPs.

As far as debt funds are concerned, there is still considerable uncertainty about global commodity prices and inflation. The 10 year G-Sec yield after coming down in the first 3 weeks of September has started creeping up again over the 10 days or so. We think it is prudent to invest in higher credit quality shorter duration accrual funds in these conditions to minimize interest and credit risks.

The Reserve Bank has injected massive amount of liquidity in the financial system which has kept the yields of very short duration funds like overnight, liquid and ultra short duration funds low. For slightly higher yields, you may invest in money market and low duration funds. However, you should have investment tenure of at least 9-12 months for these funds. For investors with minimum 3 year investment tenures, high credit quality funds of short to medium duration profiles like corporate bond funds, Banking and PSU debt funds etc will be good investment choices.

Conclusion

There are many theories about investing and lots of books have been written on various subjects related to investing. Different investors have different needs, risk appetites and investment experience. Market dynamics keep changing all the time; such is the nature of financial markets. Through this Monthly Digest, we try to keep our esteemed investors informed about developments of the market and the economy. In our view, a pragmatic approach, where you are aware of all the risk factors and make informed decisions works, best for investors. Our financial advisors will work with you to plan your investments based on your specific needs.

This time of the year is auspicious for many Indian families. On behalf of Eastern Financier's team I extend my heartiest greetings and best wishes for the festive season this month.

Best Wishes,

Ajoy Agarwal,

(Managing Director)