Dear Investors,

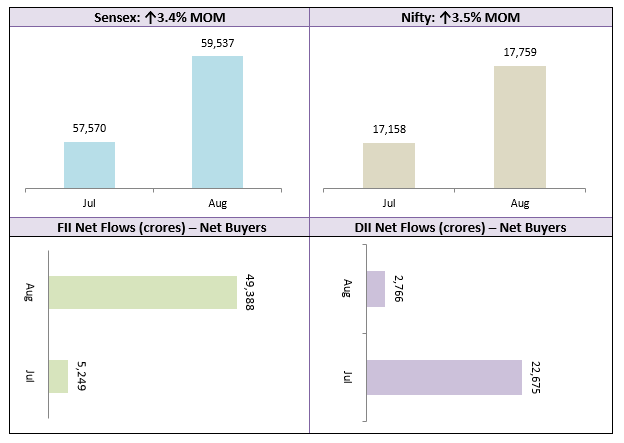

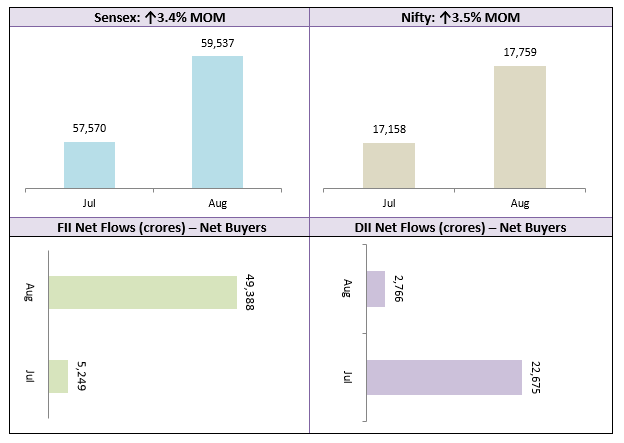

Indian equities continued to strengthen in August 2022 after a strong showing in July. Nifty rose by 3.5% to close the month at the 17,700 – 17,800 levels. The Sensex closed the month near the psychological 60,000 level. The broader market continued its strong performance from July and outperformed both the Nifty and the Sensex. The most encouraging sign in August was the strong participation of foreign institutional investors (FIIs) who made net equity purchases of nearly Rs 50,000 crores in August. The FII inflows in August indicate bullishness about the long term growth outlook of Indian equities among foreign investors.

Towards the end of the month, comments made by US Federal Reserve Governor Jerome Powell, weighed heavy on the market and we saw profit booking at higher levels. Governor Powell in his speech indicated that more interest hikes will be needed and the US economy may go into recession at the end of the interest rate tightening cycle. The S&P 500 corrected by 4% in August and the US markets are expecting more volatility in the coming months. Most economists are currently predicting a mild recession in the US and that the Fed will start cutting rates by the end of 2023. So even if the US enters bear market by end of this year, the bear market will be relatively short. A bear market in the US will have an impact on global equities including India; we may say bouts of high volatility in the coming months and quarters.

The Indian economy is on the recovery path. The GDP grew by 13.5% in the first quarter. The first quarter corporate earnings growth was also strong (Nifty EPS grew by 23% in Q1), on the back of strong earnings growth in FY 2021-22. Inflation is showing signs of cooling down, with WPI July inflation down to 13.93% in July (compared to 15.3% in June). Government policies like Atmanirbhar Bharat, Production Linked Incentive (PLI) Scheme, Goods and Services Tax (GST) rationalization (subject to agreements with State Governments) etc, is likely to revive private capex growth and consumer demand. Finally, a growing middle class, with rising disposable incomes and aspirations will ensure that India Growth Story is intact. This makes Indian equities very attractive from long term perspective.

This month marks the beginning of auspicious and of the festive season. I, on behalf of my team, wish all our dear investors in advance, a very happy and auspicious Navratra and Durga Puja.

Best Wishes,

Ajoy Agarwal,

(Managing Director)

Get the best investment ideas straight in your inbox!