Mutual funds have become a sought-after investment option in recent years. There has been a steady increase in investor accounts from 4.03 Cr in December 2014 to 14.91Cr in June 2023. AMFI data states that there are 14,91,31,708 accounts in the mutual fund industry on June 23, 2023 of which 91.2% is accounted for by retail investors. Assets managed by the Indian mutual fund industry have increased from Rs. 40.49 trillion in November 2022 to Rs. 48.75 trillion in November 2023. (Source: AMFI website)

The above data is proof enough that the popularity of mutual funds amongst Indian investors has been phenomenal over the last decade. Mutual funds are loved due to its sheer ease and convenience of investment. SIP options in mutual funds are no secret as this is a feature that adds an extra layer of benefits to the mutual fund investments by making them easy and pocket friendly for the investors.

Read on to find out tips on how your SIP investments can give you the most benefits.

1. Harnessing the power of the Top-Up

It is common knowledge amongst mutual funds investors that SIP in mutual funds can build a large corpus with disciplined investments of fixed amounts at regular intervals. This happens because of the power of compounding.

However, there is one more feature of the mutual funds SIP which you can opt for, and that is the Top Up facility.

What is an SIP Top Up Facility?

The SIP Top Up facility is an option where you can choose to increase the investment into your mutual fund by a predetermined rate or amount at every stipulated interval. In effect, this will result in your regular instalment in the MF to increase after every interval as decided by you. So, you may increase your SIP amount by any percentage like 5%, 10% etc. or you may increase your SIP by a fixed amount say Rs 500, Rs 1000 etc., at a chosen interval like monthly, quarterly, half yearly or annually.

Let us understand this with an example.

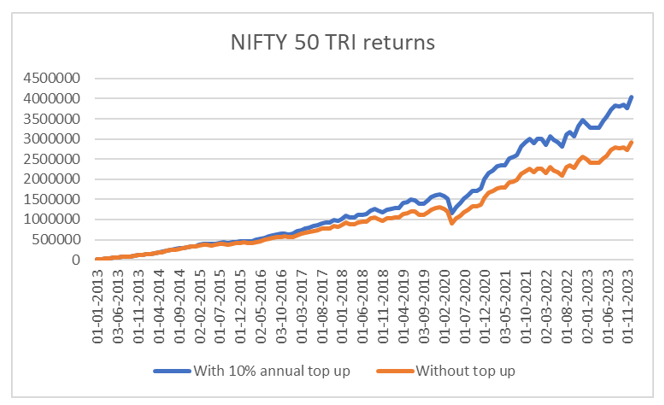

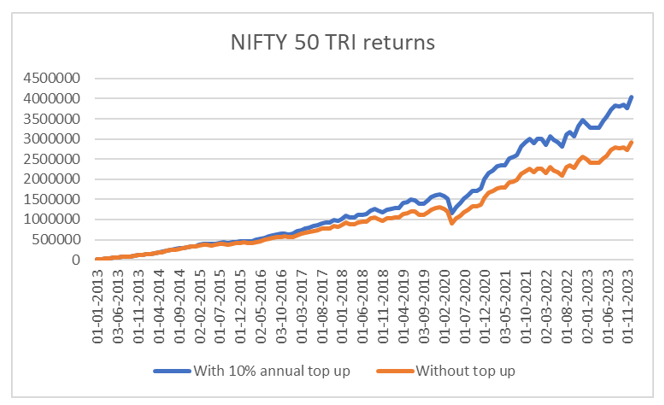

Suppose Siddharth started a monthly SIP of Rs 10,000/- in the Nifty 50 Total Returns Index (TRI) benchmark on 1st January 2013. He remained invested till 31st December 2023.

The chart below shows the difference in the corpus that he creates with or without a 10% annual top up.

Source: Eastern Financiers Research (Disclaimer: Past performance may or may not be sustained in the future)

As can be seen that with a 10% annual top up, Siddharth creates a corpus of Rs 40,36,596/- in comparison to the Rs 29,15,881/- he would have made without choosing any top up.

2. No penalty on missed SIP instalment

Along with the ease of investment in mutual funds through systematic investments or SIP, it should be noted that if you ever miss the SIP date due to some reason, there is no penalty levied by the fund house for such missed SIP instalment.

However, some banks may charge some amount for the missed ECS date. Therefore, it is better not to miss out on any SIP, not only because there is a charge deducted by some banks, but because it is a good practice to stay disciplined in your investments for realizing your financial goals.

3. Maximum investment period

If you have started an SIP in a mutual fund, then rest assured that you have committed to a journey of at least 30 years of disciplined investments. What this means is that as per the guidelines issued by AMFI, an SIP in any mutual fund will continue on auto pilot for a maximum period of 30 years. If, on the other hand, you would want to stop the SIP at any time during this period, you may do so by intimating this to the fund house.

4. The magic in the long term

The longer you keep investing through your SIP, the more profits you can generate. The power of compounding, which simply put, means profits earned on profits over long investment horizons, can create substantial wealth for you. The most important ingredient in the recipe of power of compounding is time – or the investment tenure.

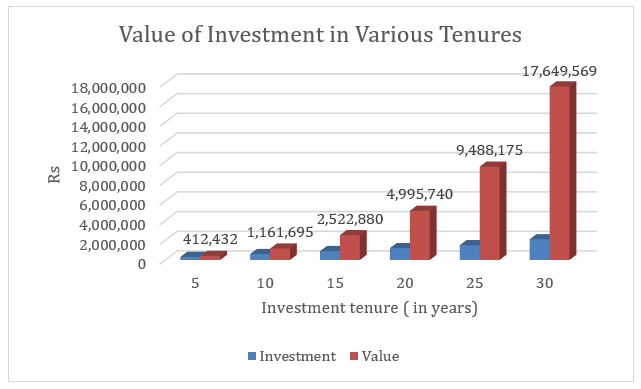

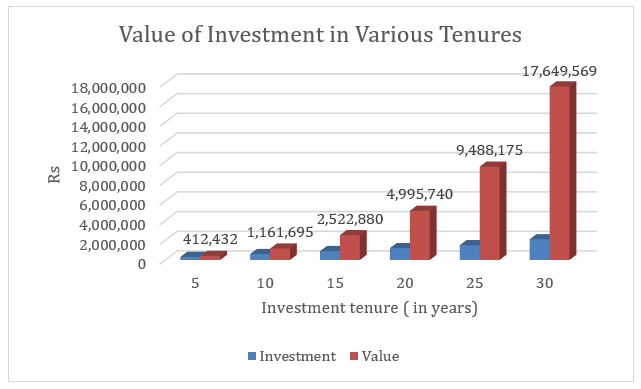

The chart below shows how much wealth you can create over different investment tenures with a monthly SIP of just Rs 5,000 (assuming 12% rate of return). Compare an investment of Rs 3 lakhs giving a value of investment of only Rs 4,12,342 in 5 years, to an investment of Rs 18 lakhs over 30 years growing to a large corpus of Rs 1,76,49,569.

As you can see in the above chart, over longer periods of holding, you can create exponential wealth, even with a small amount per month.

5. Anytime is good time to start your SIP investments

There are many opinions and a lot of speculation about which is the best date for your SIP. However, it is worthwhile to note that there is no single date that can give you a better return. The average return over the long-term investment horizon balances out for whichever date you choose your SIP date. In fact, as a good practice it is better to choose your SIP date to coincide with your income from salary or business. The option of daily or weekly SIP can be explored by investors who have a daily cash flow, to invest an amount every day or every week as well without having a bearing on the returns from your SIP investment.

Hope, next time you are starting a SIP, you will remember the above points to have more clarity about your SIP investments.

Contact your EF mutual fund Relationship Manager to understand more about SIPs and suggestions on choosing the best mutual funds for your requirement.