I am sure you have heard the buzz in the market about semiconductors. Yes, the share market has lately been very excited about this product and its manufacturers are being considered as potentially good investment bets. The sector has been called a "SUNRISE SECOR". For retail investors, who want to follow the bandwagon, Dixon Technologies, Keynes, Cyient DLM are some of the very familiar names in this segment. But very few have the clarity about the product, its importance and where does India stand when it comes to semiconductor manufacturing. Let's just try to understand what's happening and why.

So, what are these SEMICONDUCTORS

Semiconductors are materials with electrical conductivity between that of conductors (like copper - the best) and insulators (like glass - one of the worst), making them crucial for controlling the flow of electricity in electronic devices.

Where we need high conductivity like wires for transmission of electricity we use copper. Where we need to put an insulator to break the transmission we use products like glass or wood. But we all know that. But what's the use of semiconductors then? They regulate the flow of electricity. For sophisticated machines such as laptops, tabs, cell phones, television, medical equipment, and what not, semiconductors are extremely essential components.

Semiconductors can act as either conductors or insulators depending on external factors like voltage or temperature, allowing for precise control of electrical current. Comprising of silicon, they conduct electricity more than an insulator, such as glass, but less than a pure conductor, such as copper or aluminium. This property is essential for creating electronic switches and components like transistors and diodes. The word "semi" means half or partial. A semiconductor, therefore, refers to a material product having partial properties of both conductors and insulators. The biggest advantage is that their conductivity and other properties can be altered as per requirement by introducing impurities. The process is called doping and it helps in meeting the specific requirements or specifications pertaining to the electronic components in which they reside.

Semiconductors are, therefore, a necessary component for any electronic devices, due to this unique ability of controlling electrical conductivity, and enables developments and advances in communications, computing, healthcare, military systems, transportation, clean energy, and countless other applications. Put very simply, semiconductor is the brain of any modern-day electronic device [1].

Why this spotlight on SEMICONDUCTOR Industry?

Amazingly this has just been one of the fallout of CORONA. Thanks to lock downs and the consequent work from home mode, there was a demand explosion for gadgets like smart phones, tabs and PCs. From being a barely-understood "workhorse on powerful computers", these chips sprung to the position of being the "most crucial and expensive component" of any modern contemporary gadget [1]. The availability or shortage of semiconductors directly impact of the Electronic Manufacturing Services (EMS) market.

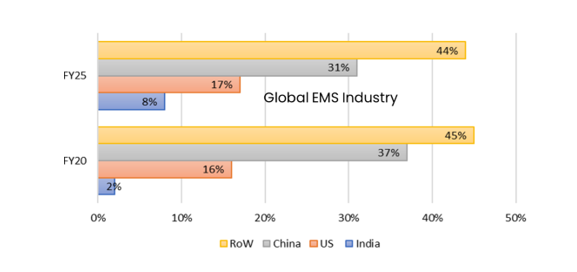

At the global level, the value of the EMS market is anticipated to reach nearly $760 bn by 2026 and India will account for around 2.3% of this market, which brings the Indian market to somewhere around $20 bn.

Considered sunrise sector, the Indian EMS sector is hovering at the threshold of a significant growth, and expects to capture 7% of the addressable global market by 2026, which entails expansion at a double-digit over the period 2021-2026 [3].

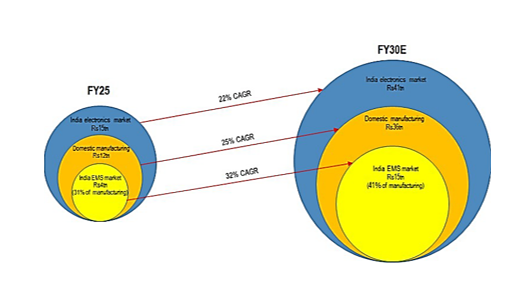

Figure 1: The Industry Size (Source : JP Morgan Report)

Such rapid expansion is expected to be driven by such factors as increasing demand for semiconductors fuelled by massive growth and advancement in information and communication technologies (ICT), government initiatives, the 'China Plus One' strategy, cost competitiveness, import substitution, and robust demand from Original Equipment Manufacturers (OEMs). With the rapid evolution of the EMS landscape, India is fast emerging as a crucial hub for electronics manufacturing [3].

According to estimates drawn by J.P. Morgan, our domestic Electronic Manufacturing Services market is likely to witness a whopping 32% CAGR in revenue during FY25 to FY30, on the back of such factors as growing share of electronics content in products, the "Make in India" initiative, along with a global supply chain realignment tilted in favour of India. This creates a lot of growth prospects for the sector and the country is working towards gradually and consistently absorbing the opportunities thrown open by the changing world dynamics.

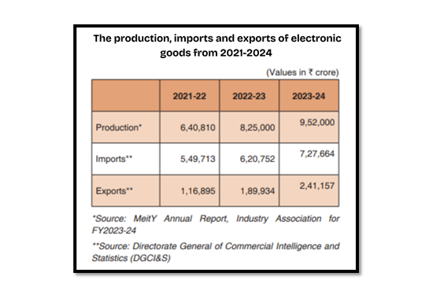

The changes are visible at home too with domestic electronics production garnering greater share of the manufacturing sector. From 31% in FY25 the share of electronic production in domestic manufacturing sector is expected to rise to 41% by FY30E. India is now moving towards a US$ 300 billion electronics production target by 2026, supported by robust policies and skilled workforce that continue to pave the way for sustained growth [4]. The country is now positioned as a key player in the global electronics and semiconductor industry. Projections indicate that India's electronics manufacturing output could touch $500 billion by FY30.

Key Points to Remember

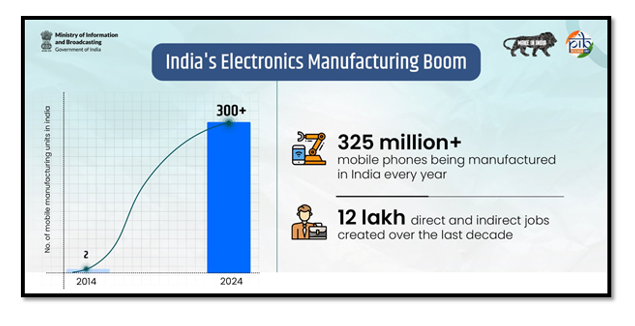

India is the Second Largest Mobile Phone Producer in the World: In 2014-15, 26% of mobile phones sold in India were locally made, rising to 99.2% by December 2024 - demand for semiconductors and EMS received massive boost. In 2014, India had just a couple of mobile manufacturing units. Presently there are more than 300.

Massive Rise in Production driven by Exports: The country's mobile phone exports surged from only ₹1,566 cr in 2014-15 to ₹1.2 lakh crore in 2023-24, a whopping 77-fold increase in a decade's time.

Robust EMS Growth Foreseen: Projections indicate that India's electronics production will reach USD 300 billion by 2026

Conducive Environment: India's semiconductor ecosystem has gained significant momentum, with 5 landmark projects receiving approval with a total combined investment nearing Rs 1.52 lakh crores

- The first major project with Micron was sanctioned for nearly ₹ 22k crores.

- Tata Electronics Private Limited (TEPL)'s proposal for setting up a Semiconductor Fab facility in India with an investment of ₹91,526 Crore was approved in February 2024. The fab facility will be set up in a technology partnership with PSMC, Taiwan. PSMC is an established semiconductor company having 6 semiconductor foundries in Taiwan. The production capacity of the project would be around 50,000 wafer starts per month (WSPM).

- Tata Electronics Private Limited (TEPL)'s proposal for setting up of OSAT facility in India with an investment of ₹27,120 Crore was approved in February 2024. The facility will use indigenous semiconductor packaging technologies with a production capacity of 48 million per day.

- CG Power and Industrial Solutions Limited's proposal for setting up an OSAT facility in India with an investment of ₹7,584 Crore was also approved in February 2024. The facility will be set up as a joint venture partnership with Renesas Electronics America Inc., USA, and STARS Microelectronic, Thailand. The Technology would be provided for this facility by Renesas Electronics Corporation, Japan and STARS Microelectronic, Thailand. The production capacity would be around 15.07 million Units per day.

- Kaynes Technology India Limited (KTIL) proposal for setting up of Outsourced Semiconductor Assembly and Test (OSAT) facility at Sanand, Gujarat for Wire bond Interconnect, Substrate Based Packages was approved in September, 2024. The Technology would be provided by ISO Technology Sdn. Bhd. and Aptos Technology Inc. This facility will be set up with an investment of ₹3,307 Crore. The facility will have the capacity to produce more than 6.33 million chips per day [4].

The sectoral growth is driven by following factors

- Rising electronics content - Higher Domestic Consumption

- Make in India - PLI policy of Govt.

- Import substitution

- realignment of global

- supply chains to India with a China+1 strategy

The emerging opportunities

- Outsourced Semiconductor Assembly Testing (OSAT)

- Printed Circuit Board or PCB (integrated circuits, transistors, and diodes)

- Exports

Why Invest in Semiconductor Stocks?

All kinds of investments are subject to market risk. Something we know and hear every day. A simple investment philosophy. It's analogous to not putting all your eggs in one basket. Hence a portfolio must always be diverse. Investment in semiconductor stocks can help in and improve portfolio diversification by creating exposure to a sector that is expected to play a crucial role in the country's technological advancements.

From the above discussion it is already evident that semiconductors are indispensable so far as electronic products are considered and are a crucial input is a large number of industries, including telecommunications, consumer electronics, automotive, and can provide a hedge against market fluctuations in other sectors.

What is more, the semiconductor industry frequently witnesses unique growth cycles, boosted by innovation and changes in demand dynamics. Investors may see performance patterns that are different compared to traditional sectors. This again has the potential to reduce the overall risk of the portfolio and improve returns through different market dynamics.

Semiconductor stocks are specifically suited for investors who are seeking growth opportunities in the tech sector. Semiconductor manufacturers and EMS companies are integral to the progression and development of India's technology and digital infrastructure. This makes semiconductor a compelling investment case for investors having a strategic focus on innovation and future technology trends.

References

[1] Semiconductor Industry Association (SIA), "What is a Semiconductor?," 2025. [Online]. Available: https://www.semiconductors.org/semiconductors-101/what-is-a-semiconductor/. [Accessed 22 Jul 2025].

[2] I. King, D. Wu and D. Pogkas, "How a Chip Shortage Snarled Everything From Phones to Cars : Bloomberg," 29 Mar 2021. [Online]. Available: https://www.bloomberg.com/graphics/2021-semiconductors-chips-shortage/. [Accessed 22 Jul 2025].

[3] Westway Electronics Ltd, "Did You Know? Global Electronic Manufacturing Services Market to Reach $760 Billion by 2026! | LinkedIn," 28 Feb 2025. [Online]. Available: https://www.linkedin.com/posts/westway-electronics-ltd_the-global-electronic-manufacturing-services-activity-7301166597153447936-71C-/. [Accessed 22 Jul 2025].

[4] PIB, "Make in India's Leap in Electronics Manufacturing & Exports: Driving Innovation & Growth," 26 Mar 2025. [Online]. Available: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2115171#:~:text=Conclusion:,global%20electronics%20and%20semiconductor%20industry. [Accessed 22 Jul 2025].